Question: Solve it correctly please. I will rate accordingly with multiple votes. Ty-ped answer please. Use the information in the table to the right to calculate

Solve it correctly please. I will rate accordingly with multiple votes. Ty-ped answer please.

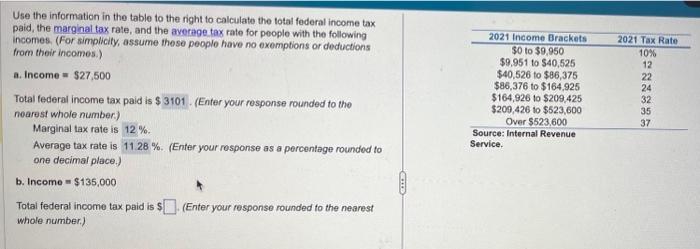

Use the information in the table to the right to calculate the total federal income tax paid, the marginal tax rate, and the average tax rate for people with the following 2021 Income Brackets 2021 Tax Rate Incomes, (For simplicity, assume these people have no exemptions or deductions $0 to $9.950 10% from their incomes.) $9.951 to $40,525 12 $40,520 to $86,375 a. Income = $27,500 22 $86,376 to $164,925 24 $164,926 to $209 425 32 Total federal income tax paid is $ 3101 . (Enter your response rounded to the $209,426 to $523.600 35 nearest whole number) Over $523.600 37 Marginal tax rate is 12 %. Source: Internal Revenue Service. Average tax rate is 11 28 %. (Enter your response as a percentage rounded to one decimal place.) b. Income = $135,000 Total federal income tax paid is $ (Enter your response rounded to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts