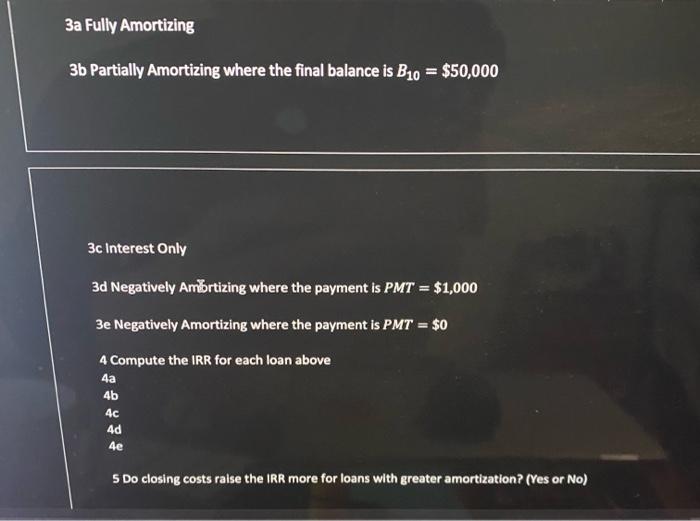

Question: solve it in excel and provide me the whole process. 3a Fully Amortizing 3b Partially Amortizing where the final balance is B10=$50,000 3c Interest Only

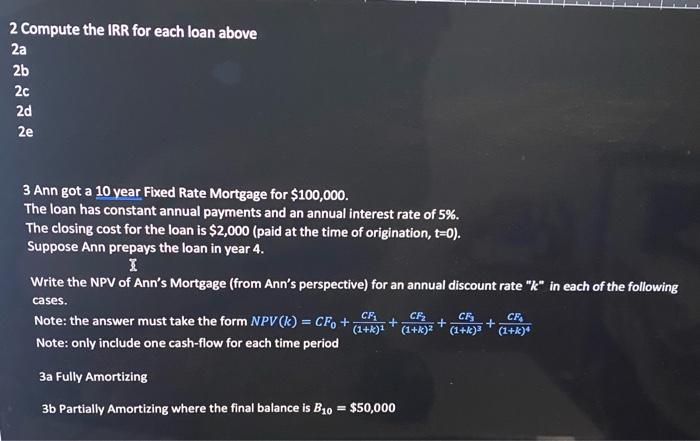

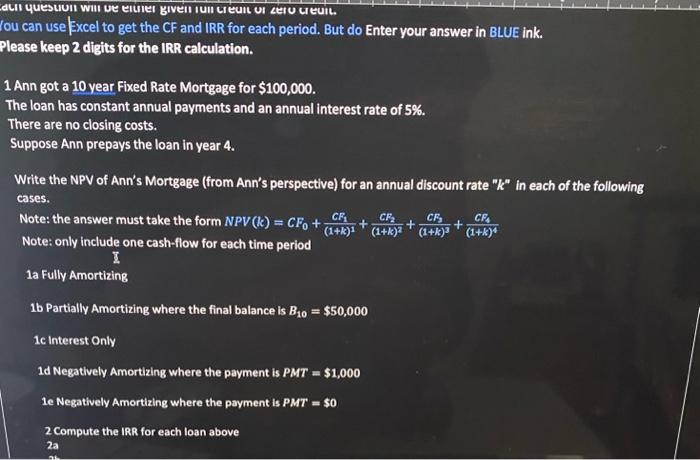

3a Fully Amortizing 3b Partially Amortizing where the final balance is B10=$50,000 3c Interest Only 3d Negatively Ambrtizing where the payment is PMT=$1,000 3e Negatively Amortizing where the payment is PMT=$0 4 Compute the IRR for each loan above 4a 4b 4c 4d 5 Do closing costs raise the IRR more for loans with greater amortization? (Yes or No) 2 Compute the IRR for each loan above 2a2b2c2d2e 3 Ann got a 10 year Fixed Rate Mortgage for $100,000. The loan has constant annual payments and an annual interest rate of 5%. The closing cost for the loan is $2,000 (paid at the time of origination, t=0 ). Suppose Ann prepays the loan in year 4. 8 Write the NPV of Ann's Mortgage (from Ann's perspective) for an annual discount rate " k " in each of the following cases. Note: the answer must take the form NPV(k)=CF0+(1+k)1CF1+(1+k)2CF2+(1+k)3CF3+(1+k)4CF4 Note: only include one cash-flow for each time period 3a Fully Amortizing 3b Partially Amortizing where the final balance is B10=$50,000 fou can use Excel to get the CF and IRR for each period. But do Enter your answer in BLUE ink. Please keep 2 digits for the IRR calculation. 1 Ann got a 10 year Fixed Rate Mortgage for $100,000. The loan has constant annual payments and an annual interest rate of 5%. There are no closing costs. Suppose Ann prepays the loan in year 4. Write the NPV of Ann's Mortgage (from Ann's perspective) for an annual discount rate " k " in each of the following cases. Note: the answer must take the form NPV(k)=CF0+(1+k)1CF1+(1+k)2CF2+(1+k)3CF3+(1+k)4CF0 Note: only include one cash-flow for each time period 7 1a Fully Amortizing 1b Partially Amortizing where the final balance is B10=$50,000 1c interest Only 1d Negatively Amortizing where the payment is PMT=$1,000 1e Negatively Amortizing where the payment is PMT=$0 2 Compute the IRR for each loan above 3a Fully Amortizing 3b Partially Amortizing where the final balance is B10=$50,000 3c Interest Only 3d Negatively Ambrtizing where the payment is PMT=$1,000 3e Negatively Amortizing where the payment is PMT=$0 4 Compute the IRR for each loan above 4a 4b 4c 4d 5 Do closing costs raise the IRR more for loans with greater amortization? (Yes or No) 2 Compute the IRR for each loan above 2a2b2c2d2e 3 Ann got a 10 year Fixed Rate Mortgage for $100,000. The loan has constant annual payments and an annual interest rate of 5%. The closing cost for the loan is $2,000 (paid at the time of origination, t=0 ). Suppose Ann prepays the loan in year 4. 8 Write the NPV of Ann's Mortgage (from Ann's perspective) for an annual discount rate " k " in each of the following cases. Note: the answer must take the form NPV(k)=CF0+(1+k)1CF1+(1+k)2CF2+(1+k)3CF3+(1+k)4CF4 Note: only include one cash-flow for each time period 3a Fully Amortizing 3b Partially Amortizing where the final balance is B10=$50,000 fou can use Excel to get the CF and IRR for each period. But do Enter your answer in BLUE ink. Please keep 2 digits for the IRR calculation. 1 Ann got a 10 year Fixed Rate Mortgage for $100,000. The loan has constant annual payments and an annual interest rate of 5%. There are no closing costs. Suppose Ann prepays the loan in year 4. Write the NPV of Ann's Mortgage (from Ann's perspective) for an annual discount rate " k " in each of the following cases. Note: the answer must take the form NPV(k)=CF0+(1+k)1CF1+(1+k)2CF2+(1+k)3CF3+(1+k)4CF0 Note: only include one cash-flow for each time period 7 1a Fully Amortizing 1b Partially Amortizing where the final balance is B10=$50,000 1c interest Only 1d Negatively Amortizing where the payment is PMT=$1,000 1e Negatively Amortizing where the payment is PMT=$0 2 Compute the IRR for each loan above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts