Question: solve it mannually, dont use excel please Fink Co. is interested in purchasing a new business vehicle. The vehicle costs $50.000 and will generate constant-dollar

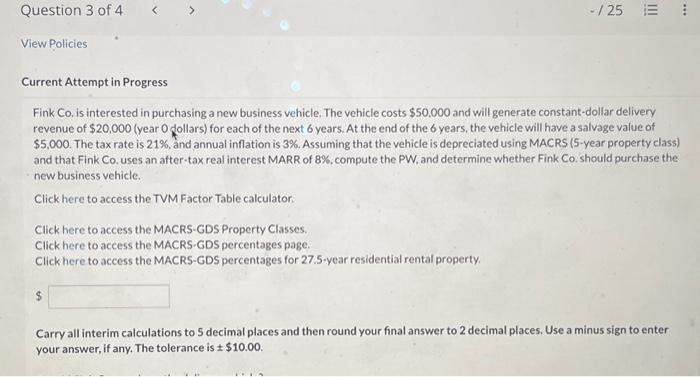

Fink Co. is interested in purchasing a new business vehicle. The vehicle costs $50.000 and will generate constant-dollar delivery revenue of $20,000 (year 0 dollars) for each of the next 6 years. At the end of the 6 years, the vehicle will have a salvage value of $5,000. The tax rate is 21%, and annual inflation is 3%. Assuming that the vehicle is depreciated using MACRS (5-year property class) and that Fink Co. uses an after-tax real interest MARR of 8%, compute the PW, and determine whether Fink Co. should purchase the new business vehicle. Click here to access the TVM Factor Table calculator: Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS.GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. $ Carry all interim calculations to 5 decimal places and then round your final answer to 2 decimal places. Use a minus sign to enter your answer, if any. The tolerance is $10.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts