Question: solve it plz 11:45 1 Done Tutorial 6 Submission 3 Tutorial 6 Submission The adjusted trial balance of the Ricci and Napoli Partnership for the

solve it plz

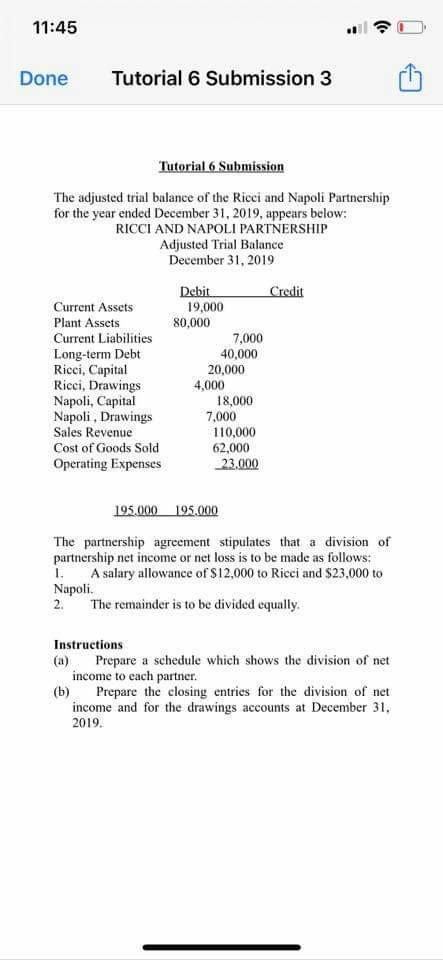

11:45 1 Done Tutorial 6 Submission 3 Tutorial 6 Submission The adjusted trial balance of the Ricci and Napoli Partnership for the year ended December 31, 2019, appears below: RICCI AND NAPOLI PARTNERSHIP Adjusted Trial Balance December 31, 2019 Debit Credit Current Assets 19,000 Plant Assets 80,000 Current Liabilities 7,000 Long-term Debt 40,000 Ricci, Capital 20,000 Rieci, Drawings 4,000 Napoli, Capital 18,000 Napoli, Drawings 7.000 Sales Revenue 110,000 Cost of Goods Sold 62,000 Operating Expenses 23.000 195.000 195.000 The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows: 1. A salary allowance of $12,000 to Ricci and $23,000 to Napoli. 2. The remainder is to be divided equally. Instructions Prepare a schedule which shows the division of net income to each partner. (b) Prepare the closing entries for the division of net income and for the drawings accounts at December 31. 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts