Question: SOLVE IT USING EXCEL DATA SOLVER LINEAR PROGRAMMING AND WRITE DOWN CONSTRAINTS and upload excel and solver screenshots Problem 10 A large toy store typically

SOLVE IT USING EXCEL DATA SOLVER LINEAR PROGRAMMING AND WRITE DOWN CONSTRAINTS

and upload excel and solver screenshots

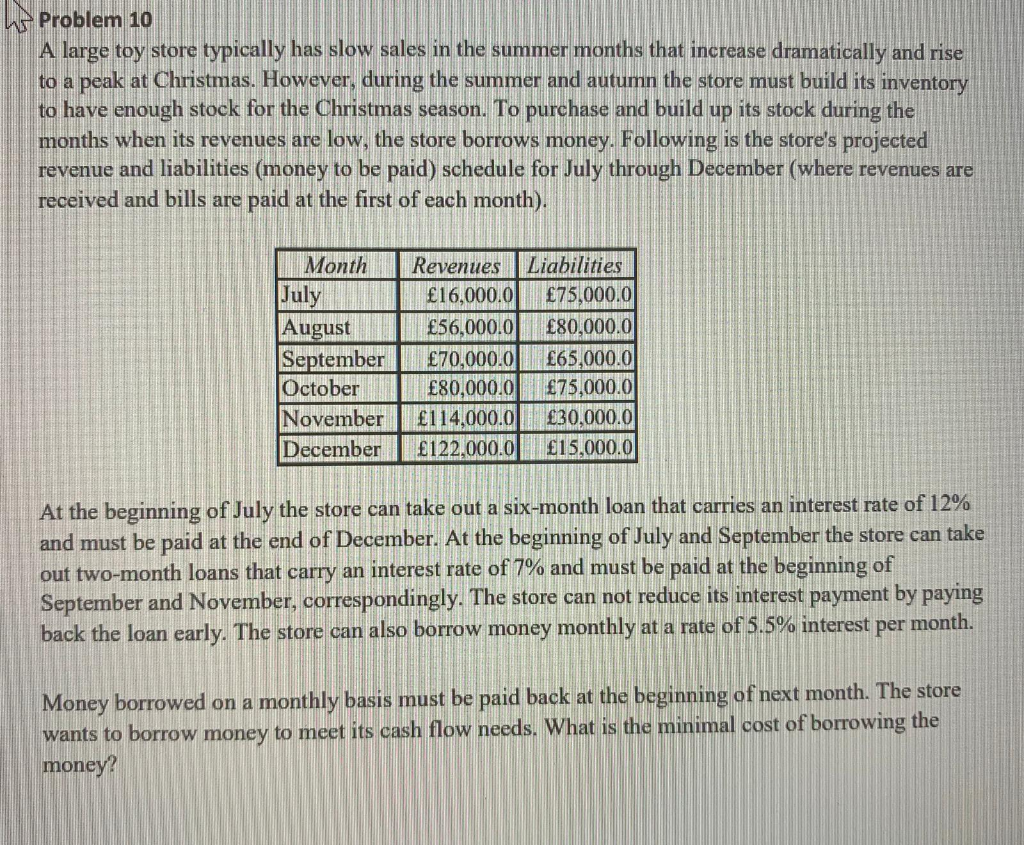

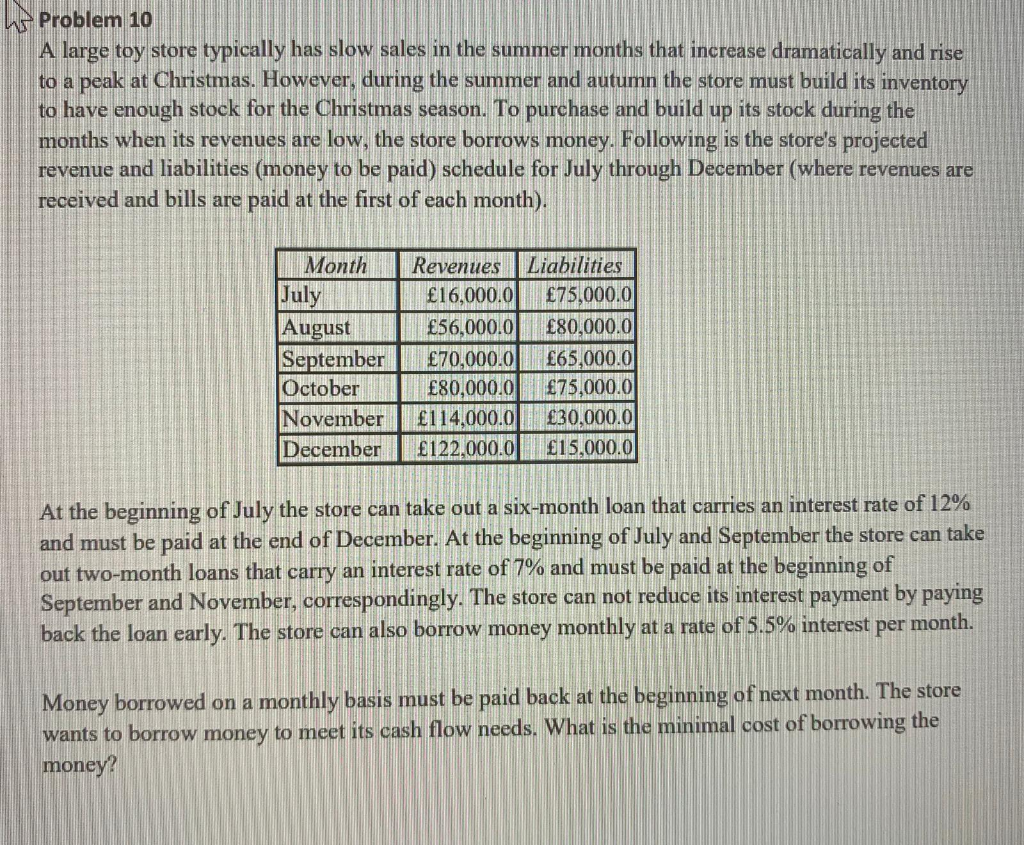

Problem 10 A large toy store typically has slow sales in the summer months that increase dramatically and rise to a peak at Christmas. However, during the summer and autumn the store must build its inventory to have enough stock for the Christmas season. To purchase and build up its stock during the months when its revenues are low, the store borrows money. Following is the store's projected revenue and liabilities (money to be paid) schedule for July through December (where revenues are received and bills are paid at the first of each month). Month July August September October November December Revenues Liabilities 16,000.0 75,000.0 56,000.0 80,000.0 70,000.0 65,000.0 80,000.0 75,000.0 114,000.0 30,000.00 122,000.0 15,000.0 At the beginning of July the store can take out a six-month loan that carries an interest rate of 12% and must be paid at the end of December. At the beginning of July and September the store can take out two-month loans that carry an interest rate of 7% and must be paid at the beginning of September and November, correspondingly. The store can not reduce its interest payment by paying back the loan early. The store can also borrow money monthly at a rate of 5.5% interest per month. Money borrowed on a monthly basis must be paid back at the beginning of next month. The store wants to borrow money to meet its cash flow needs. What is the minimal cost of borrowing the money? Problem 10 A large toy store typically has slow sales in the summer months that increase dramatically and rise to a peak at Christmas. However, during the summer and autumn the store must build its inventory to have enough stock for the Christmas season. To purchase and build up its stock during the months when its revenues are low, the store borrows money. Following is the store's projected revenue and liabilities (money to be paid) schedule for July through December (where revenues are received and bills are paid at the first of each month). Month July August September October November December Revenues Liabilities 16,000.0 75,000.0 56,000.0 80,000.0 70,000.0 65,000.0 80,000.0 75,000.0 114,000.0 30,000.00 122,000.0 15,000.0 At the beginning of July the store can take out a six-month loan that carries an interest rate of 12% and must be paid at the end of December. At the beginning of July and September the store can take out two-month loans that carry an interest rate of 7% and must be paid at the beginning of September and November, correspondingly. The store can not reduce its interest payment by paying back the loan early. The store can also borrow money monthly at a rate of 5.5% interest per month. Money borrowed on a monthly basis must be paid back at the beginning of next month. The store wants to borrow money to meet its cash flow needs. What is the minimal cost of borrowing the money