Question: Solve manually and follow the example below: What is the price of a 5-year bond that pays coupon annually at the rate 4.5% per annum

Solve manually and follow the example below:

What is the price of a 5-year bond that pays coupon annually at the rate 4.5% per annum if the principal is 50,000 pesos and the YTM is 8% compounded annually?

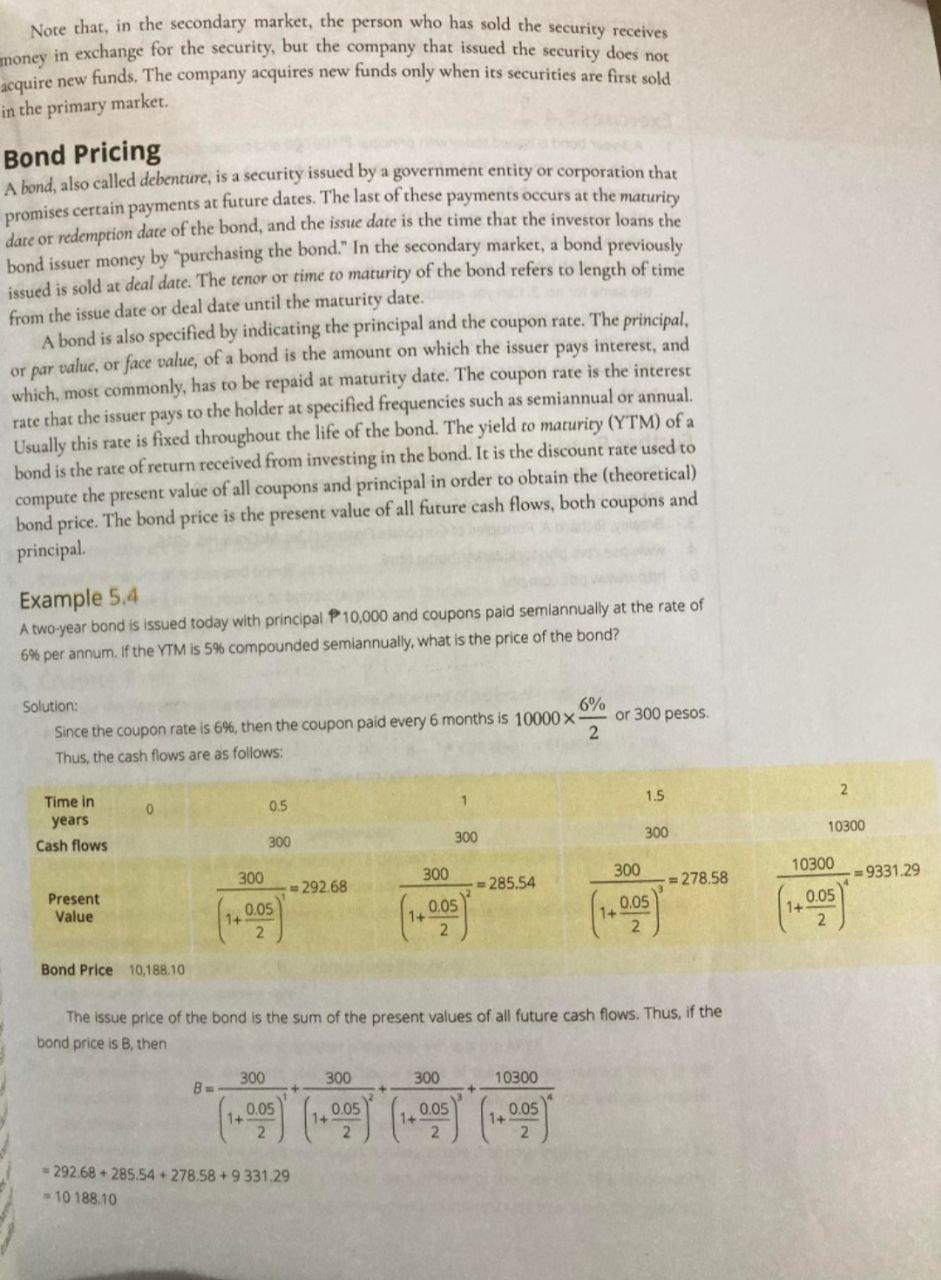

Note that, in the secondary market, the person who has sold the security receives money in exchange for the security, but the company that issued the security does not acquire new funds. The company acquires new funds only when its securities are first sold in the primary market. Bond Pricing A bond, also called debenture, is a security issued by a government entity or corporation that promises certain payments at future dates. The last of these payments occurs at the maturity date or redemption date of the bond, and the issue date is the time that the investor loans the bond issuer money by "purchasing the bond." In the secondary market, a bond previously issued is sold at deal date. The tenor or time to maturity of the bond refers to length of time from the issue date or deal date until the maturity date. A bond is also specified by indicating the principal and the coupon rate. The principal, or par value, or face value, of a bond is the amount on which the issuer pays interest, and which, most commonly, has to be repaid at maturity date. The coupon rate is the interest rate that the issuer pays to the holder at specified frequencies such as semiannual or annual. Usually this rate is fixed throughout the life of the bond. The yield to maturity (YTM) of a bond is the rate of return received from investing in the bond. It is the discount rate used to compute the present value of all coupons and principal in order to obtain the (theoretical) bond price. The bond price is the present value of all future cash flows, both coupons and principal. Example 5.4 A two-year bond is issued today with principal P10,000 and coupons paid semiannually at the rate of 6% per annum. If the YTM is 5% compounded semiannually, what is the price of the bond? Solution: Since the coupon rate is 6%, then the coupon paid every 6 months is 10000 x Thus, the cash flows are as follows: 6% 2 Time in years Cash flows Present Value 0 Bond Price 10,188.10 300 B= 1+ 0.5 300 1+ 300 0.05 2 =292.68 0.05 2 = 292.68 +285.54 +278.58 +9 331.29 -10 188.10 300 1+ 0.05 2 1+ 300 0.05 2 300 1+ The issue price of the bond is the sum of the present values of all future cash flows. Thus, if the bond price is B, then 1 300 0.05 2 =285.54 10300 0.05 2 or 300 pesos. 1+ 300 1+ 1.5 300 0.05 2 =278.58 10300 0.05 1+ 2 10300 =9331.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts