Question: * * * Solve manually ( i . e . pen and paper ) showing full work without excel * * * A project has

Solve manually ie pen and paper showing full work without excel

A project has equipment requirements that will cost $ installed. NWC of $ will also be required. The project is replacing old equipment that can be sold for $ book value If accepted, each year the project will generate new revenues of $ and new expenses of $ The equipment will be depreciated as a year asset under MACRS. The useful life is years. The new equipment has an estimated salvage value of $ The company's tax rate is

a What is the NINV for the project?

b Calculate the NPV MIRR this is different from IRR and PI for the project, if your required rate is

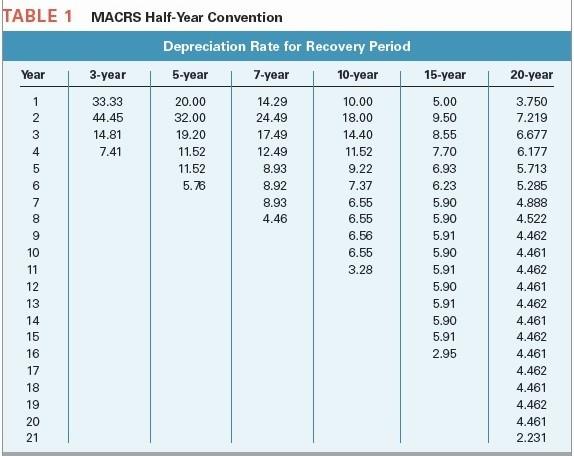

TABLE MACRS HalfYear Convention

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock