Question: solve on paper Chapter 7 Q4: Calculate the missing values in the following Tables using full valuation approach to assess interest rate risk for a

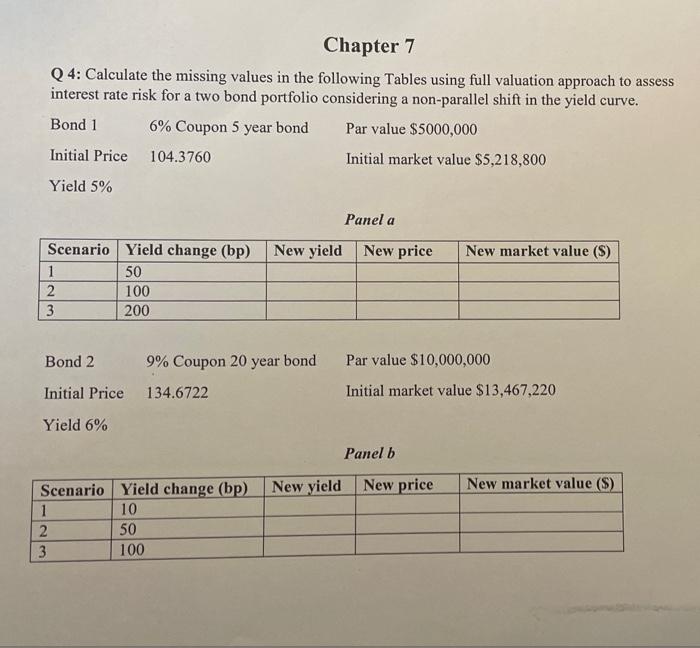

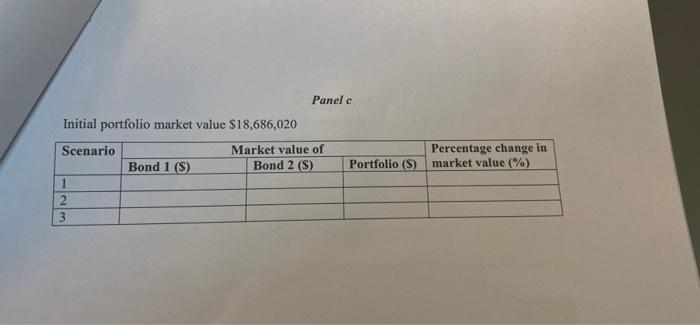

Chapter 7 Q4: Calculate the missing values in the following Tables using full valuation approach to assess interest rate risk for a two bond portfolio considering a non-parallel shift in the yield curve. Bond 1 6% Coupon 5 year bond Par value $5000,000 Initial Price 104.3760 Initial market value $5,218,800 Yield 5% Panel a New yield New price New market value (S) Scenario Yield change (bp) 1 50 2 100 3 200 Bond 2 9% Coupon 20 year bond 134.6722 Par value $10,000,000 Initial market value $13,467,220 Initial Price Yield 6% Panel b New yield New price New market value (S) Scenario Yield change (bp) 1 10 2 50 3 100 Panele Initial portfolio market value $18,686,020 Scenario Market value of Bond 1 (S) Bond 2 ($) 1 2 3 Percentage change in Portfolio ($) market value (%) WNE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts