Question: Solve on the partial solution udmoodle.ud.ac.ae Question 2: Preparation and Presentation of the Income Statement In your new position as chief financial officer for Gulf

Solve on the partial solution

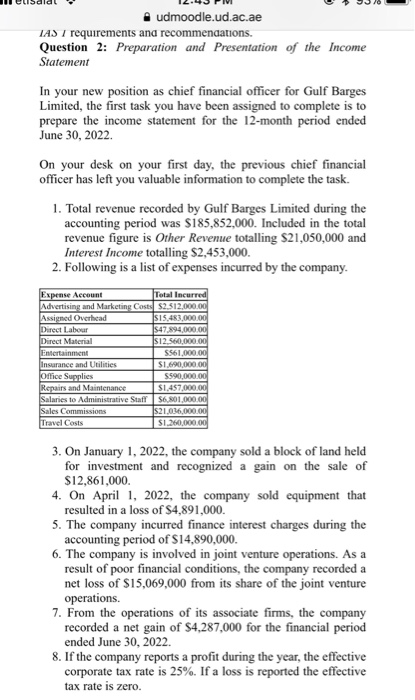

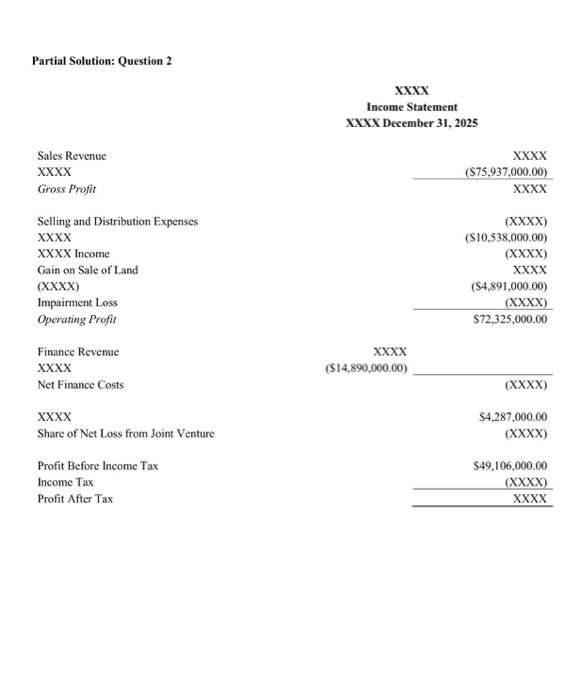

Solve on the partial solution udmoodle.ud.ac.ae Question 2: Preparation and Presentation of the Income Statement In your new position as chief financial officer for Gulf Barges Limited, the first task you have been assigned to complete is to prepare the income statement for the 12-month period ended June 30, 2022. On your desk on your first day, the previous chief financial officer has left you valuable information to complete the task 1. Total revenue recorded by Gulf Barges Limited during the accounting period was $185,852,000. Included in the total revenue figure is Other Revenue totalling $21,050,000 and Interest Income totalling $2,453,000 2. Following is a list of expenses incurred by the company ecount and Market Overhcad hrect Labour irect Matcrial 560,000.o 561,000.0 e and Utilities ffice $590,000.0 $1.457,0000 and alaries to Administrative Staff S$6, 801,000.0 ies Commis Travel Costs 1 260,000 3. On January 1, 2022, the company sold a block of land held for investment and recognized a gain on the sale of $12,861,000. 4. On April 1, 2022, the company sold equipment that 5. The company incurred finance interest charges during the 6. The company is involved in joint venture operations. As a resulted in a loss of $4.891,000 accounting period of S14,890,000 result of poor financial conditions, the company net loss of S15,069,000 from its share of the joint venture operations. recorded a 7. From the operations of its associate firms, the company recorded a net gain of $4,287,000 for the financial period ended June 30, 2022 8. If the company reports a profit during the year, the effective corporate tax rate is 25%. If a loss is reported the effective tax rate is zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts