Question: solve only part C & D on PAPER as soon as possible. URGENT HELP REQUIRED. i'll surely give u Thumbs up. Duo 6 Not yet

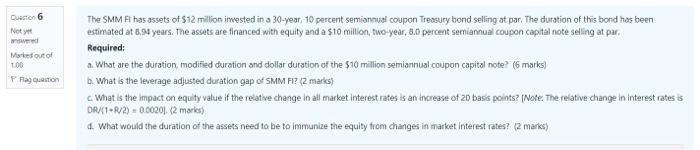

Duo 6 Not yet Market out of 100 Phaeton The SMM Ft has assets of $12 million invested in a 30-year, 10 percent semiannual coupon Treasury bond selling at par. The duration of this bond has been estimated at 8.94 years. The assets are financed with equity and a s10 million, two-year, 8.0 percent semiannual coupon capital note selling at par Required: a. What are the duration modified duration and dollar duration of the $10 million semiannual.coupon capital note? (6 marks) b. What is the leverage adjusted duration gap of SMM F? (2 marks) What is the impact on equity value if the relative change in all market interest rates is an increase of 20 basis points? Note. The relative change in interest rates DR/{1+R/2) = 0.0020.12 maries) 4. What would the duration of the assets need to be to immunize the equity from changes in market Interest rates? (2 marks) Duo 6 Not yet Market out of 100 Phaeton The SMM Ft has assets of $12 million invested in a 30-year, 10 percent semiannual coupon Treasury bond selling at par. The duration of this bond has been estimated at 8.94 years. The assets are financed with equity and a s10 million, two-year, 8.0 percent semiannual coupon capital note selling at par Required: a. What are the duration modified duration and dollar duration of the $10 million semiannual.coupon capital note? (6 marks) b. What is the leverage adjusted duration gap of SMM F? (2 marks) What is the impact on equity value if the relative change in all market interest rates is an increase of 20 basis points? Note. The relative change in interest rates DR/{1+R/2) = 0.0020.12 maries) 4. What would the duration of the assets need to be to immunize the equity from changes in market Interest rates? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts