Question: solve part 1&2 please Help Save & Required information Problem 6-3A Record transactions and prepare a partial income statement using a perpetual inventory system (L06-2,

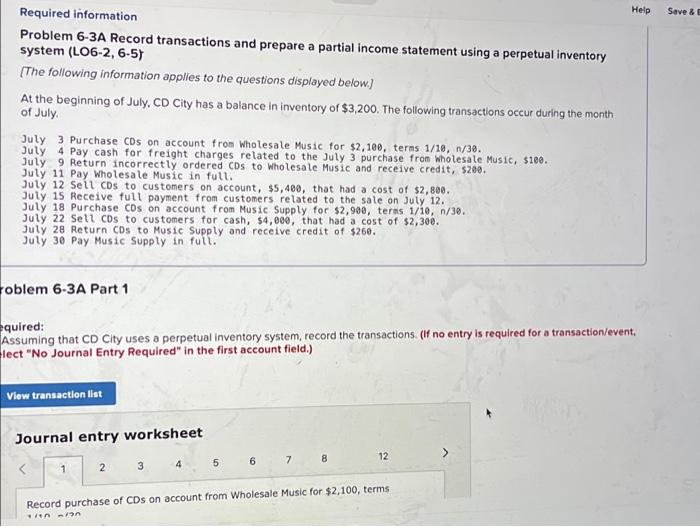

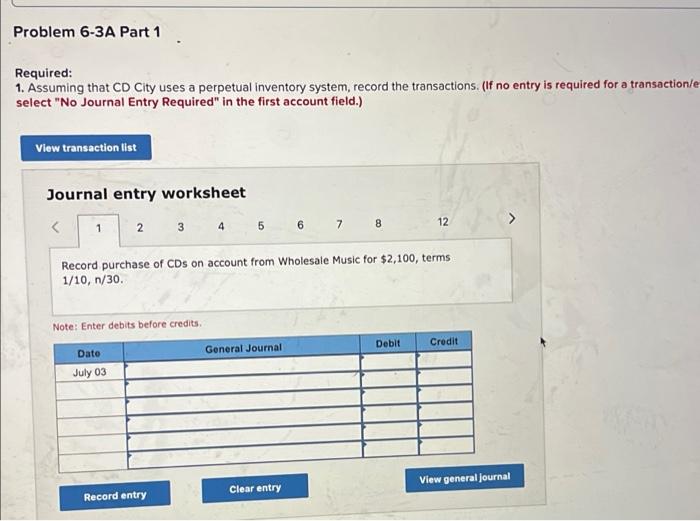

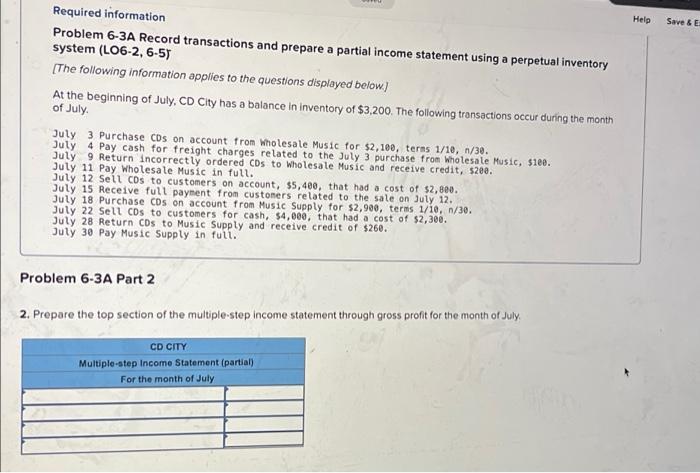

Help Save & Required information Problem 6-3A Record transactions and prepare a partial income statement using a perpetual inventory system (L06-2, 6-5) [The following information applies to the questions displayed below.) At the beginning of July, CD City has a balance in inventory of $3,200. The following transactions occur during the month of July July 3 Purchase CDs on account from Wholesale Music for $2,100, terms 1/10, n/30. July 4 Pay cash for freight charges related to the July 3 purchase fron Wholesale Music, $100. July 9 Return incorrectly ordered CDs to Wholesale Music and receive credit, $200. July 11 Pay Wholesale Music in full. July 12 Sell cds to customers on account, $5,400, that had a cost of $2,800. July 15 Receive full payment from customers related to the sale on July 12. July 18 Purchase Cos on account from Music Supply for $2,900, terns 1/10, n/30 July 22 Sell CDs to customers for cash, $4,000, that had a cost of $2,300. cred of $260. July 28 Return CDs to Music Supply and rec July 30 Pay Music Supply in full. oblem 6-3A Part 1 quired: Assuming that CD City uses a perpetual inventory system, record the transactions. (If no entry is required for a transaction/event. lect "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 8 12 2 3 4 5 6 7 Record purchase of CDs on account from Wholesale Music for $2,100, terms Problem 6-3A Part 1 Required: 1. Assuming that CD City uses a perpetual inventory system, record the transactions. (If no entry is required for a transaction/e select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 12 6 7 8 Record purchase of CDs on account from Wholesale Music for $2,100, terms 1/10, 1/30. Note: Enter debits before credits Debit Credit Dato General Journal July 03 View general Journal Clear entry Record entry Help Save & E Required information Problem 6-3A Record transactions and prepare a partial income statement using a perpetual inventory system (L06-2, 6-55 [The following information applies to the questions displayed below) At the beginning of July. CD City has a balance in inventory of $3,200. The following transactions occur during the month of July. July 3 Purchase CDs on account from Wholesale Music for $2,180, terns 1/10, n/30. July 4 Pay cash for freight charges related to the July 3 purchase from Wholesale Music, $108. July 9 Return incorrectly ordered CDs to wholesale Music and receive credit, $200. July 11 Pay Wholesale Music in full. July 12 Sell Cos to customers on account, $5,400, that had a cost of $2,800. July 15 Receive full payment from custoners related to the sale on July 12. July 18 Purchase CDs on account from Music Supply for $2,900, terns 1/10, 1/30. July 22 Sell CDs to customers for cash, $4,000, that had a cost of $2,300. July 28 Return CDs to Music Supply and receive credit of $260. July 30 Pay Music Supply in full. Problem 6-3A Part 2 2. Prepare the top section of the multiple-step income statement through gross profit for the month of July, CD CITY Multiple-step Income Statement (partial) For the month of July

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts