Question: solve part 2 MTH 237 Question 1 A fund manager asks his investment advisors to help him choose one of the mutual funds provided by

solve part 2

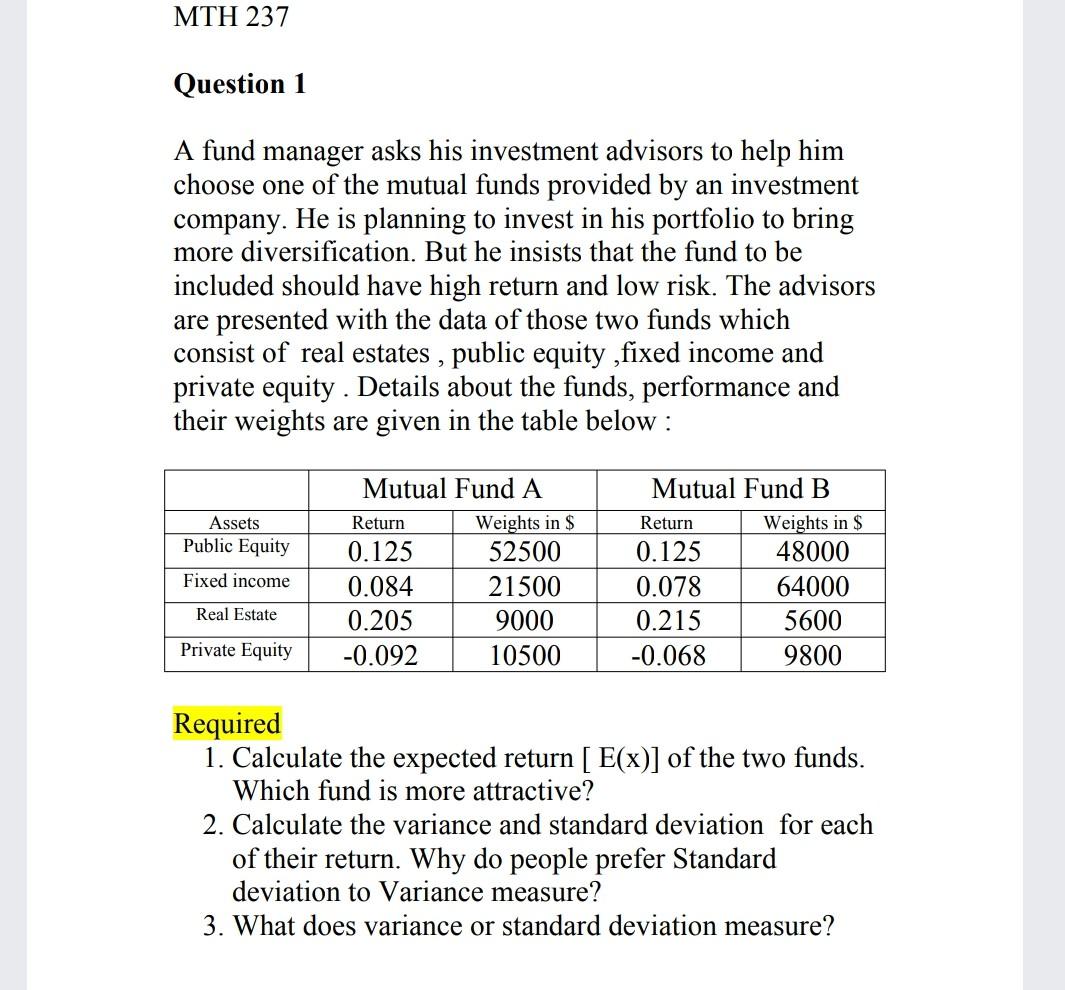

MTH 237 Question 1 A fund manager asks his investment advisors to help him choose one of the mutual funds provided by an investment company. He is planning to invest in his portfolio to bring more diversification. But he insists that the fund to be included should have high return and low risk. The advisors are presented with the data of those two funds which consist of real estates , public equity ,fixed income and private equity. Details about the funds, performance and their weights are given in the table below : Assets Public Equity Fixed income Mutual Fund A Return Weights in $ 0.125 52500 0.084 21500 0.205 9000 -0.092 10500 Mutual Fund B Return Weights in $ 0.125 48000 0.078 64000 0.215 5600 -0.068 9800 Real Estate Private Equity Required 1. Calculate the expected return [E(x)] of the two funds. Which fund is more attractive? 2. Calculate the variance and standard deviation for each of their return. Why do people prefer Standard deviation to Variance measure? 3. What does variance or standard deviation measure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts