Question: solve part A in 20 mins thanks begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} hline & A & B & C & D & E & F & G & H

solve part A in 20 mins thanks

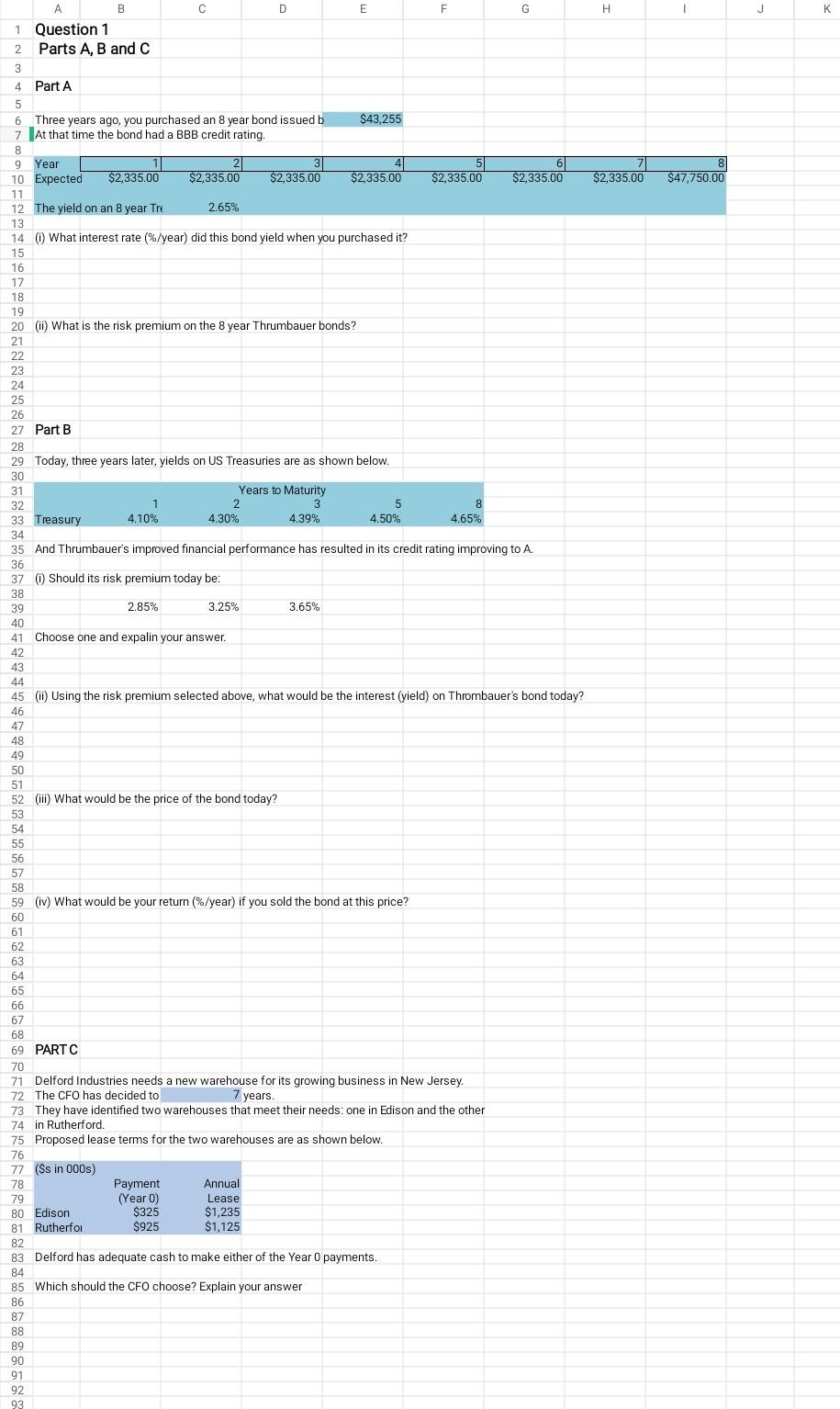

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G & H & I \\ \hline 1 & Question 1 & & & & \\ \hline 2 & Parts A, B and C & & & & & \\ \hline 3 & & & & & \\ \hline 4 & Part A & & & & & \\ \hline \end{tabular} 6 Three years ago, you purchased an 8 year bond issued b $43,255 7 At that time the bond had a BBB credit rating. 8 4 (i) What interest rate (\%/year) did this bond yield when you purchased it? (ii) What is the risk premium on the 8 year Thrumbauer bonds? (ii) Using the risk premium selected above, what would be the interest (yield) on Thrombauer's bond today? (iii) What would be the price of the bond today? (iv) What would be your return (\%/year) if you sold the bond at this price? PART C 70 71 Delford Industries needs a new warehouse for its growing business in New Jersey. 72 The CFO has decided to 7 years. 73 They have identified two warehouses that meet their needs: one in Edison and the other 74 in Rutherford. 75 Proposed lease terms for the two warehouses are as shown below. 76 83 Delford has adequate cash to make either of the Year 0 payments. 5 Which should the CFO choose? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts