Question: Solve part (v) to part (vii) QUESTION 3 (CHAPTER 4) Din Sabrie Resources Sdn Bhd (DSRSB) manufactures and sells medical equipment. Here is the information

Solve part (v) to part (vii)

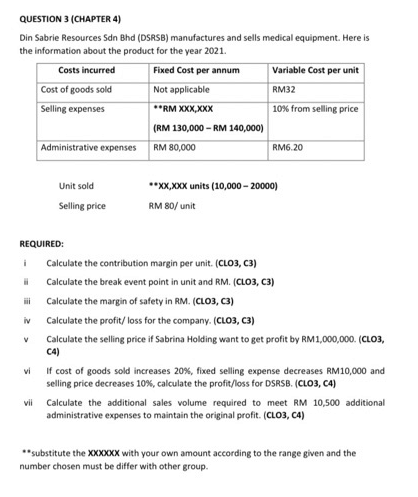

QUESTION 3 (CHAPTER 4) Din Sabrie Resources Sdn Bhd (DSRSB) manufactures and sells medical equipment. Here is the information about the product for the year 2021. Costs incurred Fixed Cost per annum Variable Cost per unit Cost of goods sold Not applicable RM32 Selling expenses **RM XXX.XXX 10% from selling price (RM 130,000 - RM 140,000) Administrative expenses RM 80,000 RM6.20 Unit sold **XX XXX units (10,000 - 20000) RM 80/unit Selling price REQUIRED: i Hi iv V Calculate the contribution margin per unit. (CLO3, C3) Calculate the break event point in unit and RM. (CLO3, C3) Calculate the margin of safety in RM. (CLO3, C3) Calculate the profit/loss for the company. (CLO3, C3) Calculate the selling price if Sabrina Holding want to get profit by RM 1,000,000. (CLO3, C4) vi If cost of goods sold increases 20%, fixed selling expense decreases RM10,000 and selling price decreases 10%, calculate the profit/loss for DSRSB. (CLO3, C4) vii Calculate the additional sales volume required to meet RM 10,500 additional administrative expenses to maintain the original profit. (CLO3, C4) **substitute the XXXXXX with your own amount according to the range given and the number chosen must be differ with other group

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts