Question: solve please Problem 7-3A Calculate and record goodwill (L07-2) Fresh Cut Corporation purchased all the outstanding common stock of Premium Meats for $11,700,000 in cash.

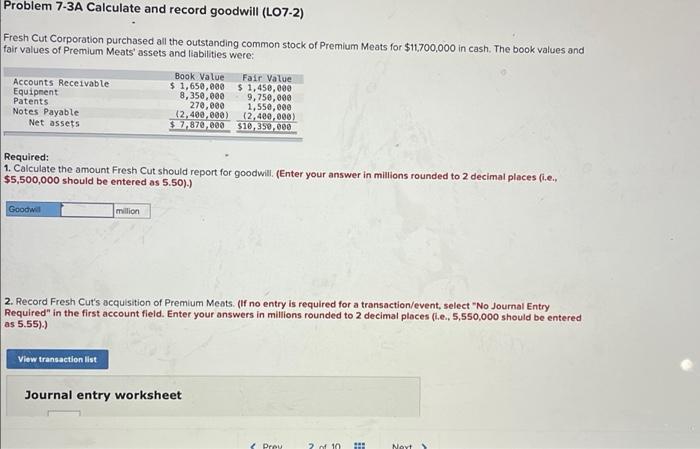

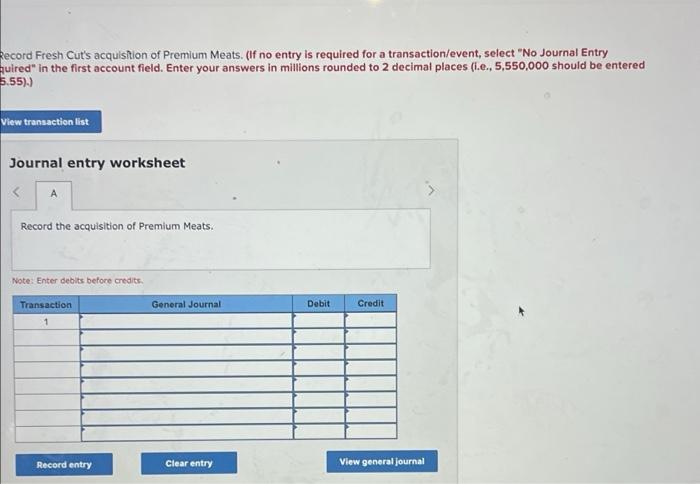

Problem 7-3A Calculate and record goodwill (L07-2) Fresh Cut Corporation purchased all the outstanding common stock of Premium Meats for $11,700,000 in cash. The book values and fair values of Premium Meats' assets and liabilities were: Book Value Fair Value Accounts Receivable $ 1,650,000 $1,450,000 Equipment 8,350,000 9.750,000 Patents 270,000 1,550,000 Notes Payable 12,400,000) (2,400,000) Net assets $7,870,000 $10,350,000 Required: 1. Calculate the amount Fresh Cut should report for goodwill. (Enter your answer in millions rounded to 2 decimal places (i.e. $5,500,000 should be entered as 5.50).) Goodwill million 2. Record Fresh Cuts acquisition of Premium Meats. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in millions rounded to 2 decimal places (ie, 5,550,000 should be entered as 5.55).) View transaction list Journal entry worksheet Prev 7 of 10 1. Nort Record Fresh Cut's acquisition of Premium Meats. (If no entry is required for a transaction/event, select "No Journal Entry nuired" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,550,000 should be entered 5.55).) View transaction list Journal entry worksheet A Record the acquisition of Premium Meats. Note: Enter debits before credits General Journal Debit Credit Transaction 1 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts