Question: solve please solve please! No 4. a) Stocks have a two-factor structure. Two widely diversified portfolios have the following data. Portfolio A has average return

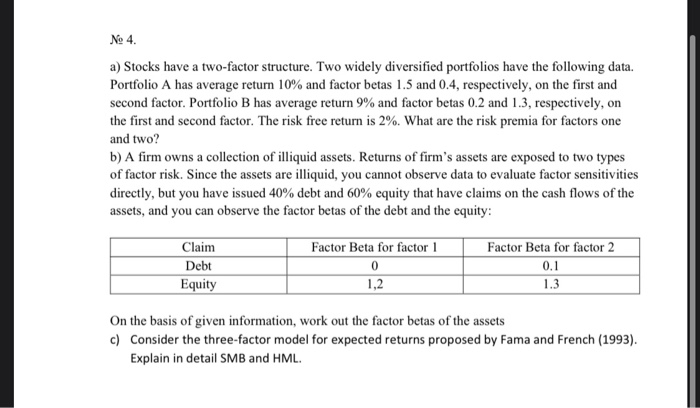

No 4. a) Stocks have a two-factor structure. Two widely diversified portfolios have the following data. Portfolio A has average return 10% and factor betas 1.5 and 0.4, respectively, on the first and second factor. Portfolio B has average return 9% and factor betas 0.2 and 1.3, respectively, on the first and second factor. The risk free return is 2%. What are the risk premia for factors one and two? b) A firm owns a collection of illiquid assets. Returns of firm's assets are exposed to two types of factor risk. Since the assets are illiquid, you cannot observe data to evaluate factor sensitivities directly, but you have issued 40% debt and 60% equity that have claims on the cash flows of the assets, and you can observe the factor betas of the debt and the equity: Factor Beta for factor 1 Factor Beta for factor 2 Claim Debt Equity 1.3 On the basis of given information, work out the factor betas of the assets c) Consider the three-factor model for expected returns proposed by Fama and French (1993). Explain in detail SMB and HML. No 4. a) Stocks have a two-factor structure. Two widely diversified portfolios have the following data. Portfolio A has average return 10% and factor betas 1.5 and 0.4, respectively, on the first and second factor. Portfolio B has average return 9% and factor betas 0.2 and 1.3, respectively, on the first and second factor. The risk free return is 2%. What are the risk premia for factors one and two? b) A firm owns a collection of illiquid assets. Returns of firm's assets are exposed to two types of factor risk. Since the assets are illiquid, you cannot observe data to evaluate factor sensitivities directly, but you have issued 40% debt and 60% equity that have claims on the cash flows of the assets, and you can observe the factor betas of the debt and the equity: Factor Beta for factor 1 Factor Beta for factor 2 Claim Debt Equity 1.3 On the basis of given information, work out the factor betas of the assets c) Consider the three-factor model for expected returns proposed by Fama and French (1993). Explain in detail SMB and HML

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts