Question: solve please step by step Instructions: 1. I will not accept any typed solution and your answer must be in hand writing. 2. You need

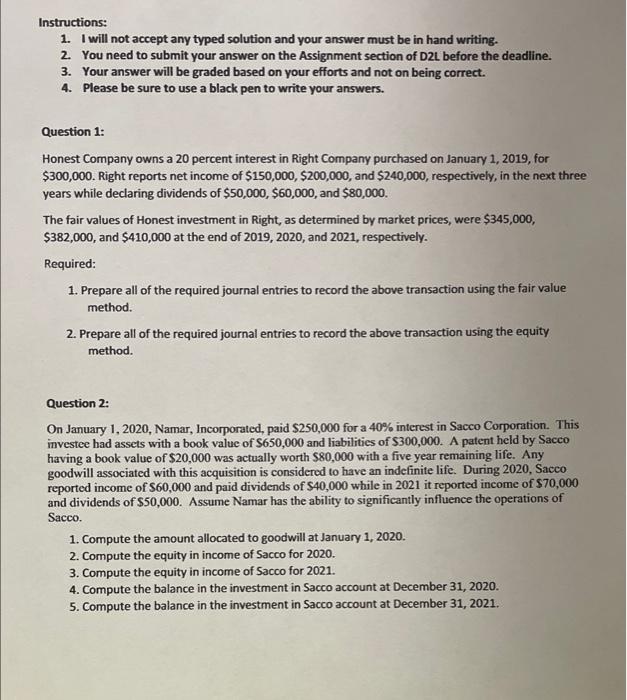

Instructions: 1. I will not accept any typed solution and your answer must be in hand writing. 2. You need to submit your answer on the Assignment section of D2L before the deadline. 3. Your answer will be graded based on your efforts and not on being correct. 4. Please be sure to use a black pen to write your answers. Question 1: Honest Company owns a 20 percent interest in Right Company purchased on January 1, 2019, for $300,000. Right reports net income of $150,000, $200,000, and $240,000, respectively, in the next three years while declaring dividends of $50,000, $60,000, and $80,000. The fair values of Honest investment in Right, as determined by market prices, were $345,000, $382,000, and $410,000 at the end of 2019, 2020, and 2021, respectively. Required: 1. Prepare all of the required journal entries to record the above transaction using the fair value method. 2. Prepare all of the required journal entries to record the above transaction using the equity method. Question 2: On January 1, 2020, Namar, Incorporated, paid $250,000 for a 40% interest in Sacco Corporation. This investee had assets with a book value of S650,000 and liabilities of $300,000. A patent held by Sacco having a book value of $20,000 was actually worth $80,000 with a five year remaining life. Any goodwill associated with this acquisition is considered to have an indefinite life. During 2020, Sacco reported income of $60,000 and paid dividends of S40,000 while in 2021 it reported income of $70,000 and dividends of $50,000. Assume Namar has the ability to significantly influence the operations of Sacco. 1. Compute the amount allocated to goodwill at January 1, 2020. 2. Compute the equity in income of Sacco for 2020. 3. Compute the equity in income of Sacco for 2021. 4. Compute the balance in the investment in Sacco account at December 31, 2020. 5. Compute the balance in the investment in Sacco account at December 31, 2021. Instructions: 1. I will not accept any typed solution and your answer must be in hand writing. 2. You need to submit your answer on the Assignment section of D2L before the deadline. 3. Your answer will be graded based on your efforts and not on being correct. 4. Please be sure to use a black pen to write your answers. Question 1: Honest Company owns a 20 percent interest in Right Company purchased on January 1, 2019, for $300,000. Right reports net income of $150,000, $200,000, and $240,000, respectively, in the next three years while declaring dividends of $50,000, $60,000, and $80,000. The fair values of Honest investment in Right, as determined by market prices, were $345,000, $382,000, and $410,000 at the end of 2019, 2020, and 2021, respectively. Required: 1. Prepare all of the required journal entries to record the above transaction using the fair value method. 2. Prepare all of the required journal entries to record the above transaction using the equity method. Question 2: On January 1, 2020, Namar, Incorporated, paid $250,000 for a 40% interest in Sacco Corporation. This investee had assets with a book value of S650,000 and liabilities of $300,000. A patent held by Sacco having a book value of $20,000 was actually worth $80,000 with a five year remaining life. Any goodwill associated with this acquisition is considered to have an indefinite life. During 2020, Sacco reported income of $60,000 and paid dividends of S40,000 while in 2021 it reported income of $70,000 and dividends of $50,000. Assume Namar has the ability to significantly influence the operations of Sacco. 1. Compute the amount allocated to goodwill at January 1, 2020. 2. Compute the equity in income of Sacco for 2020. 3. Compute the equity in income of Sacco for 2021. 4. Compute the balance in the investment in Sacco account at December 31, 2020. 5. Compute the balance in the investment in Sacco account at December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts