Question: solve problem, show equation and process. NO EXCEL Use the following information to answer Questions 34-35. Aeon Company is considering an investment in a new

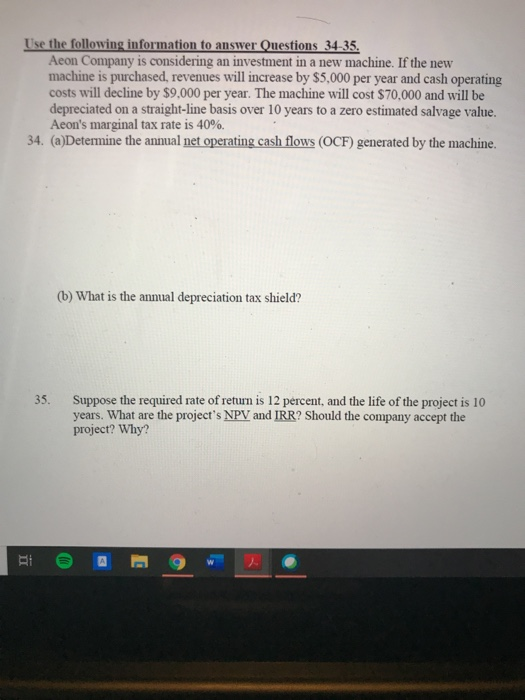

Use the following information to answer Questions 34-35. Aeon Company is considering an investment in a new machine. If the new machine is purchased, revenues will increase by $5,000 per year and cash operating costs will decline by $9,000 per year. The machine will cost $70,000 and will be depreciated on a straight-line basis over 10 years to a zero estimated salvage value. Aeon's marginal tax rate is 40%. 34. (a)Determine the annual net operating cash flows (OCF) generated by the machine. (b) What is the annual depreciation tax shield? 35. Suppose the required rate of return is 12 percent, and the life of the project is 10 years. What are the project's NPV and IRR? Should the company accept the project? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts