Question: Solve problems 4&5 and show math solutions to 2&3 are provided below 2. You can acquire an existing business for $2 million. You are uncertain

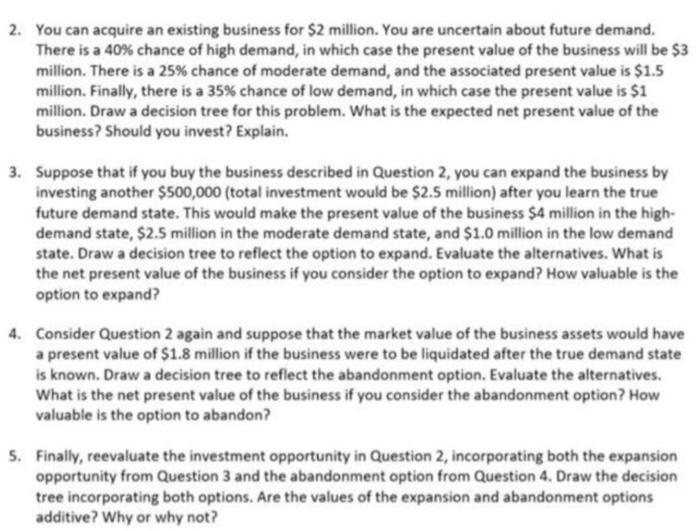

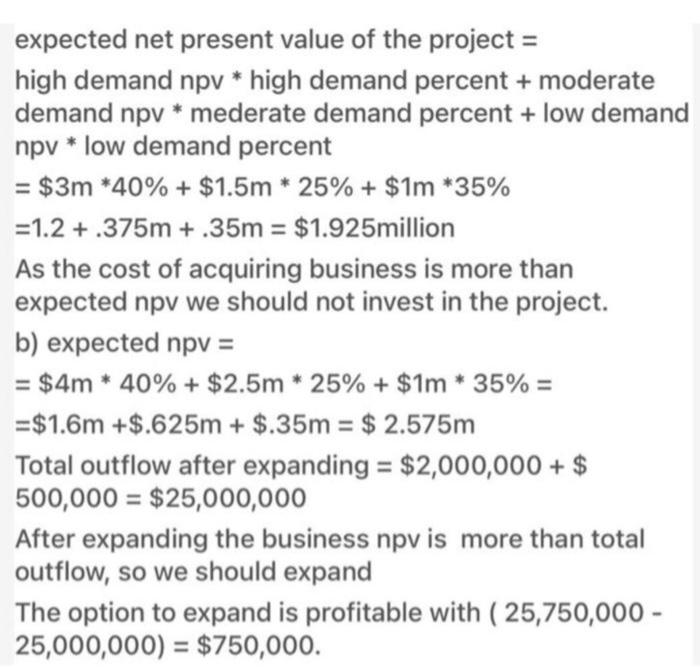

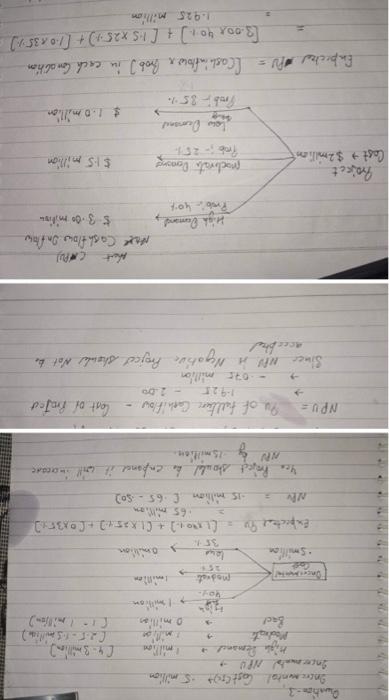

2. You can acquire an existing business for $2 million. You are uncertain about future demand. There is a 40% chance of high demand, in which case the present value of the business will be $3 million. There is a 25% chance of moderate demand, and the associated present value is $1.5 million. Finally, there is a 35% chance of low demand, in which case the present value is $1 million. Draw a decision tree for this problem. What is the expected net present value of the business? Should you invest? Explain. 3. Suppose that if you buy the business described in Question 2, you can expand the business by investing another $500,000 (total investment would be $2.5 million) after you learn the true future demand state. This would make the present value of the business S4 million in the high- demand state, $2.5 million in the moderate demand state, and $1.0 million in the low demand state. Draw a decision tree to reflect the option to expand. Evaluate the alternatives. What is the net present value of the business if you consider the option to expand? How valuable is the option to expand? 4. Consider Question 2 again and suppose that the market value of the business assets would have a present value of $1.8 million if the business were to be liquidated after the true demand state is known. Draw a decision tree to reflect the abandonment option. Evaluate the alternatives. What is the net present value of the business if you consider the abandonment option? How valuable is the option to abandon? 5. Finally, reevaluate the investment opportunity in Question 2, incorporating both the expansion opportunity from Question 3 and the abandonment option from Question 4. Draw the decision tree incorporating both options. Are the values of the expansion and abandonment options additive? Why or why not? expected net present value of the project = high demand npv * high demand percent + moderate demand npv * mederate demand percent + low demand npv * low demand percent = $3m *40% + $1.5m * 25% + $1m *35% =1.2 + .375m +.35m = $1.925million As the cost of acquiring business is more than expected npv we should not invest in the project. b) expected npv = = $4m * 40% + $2.5m * 25% + $1m * 35% = =$1.6m +$.625m + $.35m = $ 2.575m Total outflow after expanding = $2,000,000+ $ 500,000 = $25,000,000 After expanding the business npv is more than total outflow, so we should expand The option to expand is profitable with ( 25,750,000 - 25,000,000) = $750,000. Puh: 3 Incremental Cost Crst 5 milion Incertu higie Demand million Moleto mo Bac! (4.8 million ) VO Modne Cas Smillie lewe 351 Expected 10:1] + CLXS (0X320 .65 million NN 15 million [.65 - sol You project should be enfance it will increase N milion NPU = u of fullture Carhiflow Cost of project 1.9.25 -.075 million Since NPU Negative Project shouler Not be -- Mare Cash flow on flow $ 3.00 milion High Danmark Pror 404 Project Cast $2 milliant $1.5 million moderate Donosna Prob - 251 Low Deoranet Pribor 85% $ 10 million Enbecked Apu = (cash inflowx Prob] in each Conalition. 13.00 x 40:1] + [15x25:))+ (1.04351] 1.925 million 2. You can acquire an existing business for $2 million. You are uncertain about future demand. There is a 40% chance of high demand, in which case the present value of the business will be $3 million. There is a 25% chance of moderate demand, and the associated present value is $1.5 million. Finally, there is a 35% chance of low demand, in which case the present value is $1 million. Draw a decision tree for this problem. What is the expected net present value of the business? Should you invest? Explain. 3. Suppose that if you buy the business described in Question 2, you can expand the business by investing another $500,000 (total investment would be $2.5 million) after you learn the true future demand state. This would make the present value of the business S4 million in the high- demand state, $2.5 million in the moderate demand state, and $1.0 million in the low demand state. Draw a decision tree to reflect the option to expand. Evaluate the alternatives. What is the net present value of the business if you consider the option to expand? How valuable is the option to expand? 4. Consider Question 2 again and suppose that the market value of the business assets would have a present value of $1.8 million if the business were to be liquidated after the true demand state is known. Draw a decision tree to reflect the abandonment option. Evaluate the alternatives. What is the net present value of the business if you consider the abandonment option? How valuable is the option to abandon? 5. Finally, reevaluate the investment opportunity in Question 2, incorporating both the expansion opportunity from Question 3 and the abandonment option from Question 4. Draw the decision tree incorporating both options. Are the values of the expansion and abandonment options additive? Why or why not? expected net present value of the project = high demand npv * high demand percent + moderate demand npv * mederate demand percent + low demand npv * low demand percent = $3m *40% + $1.5m * 25% + $1m *35% =1.2 + .375m +.35m = $1.925million As the cost of acquiring business is more than expected npv we should not invest in the project. b) expected npv = = $4m * 40% + $2.5m * 25% + $1m * 35% = =$1.6m +$.625m + $.35m = $ 2.575m Total outflow after expanding = $2,000,000+ $ 500,000 = $25,000,000 After expanding the business npv is more than total outflow, so we should expand The option to expand is profitable with ( 25,750,000 - 25,000,000) = $750,000. Puh: 3 Incremental Cost Crst 5 milion Incertu higie Demand million Moleto mo Bac! (4.8 million ) VO Modne Cas Smillie lewe 351 Expected 10:1] + CLXS (0X320 .65 million NN 15 million [.65 - sol You project should be enfance it will increase N milion NPU = u of fullture Carhiflow Cost of project 1.9.25 -.075 million Since NPU Negative Project shouler Not be -- Mare Cash flow on flow $ 3.00 milion High Danmark Pror 404 Project Cast $2 milliant $1.5 million moderate Donosna Prob - 251 Low Deoranet Pribor 85% $ 10 million Enbecked Apu = (cash inflowx Prob] in each Conalition. 13.00 x 40:1] + [15x25:))+ (1.04351] 1.925 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts