Question: Solve Q3 show work on how you calculated lease payable. Part #6 [Operating lease] Renew Co. uses leasing as a secondary means of selling its

Solve Q3 show work on how you calculated lease payable.

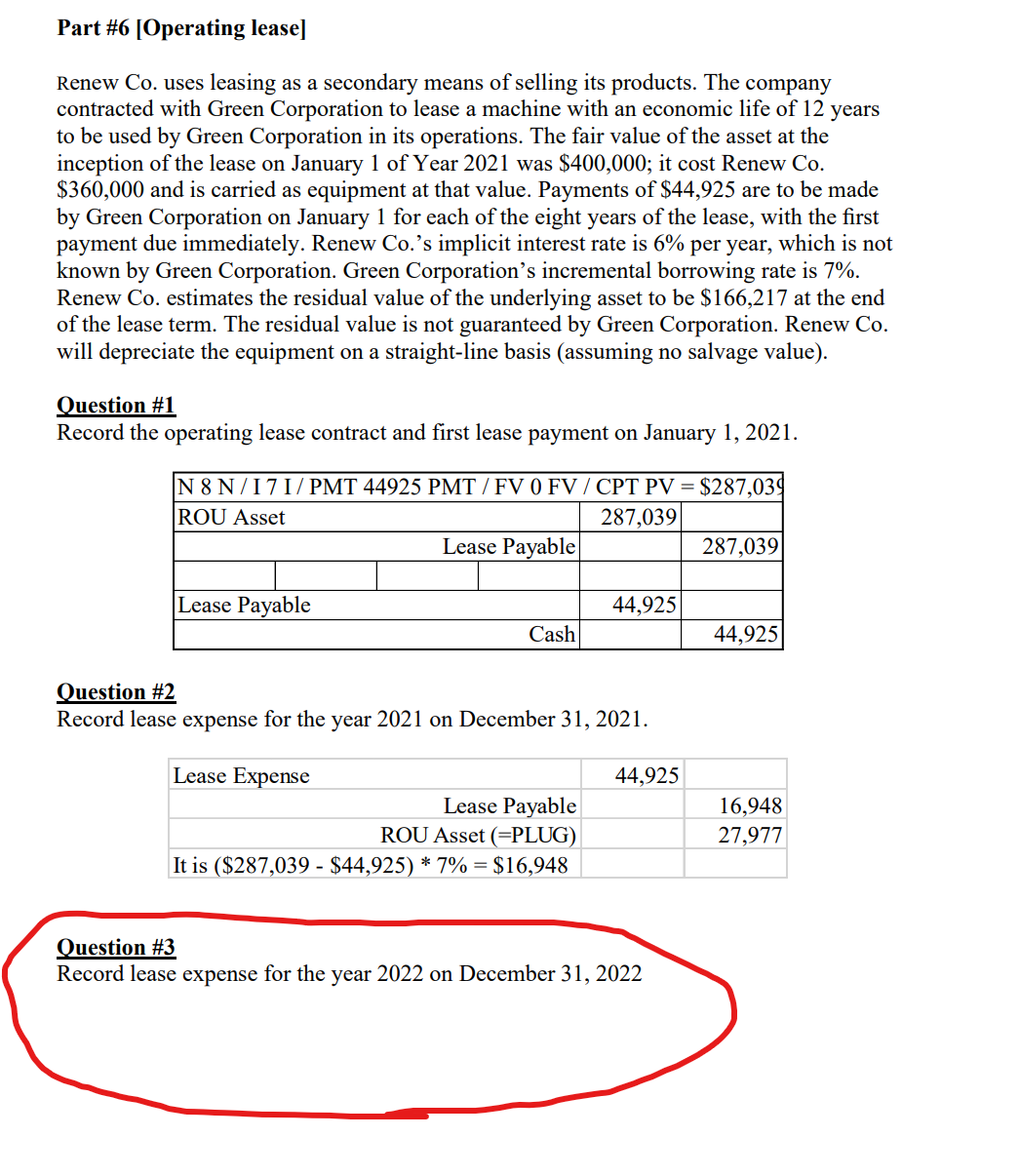

Part #6 [Operating lease] Renew Co. uses leasing as a secondary means of selling its products. The company contracted with Green Corporation to lease a machine with an economic life of 12 years to be used by Green Corporation in its operations. The fair value of the asset at the inception of the lease on January 1 of Year 2021 was $400,000; it cost Renew Co. $360,000 and is carried as equipment at that value. Payments of $44,925 are to be made by Green Corporation on January 1 for each of the eight years of the lease, with the rst payment due immediately. Renew Co.'s implicit interest rate is 6% per year, which is not known by Green Corporation. Green Corporation's incremental borrowing rate is 2%. Renew Co. estimates the residual value of the underlying asset to be $166,217 at the end of the lease term. The residual value is not guaranteed by Green Corporation. Renew Co. will depreciate the equipment on a straight-line basis (assuming no salvage value). Question #1 Record the operating lease contract and rst lease payment on January 1, 2021. N 8 NH? I/PMT 44925 PMTJFVOFV/CPT PV = $287,03' ROU Asset 287,039 Lease Payable 287,039 Lease Payable 44,925 Question #2 Record lease expense for the year 2021 on December 31, 2021. [case Expense 44,925 [case Payable 16,948 ROU Asset (=PLUG) 22,92? It is ($289,039 - $44,925) * 7% = $16,948 Question #3 Record lease expense for the year 2022 on December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts