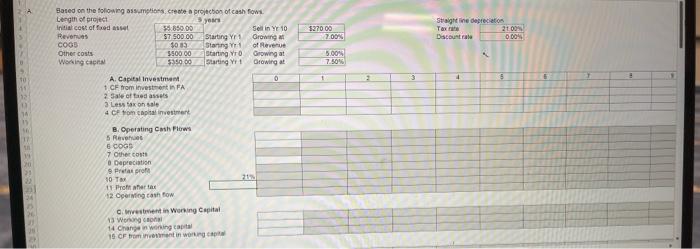

Question: solve question A 14 300 37 18 39 Based on the following assumptions, create a projection of cash flows Length of project 5 years Initial

14 300 37 18 39 Based on the following assumptions, create a projection of cash flows Length of project 5 years Initial cost of fixed asset Revenues COGS $5.850.00 $7.500.00 1083 $500 00 $350.00 Starting Yr 1 Starting Yr Starting Vro Other costs Working capital Starting Vr 1 A. Capital Investment 1 CF from investment FA 2 Sale of the assets 3 Less tax on sale 4 CF from capital investment B. Operating Cash Flows 5 Revenues 6 COGD 7 Other costs Depreciation 9 Pretax profe 10 Tax 11 Proft afer tax 12 Operating cash flow C. Investment in Working Capital 13 Working cephal 14 Change in working capital 15 CF from investment in working capital Sell in Yr 10 Growing at of Revenue Growing at Growing at 0 21% $270 00 7.00% 5.00% 7.50% 2 Straight line depreciation Tax rate Discount rate A 4 21.00% 14 300 37 18 39 Based on the following assumptions, create a projection of cash flows Length of project 5 years Initial cost of fixed asset Revenues COGS $5.850.00 $7.500.00 1083 $500 00 $350.00 Starting Yr 1 Starting Yr Starting Vro Other costs Working capital Starting Vr 1 A. Capital Investment 1 CF from investment FA 2 Sale of the assets 3 Less tax on sale 4 CF from capital investment B. Operating Cash Flows 5 Revenues 6 COGD 7 Other costs Depreciation 9 Pretax profe 10 Tax 11 Proft afer tax 12 Operating cash flow C. Investment in Working Capital 13 Working cephal 14 Change in working capital 15 CF from investment in working capital Sell in Yr 10 Growing at of Revenue Growing at Growing at 0 21% $270 00 7.00% 5.00% 7.50% 2 Straight line depreciation Tax rate Discount rate A 4 21.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts