Question: SOLVE question below 4. This question is on stochastic interest rates and bond pricing a. [25 Marks] Suppose the spot interest rate T, which is

SOLVE question below

![bond pricing a. [25 Marks] Suppose the spot interest rate T, which](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6703f9acdde80_7726703f9accbb2e.jpg)

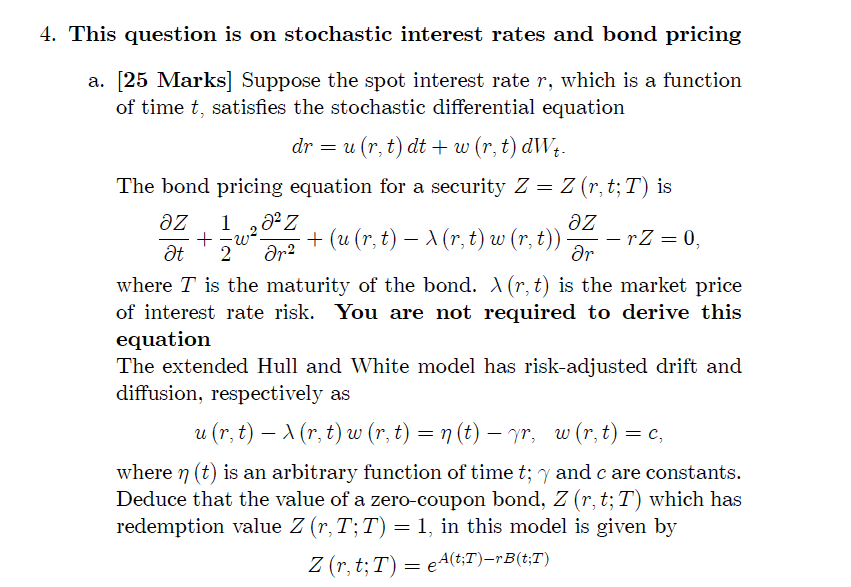

4. This question is on stochastic interest rates and bond pricing a. [25 Marks] Suppose the spot interest rate T, which is a function of time t, satises the stochastic differential equation 01:" = u (r, t) dt + w (r, t) til-Vt- The bond pricing equation for a security Z = Z (r) t; T) is 6g + $102+ (um) A(r?t)w(r)t)):f rZ=OJ where T is the maturity of the bond. A (at) is the market price of interest rate risk. You are not required to derive this equation The extended Hull and White model has riskadjusted drift and diffusion, respectively as n(r,t)A(r,t)w[r,t) :n(t)rr w(r,t) :c, 5' where if] (t) is an arbitrary function of time t; 'y and c are constants. Deduce that the value of a zerocoupon bond, Z (r, t; T) which has redemption value Z (r, T; T) = l? in this model is given by Z (in, t; T) : eA(t;T)"B(t;T} where B (t; T ) = = (1 -e-7(I-t) ) and T A (t; T) = - n (T ) B (T; T) dr + t (T - t ) + -e-1(I-t ) -27(T-t) 2-2 e ry 27 b. [45 Marks] The drift in the Hull and White model is to be adapted for the calibration procedure which is performed at time t = t*, when the spot rate is r*. The market prices of bonds are denoted by Zy(t*; T). Show that this implies 22 n* (t) = a at2 log( ZM(t*; t))- at log (ZM(t* ; t) ) +- 27 1 - e- 27 (t -t* ) )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts