Question: Solve question either by financial calculator and indicating inputs or using a constant growth rate infinite horizon type of equation please. QUESTION 1 Your analysis

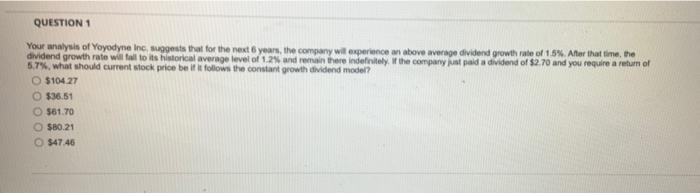

QUESTION 1 Your analysis of Yoyodyne Inc, suggests that for the next years, the company will experience above average dividend growth rate of 1.5%. After that time, the dividend growth rate will fall to its historical average level of 1.2% and remain there indefinitely if the company is paid a dividend of $2.70 and you require a return of 5.7%, what should current stock price be it is follows the constant growth dividend model? $104.27 $36.51 561.70 $80.21 $47.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts