Question: solve question pleaseee a model firm in a perfect M&M world decides to experiment with different capital structures. It invests $800 today, and its cashflows

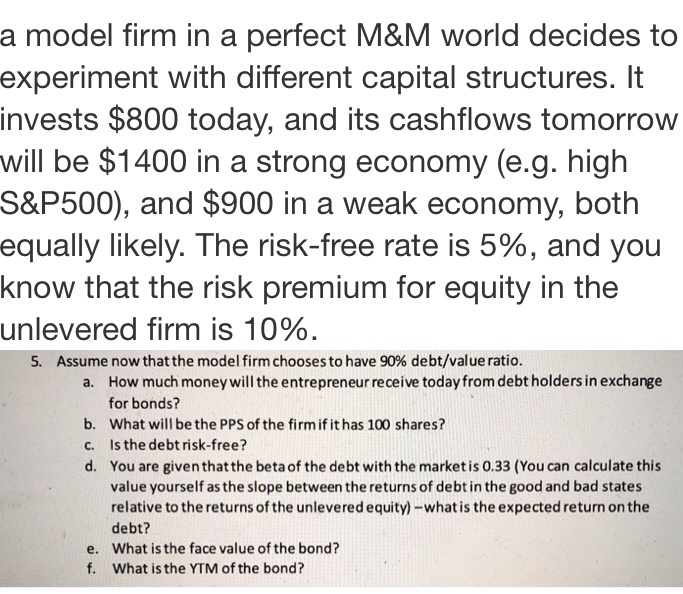

a model firm in a perfect M&M world decides to experiment with different capital structures. It invests $800 today, and its cashflows tomorrow will be $1400 in a strong economy (e.g. high S&P500), and $900 in a weak economy, both equally likely. The risk-free rate is 5%, and you know that the risk premium for equity in the unlevered firm is 10%. 5. Assume now that the model firm chooses to have 90% debt/value ratio. a. How much money will the entrepreneur receive today from debt holders in exchange for bonds? b. What will be the PPS of the firm if it has 100 shares? c. Is the debt risk-free? d. You are given that the beta of the debt with the market is 0.33 (You can calculate this value yourself as the slope between the returns of debt in the good and bad states relative to the returns of the unlevered equity) - what is the expected return on the debt? e. What is the face value of the bond? f. What is the YTM of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts