Question: solve questions 3 and 4 please 3) Suppose you plan on purchasing Von Bora stock in one year, right after the $1.25 dividend is paid.

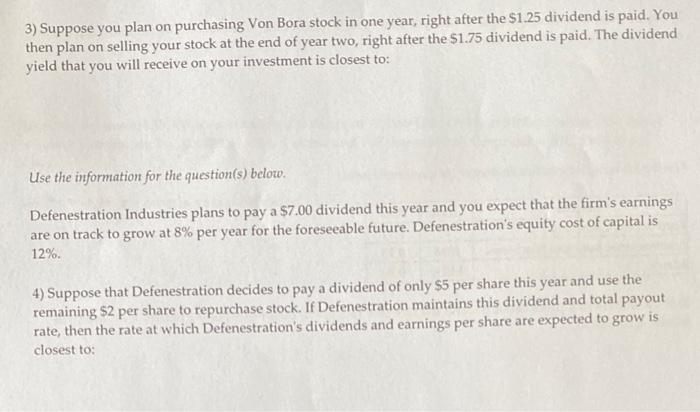

3) Suppose you plan on purchasing Von Bora stock in one year, right after the $1.25 dividend is paid. You then plan on selling your stock at the end of year two, right after the $1.75 dividend is paid. The dividend yield that you will receive on your investment is closest to: Use the information for the question(s) below. Defenestration Industries plans to pay a $7.00 dividend this year and you expect that the firm's earnings are on track to grow at 8% per year for the foreseeable future. Defenestration's equity cost of capital is 12%. 4) Suppose that Defenestration decides to pay a dividend of only $5 per share this year and use the remaining $2 per share to repurchase stock. If Defenestration maintains this dividend and total payout rate, then the rate at which Defenestration's dividends and earnings per share are expected to grow is closest to: 3) Suppose you plan on purchasing Von Bora stock in one year, right after the $1.25 dividend is paid. You then plan on selling your stock at the end of year two, right after the $1.75 dividend is paid. The dividend yield that you will receive on your investment is closest to: Use the information for the question(s) below. Defenestration Industries plans to pay a $7.00 dividend this year and you expect that the firm's earnings are on track to grow at 8% per year for the foreseeable future. Defenestration's equity cost of capital is 12%. 4) Suppose that Defenestration decides to pay a dividend of only $5 per share this year and use the remaining $2 per share to repurchase stock. If Defenestration maintains this dividend and total payout rate, then the rate at which Defenestration's dividends and earnings per share are expected to grow is closest to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts