Question: Solve questions from 1-5. Show each step. 1. It is common in Australian Finance for Annual Percentage Rates (APR's) to be quoted when discussing the

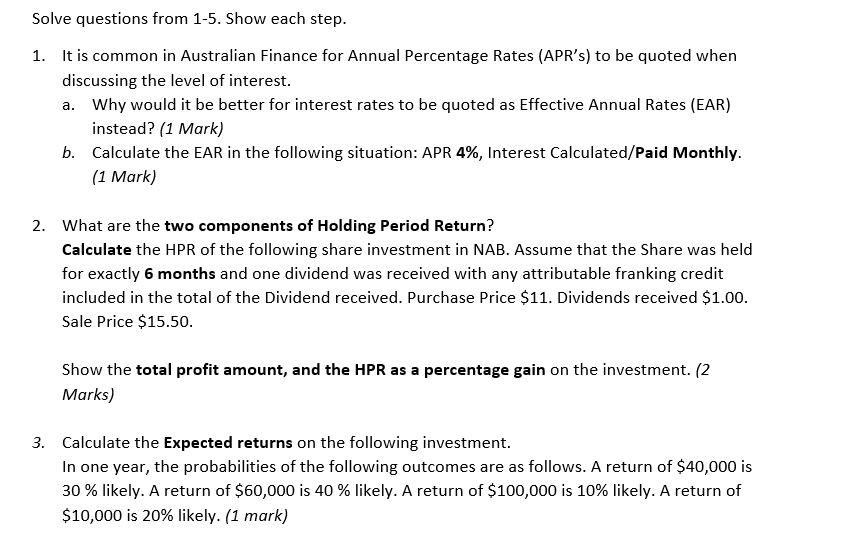

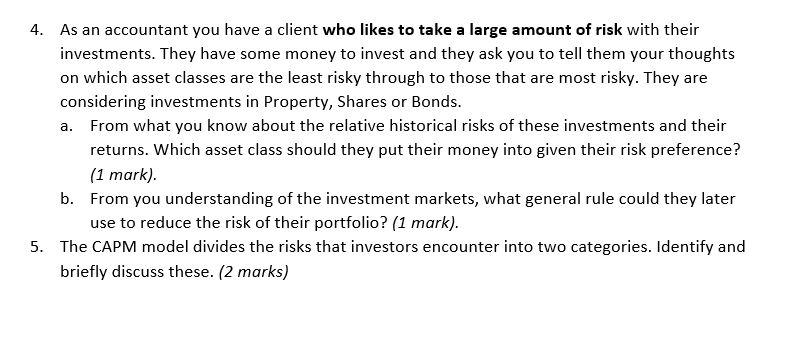

Solve questions from 1-5. Show each step. 1. It is common in Australian Finance for Annual Percentage Rates (APR's) to be quoted when discussing the level of interest. a. Why would it be better for interest rates to be quoted as Effective Annual Rates (EAR) instead? (1 Mark) b. Calculate the EAR in the following situation: APR 4%, Interest Calculated/Paid Monthly. (1 Mark) 2. What are the two components of Holding Period Return? Calculate the HPR of the following share investment in NAB. Assume that the Share was held for exactly 6 months and one dividend was received with any attributable franking credit included in the total of the Dividend received. Purchase Price $11. Dividends received $1.00. Sale Price $15.50. Show the total profit amount, and the HPR as a percentage gain on the investment. (2 Marks) 3. Calculate the Expected returns on the following investment. In one year, the probabilities of the following outcomes are as follows. A return of $40,000 is 30 % likely. A return of $60,000 is 40 % likely. A return of $100,000 is 10% likely. A return of $10,000 is 20% likely. (1 mark) 4. As an accountant you have a client who likes to take a large amount of risk with their investments. They have some money to invest and they ask you to tell them your thoughts on which asset classes are the least risky through to those that are most risky. They are considering investments in Property, Shares or Bonds. a. From what you know about the relative historical risks of these investments and their returns. Which asset class should they put their money into given their risk preference? (1 mark). b. From you understanding of the investment markets, what general rule could they later use to reduce the risk of their portfolio? (1 mark). 5. The CAPM model divides the risks that investors encounter into two categories. Identify and briefly discuss these. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts