Question: Solve: REQUIREMENT #8/9: Given: Work that has been done already: #1 #2 #3 #4 & 5 #6 #7 Requirement #8: Prepare the closing entries at

Solve: REQUIREMENT #8/9:

Given:

Work that has been done already:

#1

#2

#3

#4 & 5

#6

#7

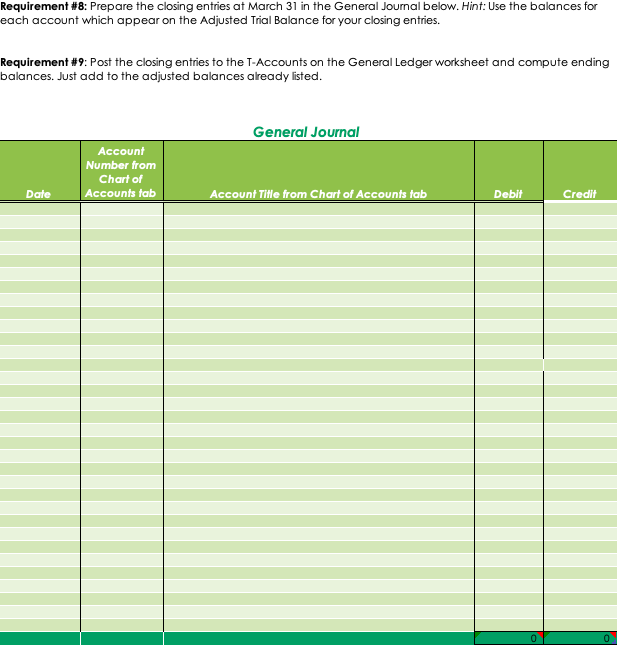

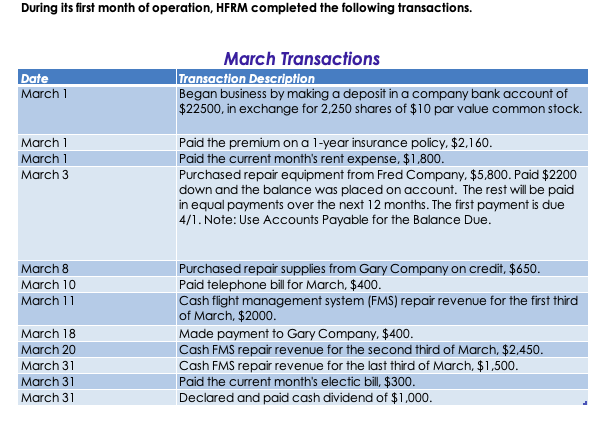

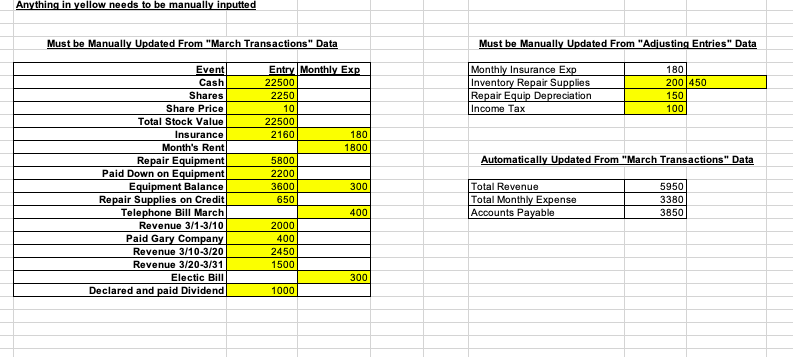

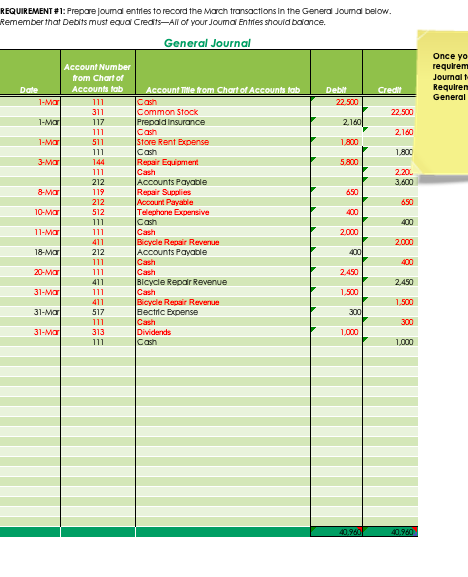

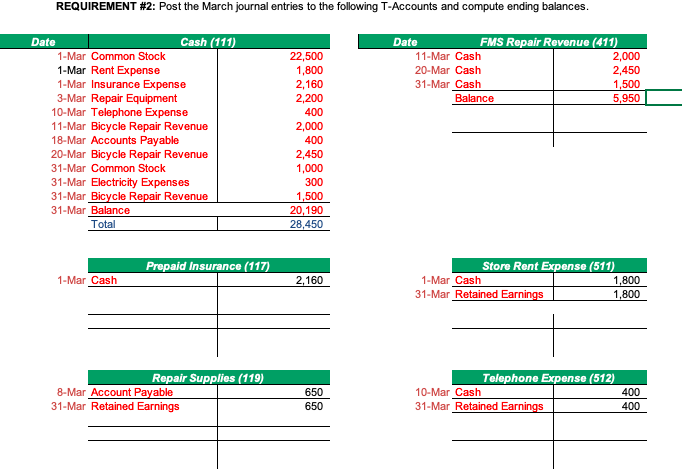

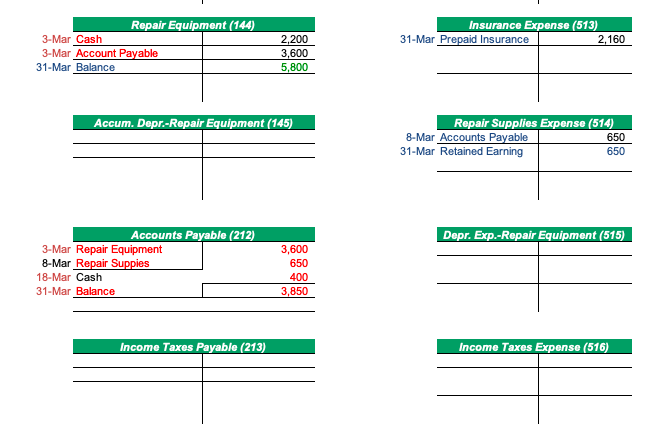

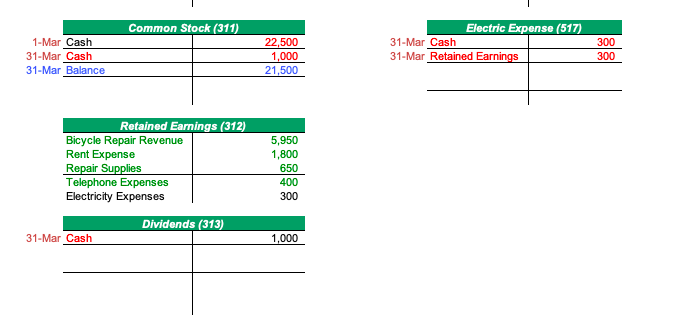

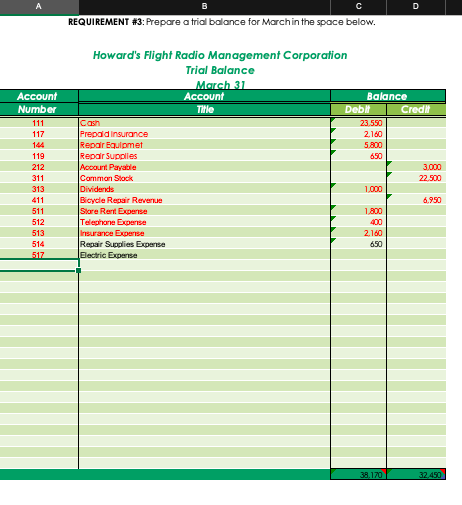

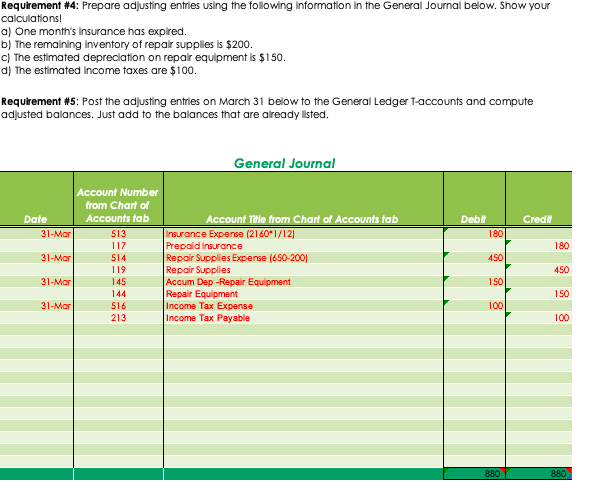

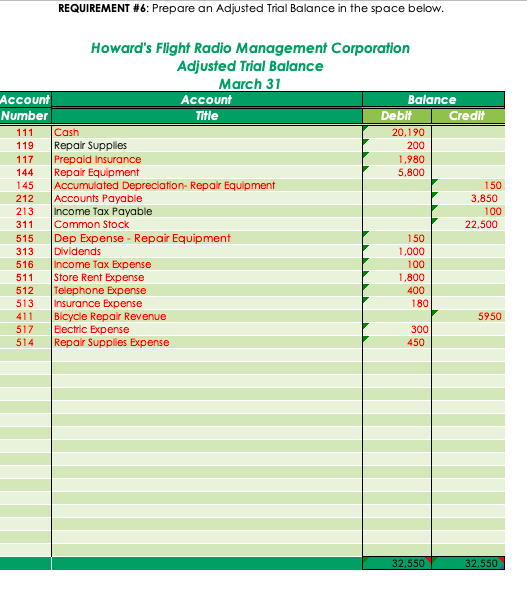

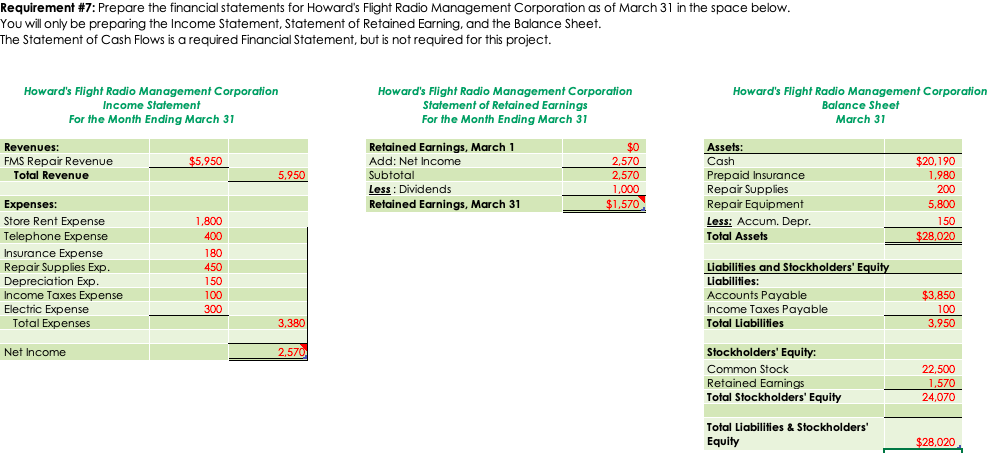

Requirement \#8: Prepare the closing entries at March 31 in the General Journal below. Hint: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement \#: Post the closing entries to the T-Accounts on the General Ledger worksheet and compute ending palances. Just add to the adjusted balances already listed. During its first month of operation, HFRM completed the following transactions. Must be Manually Updated From "Adjusting Entries" Data Automatically Updated From "March Transactions" Data REQUIREMENT \# 1: Prepare joumal entrles to record the Mach transactions in the General Jouma below. Remember that Debits must equa Credits-All of your Jouma Entries shouid balance. REQUIREMENT \#2: Post the March journal entries to the following T-Accounts and compute ending balances. \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ FMS Repair Revenue (411) } \\ \hline 11-Mar Cash & \multicolumn{1}{|c|}{2,000} \\ 20-Mar Cash & 2,450 \\ 31-Mar Cash & 1,500 \\ \hline Balance & 5,950 \\ \hline & \\ \hline \end{tabular} 1-Mar \begin{tabular}{l|r} \multicolumn{2}{|c}{ Store Rent Expense (511) } \\ 31-Mar Rash & 1,800 \\ \hline & 1,800 \\ \hline & \\ \hline & \end{tabular} 3-Mar \begin{tabular}{|l|l} \hline \multicolumn{2}{|c|}{ Repair Equipment (144) } \\ \cline { 2 - 3 } 3-Mash & 2,200 \\ \cline { 2 - 2 } 31-Mar Account Payable & 3,600 \\ \hline 3alance & 5,800 \\ \hline & \end{tabular} \begin{tabular}{l|l} \hline Accum. Depr.-Repair Equipment (145) \\ \hline & \\ \hline & \\ \hline & \end{tabular} \begin{tabular}{l|l} \hline \multicolumn{2}{c}{ Income Taxes Payable (213) } \\ \hline & \\ \hline & \\ \hline & \end{tabular} \begin{tabular}{l|l} \multicolumn{2}{c}{ Income Taxes Expense (516) } \\ \hline & \\ \hline & \\ \hline & \end{tabular} \begin{tabular}{l|r} \multicolumn{2}{c}{ Retained Eamings (312) } \\ \hline Bicycle Repair Revenue & 5,950 \\ Rent Expense & 1,800 \\ Repair Supplies & 650 \\ \hline Telephone Expenses & 400 \\ Electricity Expenses & 300 \end{tabular} 31-Mar Cash \begin{tabular}{l|l} \multicolumn{2}{c}{ Dividends (313) } \\ \hline & \\ \hline & \\ \hline & \end{tabular} REQUIREMENT \#3: Prepare a frial balance for March in the space below. Requirement \#4: Prepare adjusting entrles using the following Information In the General Journal below. Show your calculations! a) One month's Insurance has expired. b) The remaining Inventory of repalr supplies is $200. c) The estimated depreclation on repalr equipment is $150. d) The estimated Income taxes are $100. Requirement #5 : Post the adjusting entrles on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. REQUIREMENT \#6: Prepare an Adjusted Trial Balance in the space below. Requirement \#7: Prepare the financial statements for Howard's Flight Radio Management Corporation as of March 31 in the space below. rou will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet. he Statement of Cash Flows is a required Financial Statement, but is not required for this project. Howard's Flight Radio Management Corporation Income Statement For the Month Ending March 31 Howard's Flight Radio Management Corporation Statement of Retained Earnings For the Month Ending March 31 Howard's Flight Radio Management Corporation Balance Sheet March 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts