Question: Solve step by step showing computations 1. 10 points Under the following market (Uniperiodal Binomial model) values i=1.5%, u=1.05,d=0.95, price of risky asset S0=1, probability

Solve step by step showing computations

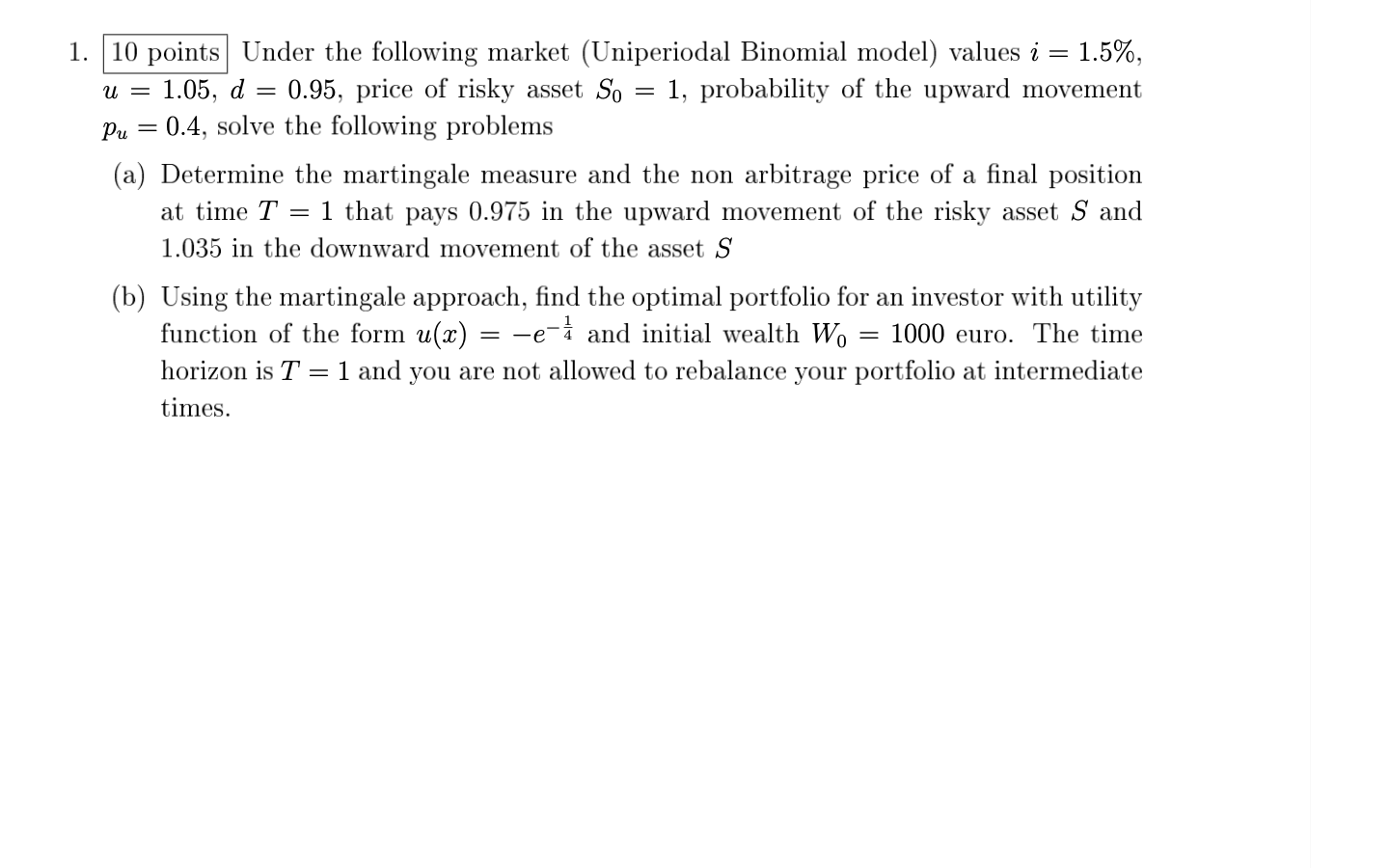

1. 10 points Under the following market (Uniperiodal Binomial model) values i=1.5%, u=1.05,d=0.95, price of risky asset S0=1, probability of the upward movement pu=0.4, solve the following problems (a) Determine the martingale measure and the non arbitrage price of a final position at time T=1 that pays 0.975 in the upward movement of the risky asset S and 1.035 in the downward movement of the asset S (b) Using the martingale approach, find the optimal portfolio for an investor with utility function of the form u(x)=e41 and initial wealth W0=1000 euro. The time horizon is T=1 and you are not allowed to rebalance your portfolio at intermediate times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts