Question: Solve the above question in the provided excel format Assignment 2 Silver Lining, Inc., provides investment advisory services. The company adjusts its accounts monthly, but

Solve the above question in the provided excel format

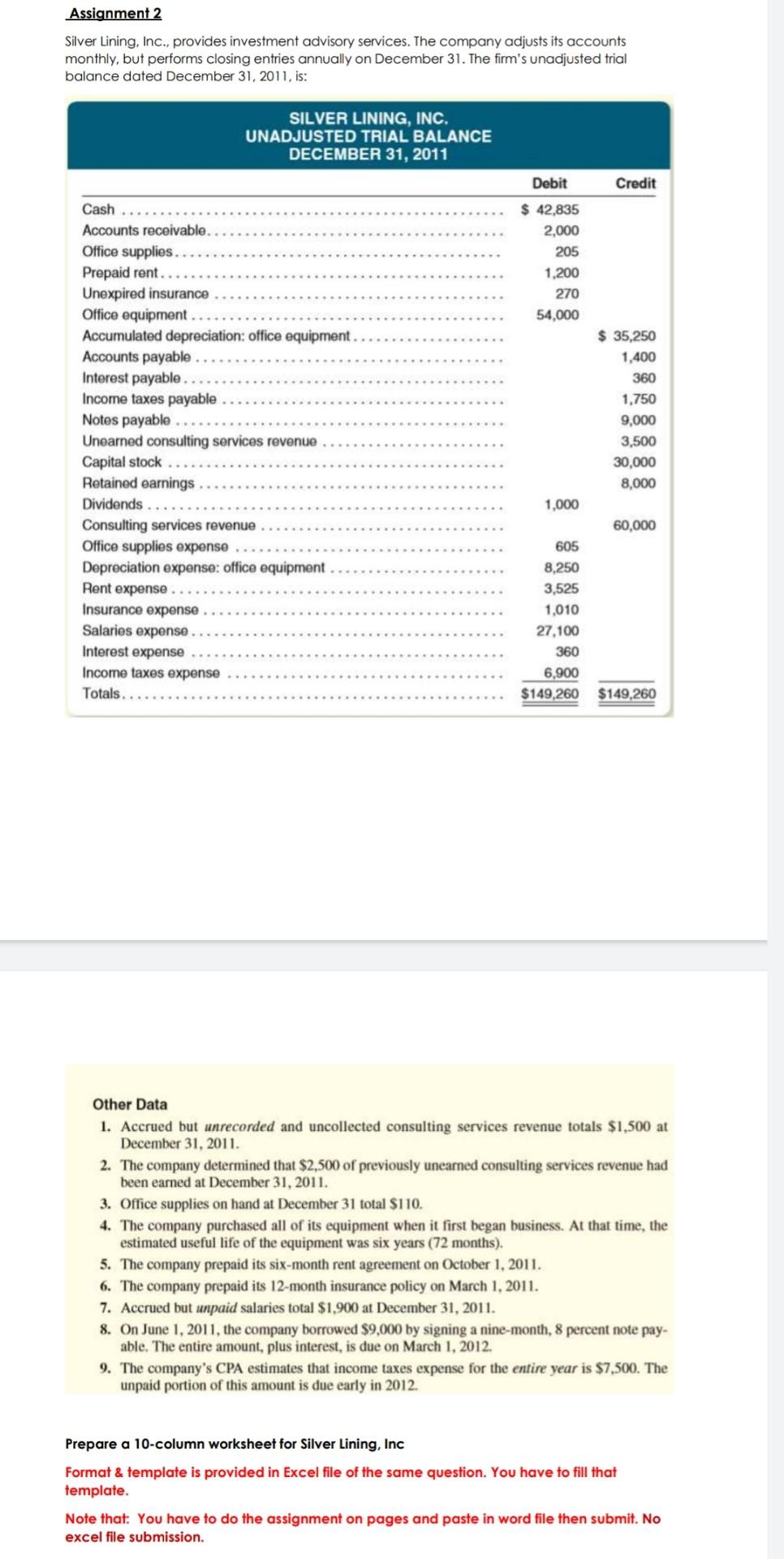

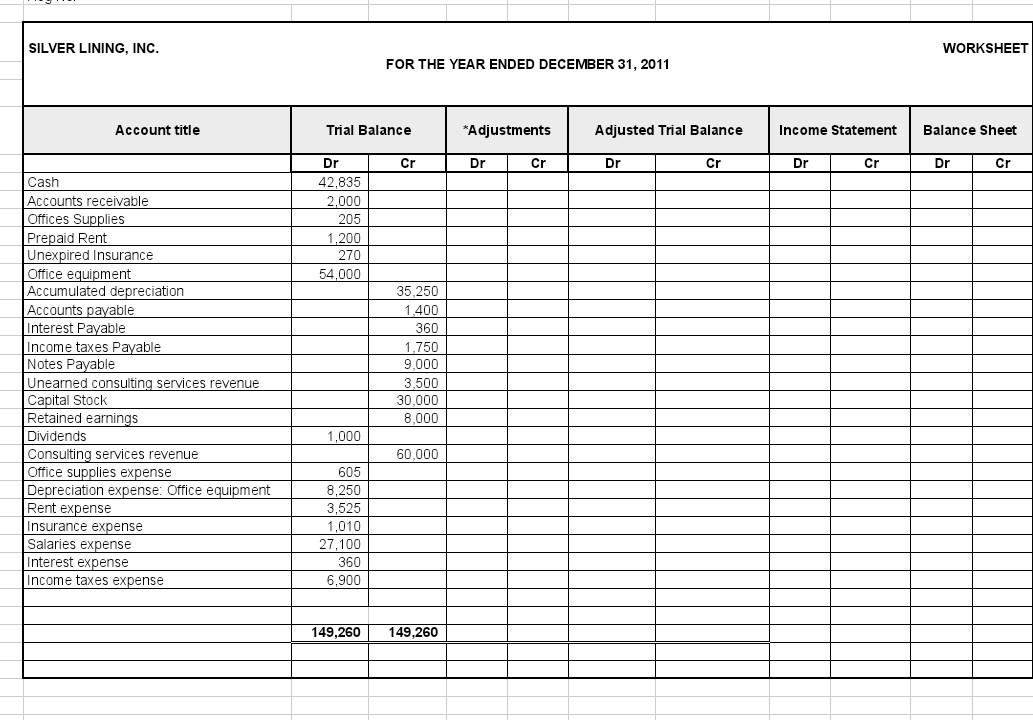

Assignment 2 Silver Lining, Inc., provides investment advisory services. The company adjusts its accounts monthly, but performs closing entries annually on December 31. The firm's unadjusted trial balance dated December 31, 2011, is: SILVER LINING, INC. UNADJUSTED TRIAL BALANCE DECEMBER 31, 2011 Debit Credit $ 42,835 2,000 205 1,200 270 54,000 Cash Accounts receivable. Office supplies.. Prepaid rent. Unexpired insurance Office equipment Accumulated depreciation office equipment Accounts payable Interest payable Income taxes payable Notes payable Unearned consulting services revenue Capital stock Retained earnings Dividends ... Consulting services revenue Office supplies expense Depreciation expense: office equipment Rent expense Insurance expense Salaries expense Interest expense Income taxes expense Totals. $ 35,250 1,400 360 1,750 9,000 3,500 30,000 8,000 1,000 60,000 605 8,250 3,525 1,010 27.100 360 6,900 $149,260 $149,260 Other Data 1. Accrued but unrecorded and uncollected consulting services revenue totals $1,500 at December 31, 2011. 2. The company determined that $2,500 of previously unearned consulting services revenue had been earned at December 31, 2011. 3. Office supplies on hand at December 31 total $110. 4. The company purchased all of its equipment when it first began business. At that time, the estimated useful life of the equipment was six years (72 months). 5. The company prepaid its six-month rent agreement on October 1, 2011, 6. The company prepaid its 12-month insurance policy on March 1, 2011. 7. Accrued but unpaid salaries total $1,900 at December 31, 2011. 8. On June 1, 2011, the company borrowed $9,000 by signing a nine-month, 8 percent note pay- able. The entire amount, plus interest, is due on March 1, 2012. 9. The company's CPA estimates that income taxes expense for the entire year is $7,500. The unpaid portion of this amount is due early in 2012. Prepare a 10-column worksheet for Silver Lining, Inc Format & template is provided in Excel file of the same question. You have to fill that template. Note that: You have to do the assignment on pages and paste in word file then submit. No excel file submission. SILVER LINING, INC. WORKSHEET FOR THE YEAR ENDED DECEMBER 31, 2011 Account title Trial Balance *Adjustments Adjusted Trial Balance Income Statement Balance Sheet Cr Dr Cr Dr Cr Dr Cr Dr Cr Dr 42.835 2.000 205 1,200 270 54,000 Cash Accounts receivable Offices Supplies Prepaid Rent Unexpired Insurance Office equipment Accumulated depreciation Accounts payable Interest Payable Income taxes Payable Notes Payable Unearned consulting services revenue Capital Stock Retained earnings Dividends Consulting services revenue Office supplies expense Depreciation expense: Office equipment Rent expense Insurance expense Salaries expense Interest expense Income taxes expense 35,250 1.400 360 1,750 9.000 3.500 30,000 8.000 1,000 60.000 605 8,250 3,525 1,010 27,100 360 6.900 149,260 149,260

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts