Question: Solve the decision problem shown below. Assume an interest rate of 12%. Answer specifically what should be the decisions at nodes 1 and 2.

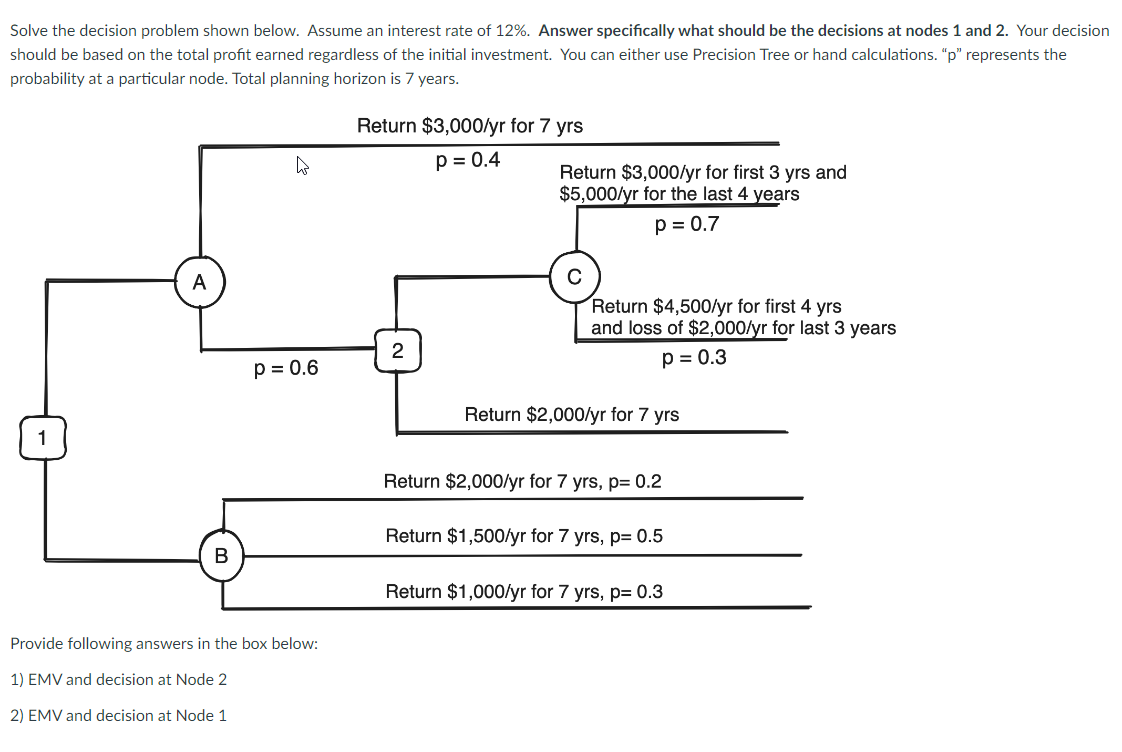

Solve the decision problem shown below. Assume an interest rate of 12%. Answer specifically what should be the decisions at nodes 1 and 2. Your decision should be based on the total profit earned regardless of the initial investment. You can either use Precision Tree or hand calculations. "p" represents the probability at a particular node. Total planning horizon is 7 years. Return $3,000/yr for 7 yrs 1 A B p = 0.6 Provide following answers in the box below: 1) EMV and decision at Node 2 2) EMV and decision at Node 1 p = 0.4 Return $3,000/yr for first 3 yrs and $5,000/yr for the last 4 years p=0.7 2 Return $4,500/yr for first 4 yrs and loss of $2,000/yr for last 3 years p = 0.3 Return $2,000/yr for 7 yrs Return $2,000/yr for 7 yrs, p= 0.2 Return $1,500/yr for 7 yrs, p= 0.5 Return $1,000/yr for 7 yrs, p=0.3

Step by Step Solution

There are 3 Steps involved in it

Solutions Step 1 Part a Decision Tree for the Current Assessment Step 1 Construct the Decision Tree Lets start by constructing the decision tree based on the companys assessment The decision tree will ... View full answer

Get step-by-step solutions from verified subject matter experts