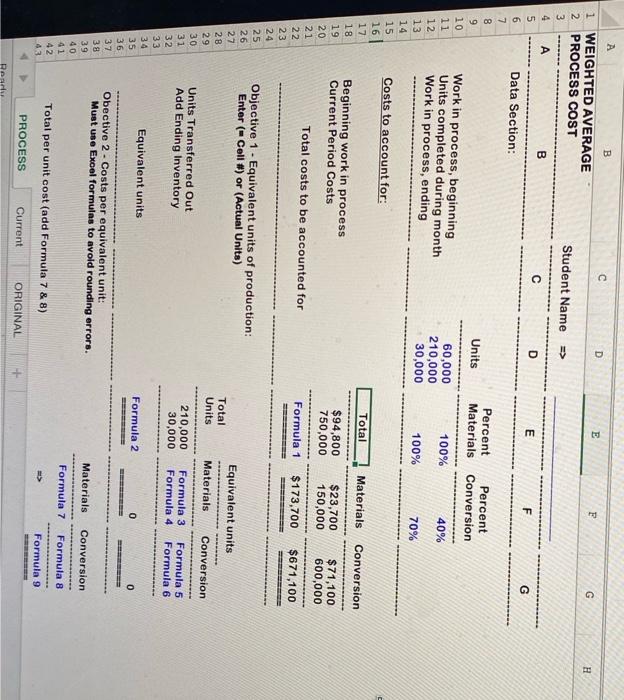

Question: Solve the Excel and answer questions #1,2,3,4,5,6,7,8. A B 1 WEIGHTED AVERAGE 2 PROCESS COST - A B Data Section: Work in process, beginning Units

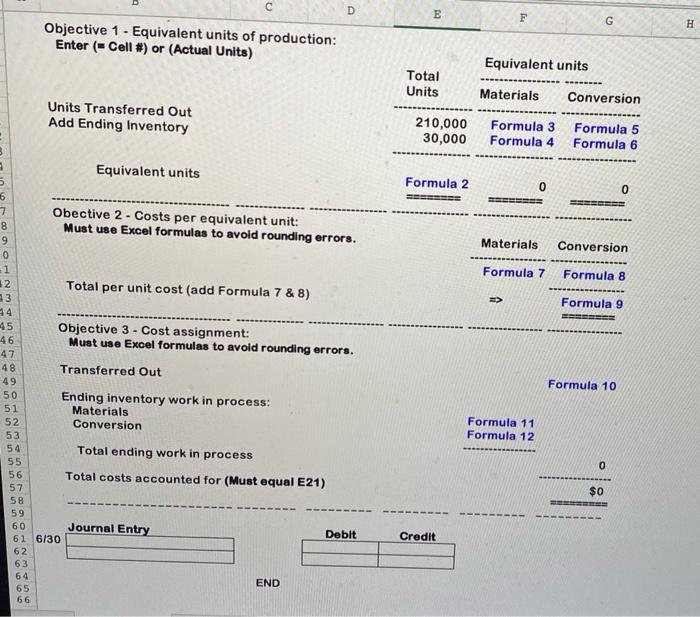

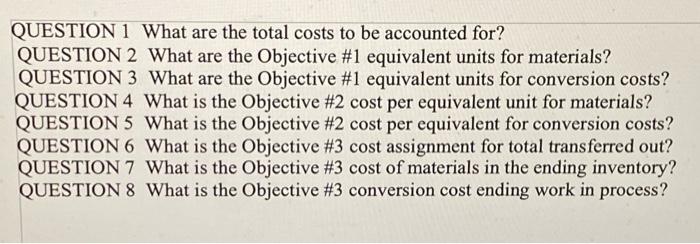

A B 1 WEIGHTED AVERAGE 2 PROCESS COST - A B Data Section: Work in process, beginning Units completed during month Work in process, ending Costs to account for: Beginning work in process Current Period Costs Total costs to be accounted for Objective 1- Equivalent units of production: Enter ( Cell #) or (Actual Units) Units Transferred Out Add Ending Inventory Equivalent units Obective 2- Costs per equivalent unit: Must use Excel formulas to avoid rounding errors. Total per unit cost (add Formula 7 & 8) PROCESS Current 3 4 5 6 789LLE 012 10 11 12 13 14 15 16 17 45 T1T 18 NNNNN 2244TO6B0 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 1968 35 36 37 38 39 40 41 42 43 Rearly C Student Name ********* C D => ORIGINAL D Units 60,000 210,000 30,000 E F E F Percent Percent Materials Conversion 100% 40% 100% 70% Total Materials Conversion $94,800 $23,700 $71,100 750,000 150,000 600,000 Formula 1 $173,700 $671,100 Equivalent units Total Units Materials. Conversion 210,000 Formula 3 Formula 5 30,000 Formula 4 Formula 6 Formula 2 0 0 ======= Materials Conversion Formula 7 Formula 8 Formula 91 G G H 1 5 6 7 8 9 0 1 12 13 14 45 46 47 48 49 50 51 52 53 54 55 S55555555556 S6TB a 56 57 58 59 60 123456 61 6/30 62 63 64 65 D Objective 1- Equivalent units of production: Enter (Cell #) or (Actual Units) Units Transferred Out Add Ending Inventory Equivalent units Obective 2- Costs per equivalent unit: Must use Excel formulas to avoid rounding errors. Total per unit cost (add Formula 7 & 8) Objective 3- Cost assignment: Must use Excel formulas to avoid rounding errors. Transferred Out Ending inventory work in process: Materials Conversion Total ending work in process Total costs accounted for (Must equal E21) Journal Entry END 66 Debit by Total Units 210,000 30,000 Formula 2 Credit F Equivalent units Materials Formula 3 Formula 4 0 Materials Formula 7 => Formula 11 Formula 12 G ... Conversion Formula 5 Formula 6 0 Conversion Formula 8 Formula 9 Formula 10 0 $0 H QUESTION 1 What are the total costs to be accounted for? QUESTION 2 What are the Objective #1 equivalent units for materials? QUESTION 3 What are the Objective #1 equivalent units for conversion costs? QUESTION 4 What is the Objective #2 cost per equivalent unit for materials? QUESTION 5 What is the Objective #2 cost per equivalent for conversion costs? QUESTION 6 What is the Objective #3 cost assignment for total transferred out? QUESTION 7 What is the Objective #3 cost of materials in the ending inventory? QUESTION 8 What is the Objective #3 conversion cost ending work in process? A B 1 WEIGHTED AVERAGE 2 PROCESS COST - A B Data Section: Work in process, beginning Units completed during month Work in process, ending Costs to account for: Beginning work in process Current Period Costs Total costs to be accounted for Objective 1- Equivalent units of production: Enter ( Cell #) or (Actual Units) Units Transferred Out Add Ending Inventory Equivalent units Obective 2- Costs per equivalent unit: Must use Excel formulas to avoid rounding errors. Total per unit cost (add Formula 7 & 8) PROCESS Current 3 4 5 6 789LLE 012 10 11 12 13 14 15 16 17 45 T1T 18 NNNNN 2244TO6B0 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 1968 35 36 37 38 39 40 41 42 43 Rearly C Student Name ********* C D => ORIGINAL D Units 60,000 210,000 30,000 E F E F Percent Percent Materials Conversion 100% 40% 100% 70% Total Materials Conversion $94,800 $23,700 $71,100 750,000 150,000 600,000 Formula 1 $173,700 $671,100 Equivalent units Total Units Materials. Conversion 210,000 Formula 3 Formula 5 30,000 Formula 4 Formula 6 Formula 2 0 0 ======= Materials Conversion Formula 7 Formula 8 Formula 91 G G H 1 5 6 7 8 9 0 1 12 13 14 45 46 47 48 49 50 51 52 53 54 55 S55555555556 S6TB a 56 57 58 59 60 123456 61 6/30 62 63 64 65 D Objective 1- Equivalent units of production: Enter (Cell #) or (Actual Units) Units Transferred Out Add Ending Inventory Equivalent units Obective 2- Costs per equivalent unit: Must use Excel formulas to avoid rounding errors. Total per unit cost (add Formula 7 & 8) Objective 3- Cost assignment: Must use Excel formulas to avoid rounding errors. Transferred Out Ending inventory work in process: Materials Conversion Total ending work in process Total costs accounted for (Must equal E21) Journal Entry END 66 Debit by Total Units 210,000 30,000 Formula 2 Credit F Equivalent units Materials Formula 3 Formula 4 0 Materials Formula 7 => Formula 11 Formula 12 G ... Conversion Formula 5 Formula 6 0 Conversion Formula 8 Formula 9 Formula 10 0 $0 H QUESTION 1 What are the total costs to be accounted for? QUESTION 2 What are the Objective #1 equivalent units for materials? QUESTION 3 What are the Objective #1 equivalent units for conversion costs? QUESTION 4 What is the Objective #2 cost per equivalent unit for materials? QUESTION 5 What is the Objective #2 cost per equivalent for conversion costs? QUESTION 6 What is the Objective #3 cost assignment for total transferred out? QUESTION 7 What is the Objective #3 cost of materials in the ending inventory? QUESTION 8 What is the Objective #3 conversion cost ending work in process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts