Question: solve the following and please write down the formula for each question ! thank you ! HPR HPR arithmetic mean Geometric mean Standard deviation 1.DODOJO

solve the following and please write down the formula for each question ! thank you !

solve the following and please write down the formula for each question ! thank you !

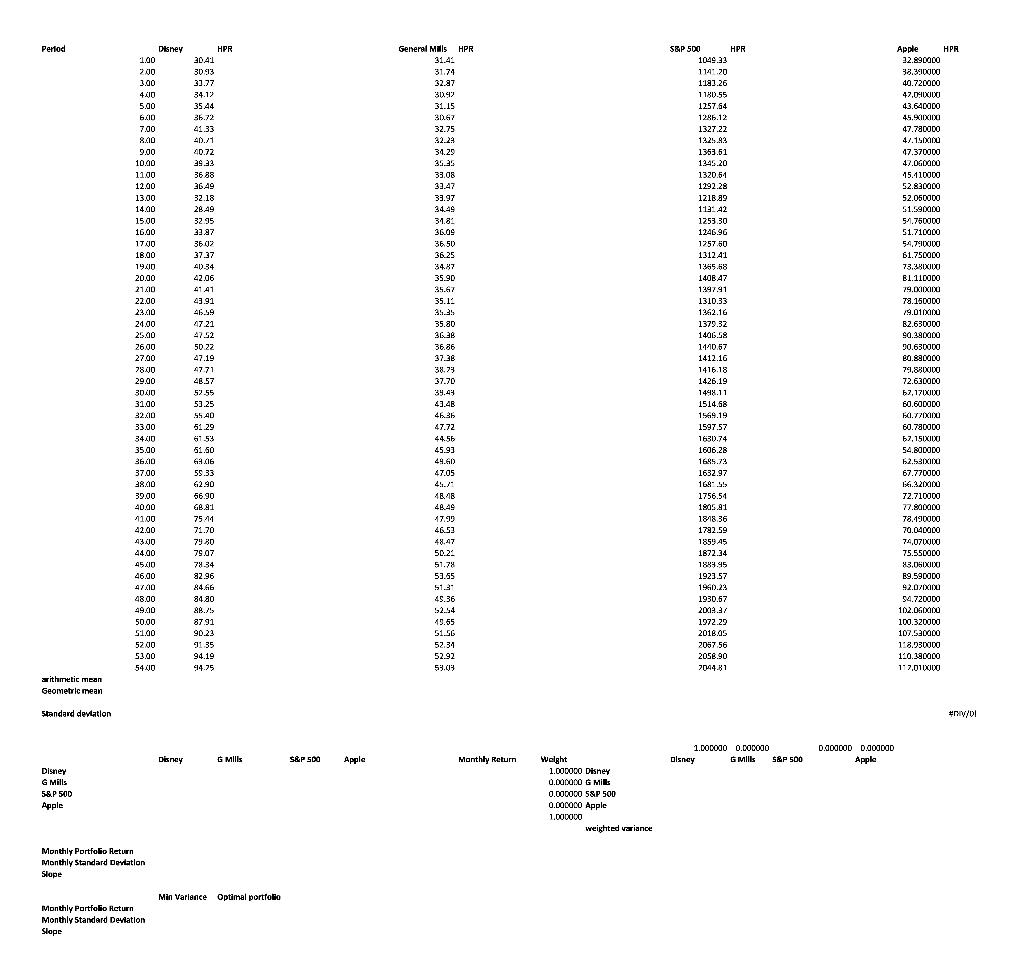

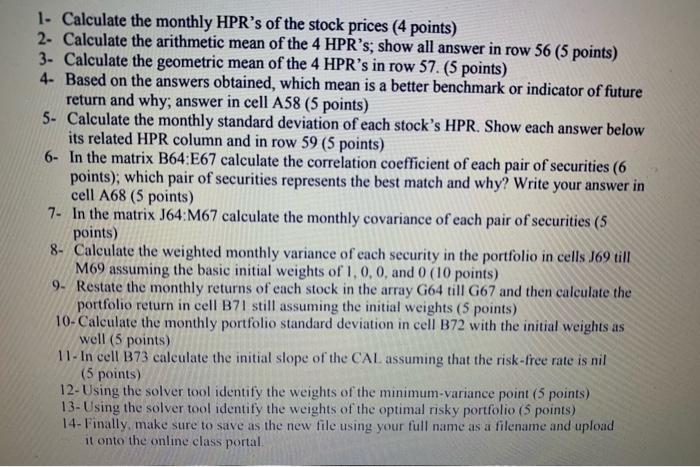

HPR HPR arithmetic mean Geometric mean Standard deviation 1.DODOJO O.DODO D.GDODOD Dacacor 6 Mills ple Monthly Return tentang kalian 5.8.P 50 Weight como Disney ampa sp 0.00LOCO weighted using Monacondard Devtation Sa 11 Min Variance Optimal portfolio Monthly Portfolio Return Monthly Standard Deviation 1. Calculate the monthly HPR's of the stock prices (4 points) 2- Calculate the arithmetic mean of the 4 HPR's; show all answer in row 56 (5 points) 3- Calculate the geometric mean of the 4 HPR's in row 57. (5 points) 4. Based on the answers obtained, which mean is a better benchmark or indicator of future return and why, answer in cell A58 (5 points) 5- Calculate the monthly standard deviation of each stock's HPR. Show each answer below its related HPR column and in row 59 (5 points) 6- In the matrix B64:E67 calculate the correlation coefficient of each pair of securities (6 points), which pair of securities represents the best match and why? Write your answer in cell A68 (5 points) 7- In the matrix J64 M67 calculate the monthly covariance of each pair of securities (5 points) 8- Calculate the weighted monthly variance of each security in the portfolio in cells J69 till M69 assuming the basic initial weights of 1.0.0, and 0 (10 points) 9. Restate the monthly returns of each stock in the array G64 till G67 and then calculate the portfolio return in cell B71 still assuming the initial weights (5 points) 10- Calculate the monthly portfolio standard deviation in cell B72 with the initial weights as well (5 points) 11- In cell B73 calculate the initial slope of the CAL assuming that the risk-free rate is nil (5 points) 12- Using the solver tool identify the weights of the minimum-variance point (5 points) 13- Using the solver tool identify the weights of the optimal risky portfolio (5 points) 14-Finally, make sure to save as the new file using your full name as a filename and upload it onto the online class portal HPR HPR arithmetic mean Geometric mean Standard deviation 1.DODOJO O.DODO D.GDODOD Dacacor 6 Mills ple Monthly Return tentang kalian 5.8.P 50 Weight como Disney ampa sp 0.00LOCO weighted using Monacondard Devtation Sa 11 Min Variance Optimal portfolio Monthly Portfolio Return Monthly Standard Deviation 1. Calculate the monthly HPR's of the stock prices (4 points) 2- Calculate the arithmetic mean of the 4 HPR's; show all answer in row 56 (5 points) 3- Calculate the geometric mean of the 4 HPR's in row 57. (5 points) 4. Based on the answers obtained, which mean is a better benchmark or indicator of future return and why, answer in cell A58 (5 points) 5- Calculate the monthly standard deviation of each stock's HPR. Show each answer below its related HPR column and in row 59 (5 points) 6- In the matrix B64:E67 calculate the correlation coefficient of each pair of securities (6 points), which pair of securities represents the best match and why? Write your answer in cell A68 (5 points) 7- In the matrix J64 M67 calculate the monthly covariance of each pair of securities (5 points) 8- Calculate the weighted monthly variance of each security in the portfolio in cells J69 till M69 assuming the basic initial weights of 1.0.0, and 0 (10 points) 9. Restate the monthly returns of each stock in the array G64 till G67 and then calculate the portfolio return in cell B71 still assuming the initial weights (5 points) 10- Calculate the monthly portfolio standard deviation in cell B72 with the initial weights as well (5 points) 11- In cell B73 calculate the initial slope of the CAL assuming that the risk-free rate is nil (5 points) 12- Using the solver tool identify the weights of the minimum-variance point (5 points) 13- Using the solver tool identify the weights of the optimal risky portfolio (5 points) 14-Finally, make sure to save as the new file using your full name as a filename and upload it onto the online class portal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts