Question: Solve the following expression for the implied three year yield where: (l + y)^r = (l + r_1)(l + r_2) (l + r_r) = (1

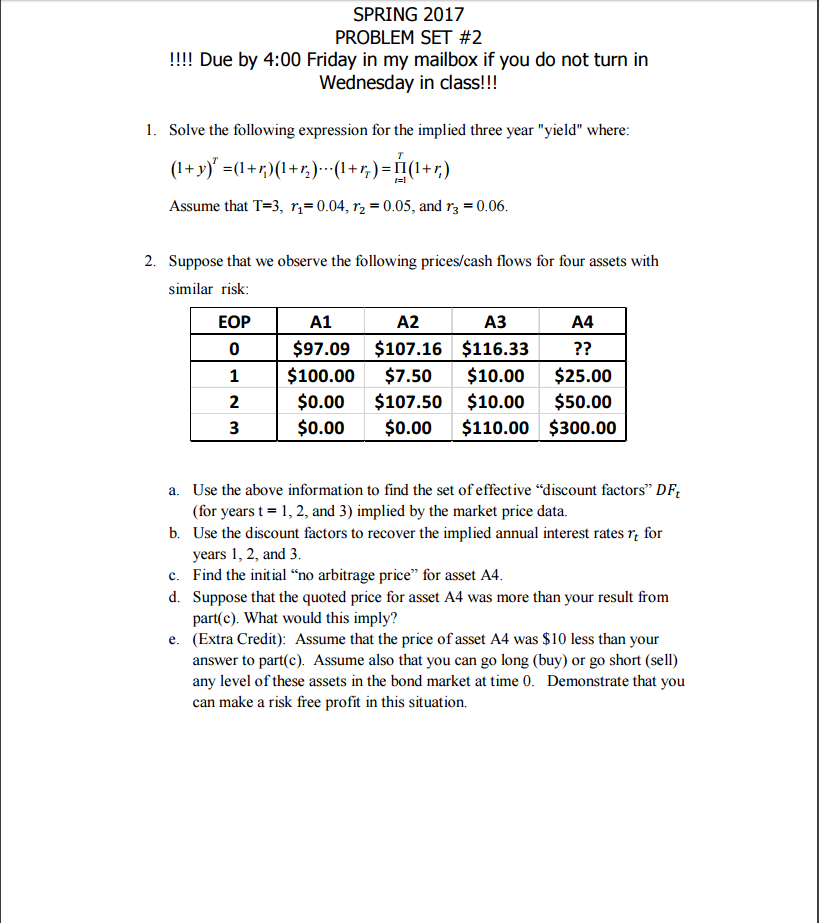

Solve the following expression for the implied three year "yield" where: (l + y)^r = (l + r_1)(l + r_2) (l + r_r) = (1 + r_1) Assume that T = 3, r_1 = 0.04, r_2 = 0.05, and r_3 = 0.06. Suppose that we observe the following prices/cash flows for four assets with similar risk: Use the above information to find the set of effective "discount factors" DF_t (for years t = 1, 2, and 3) implied by the market price data. Use the discount factors to recover the implied annual interest rates rt for years 1, 2, and 3. Find the initial "no arbitrage price" for asset A4. Suppose that the quoted price for asset A4 was more than your result from part(c). What would this imply? (Extra Credit): Assume that the price of asset A4 was $10 less than your answer to part(c). Assume also that you can go long (buy) or go short (sell) any level of these assets in the bond market at time 0. Demonstrate that you can make a risk free profit in this situation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts