Question: SOLVE THE FOLLOWING IN COMPLETE SOLUTION STEP BY STEP. PRESENT ECONOMY > When alternatives foraccomplishing a specific task are being compared over one year of

SOLVE THE FOLLOWING IN COMPLETE SOLUTION STEP BY STEP.

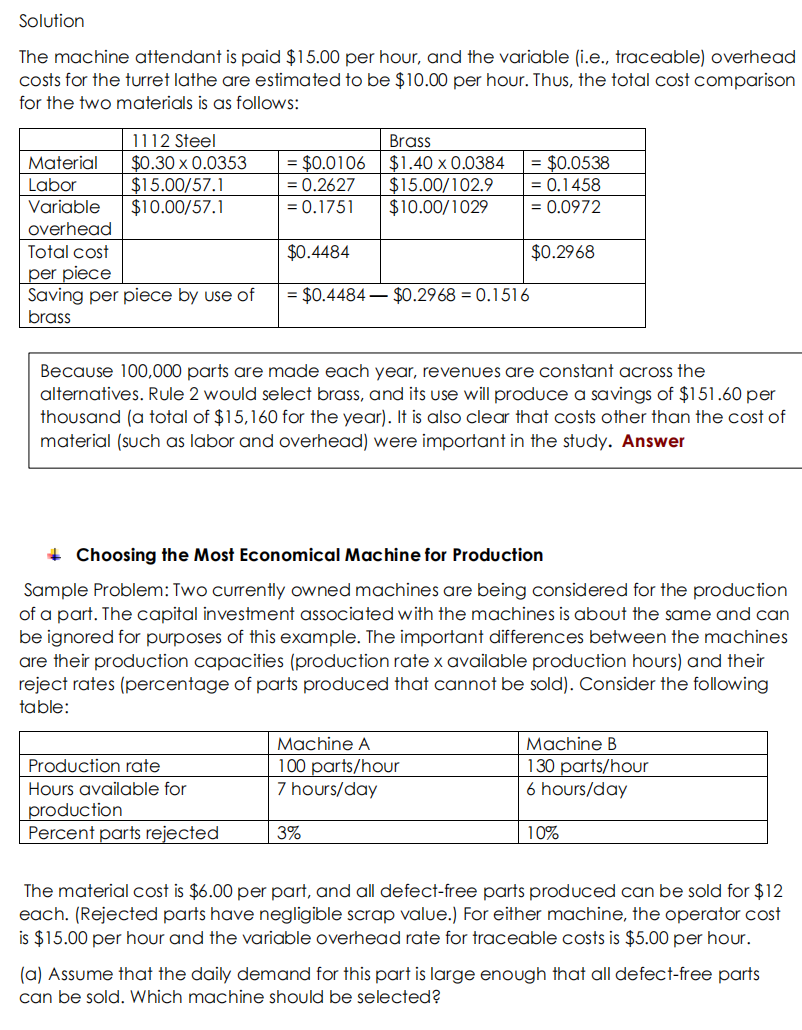

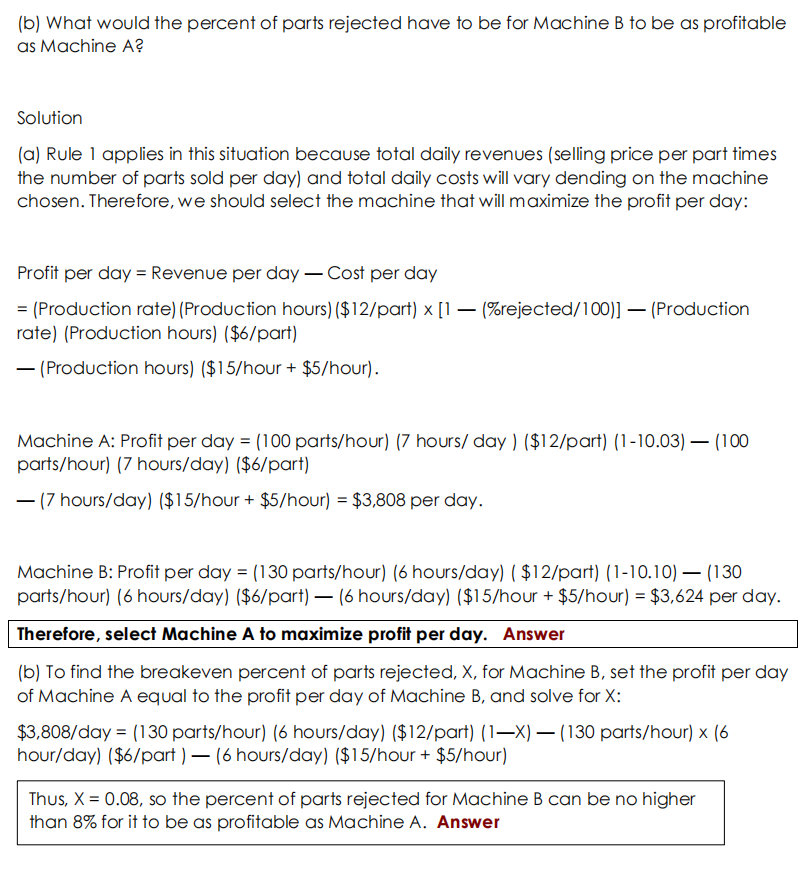

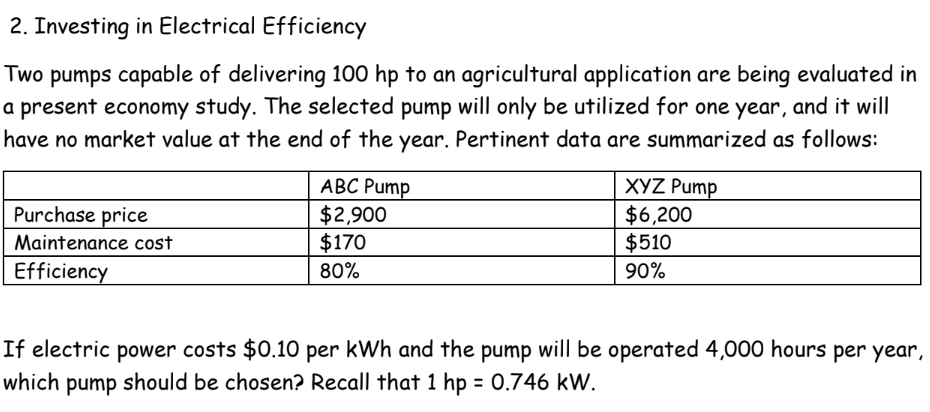

PRESENT ECONOMY > When alternatives foraccomplishing a specific task are being compared over one year of less and the inuence of time on money can be ignored. > The rules. or criteria. shown below will be used to select the preferred alternatives when defect-free output is variable or constant among the alternatives being considered. IIIMIIIIII Rule 1: When revenues/income and other economic benefit are present- and vary among alternatives. choose the alternative that maximizes overall profitability based on the number of defect-free units of a product or serviced produced. Rule 2 : When revenues! income and other economic benefit- are not preSent or are constant among all alternatives. consider only the costs and select the alternative that nim'mizes total' costs per defect-free unit of product or service output. it _:z: EXPLAIN Illustrative Example on how to make present economy studies: 4 Choosing the Most Economic Material for o Putt Sample Problem: A good example of this situation is illustrated by a part for which annual demand is l00.000 units. The part is produced on a high-speed turret lathe. using it l2 screw- machine steel costing $0.30 per pound. A study was conducted to determine whether it might be cheaper to use brass screw stock, costing ft] .40 per pound. Because the weight of steel required per piece was 0.0353 pounds and that of brass was 0.0384 pounds. the material cost per piece was $0.0l06 for steel and $00538 for brass. However. when the manufacturing engineering department was consulted. it was found that. although 57.l defect-free parts per hour were being produced by using steel. the output would be l02.9 defect-free parts per hour if brass were used. Which material should be used for this part? Solution The machine attendant is paid $15.00 per hour. and the variable [i.e.. traceable] overhead costs for the turret lathe are estimated to be $l000 per hour. Thus. the total cost comparison for the two materials is as follows: ll l2 Steel Brass Material $0.30 x 0.0353 = $0.0l06 $l .40 X00384 = $00538 Labor $l5.00!57.l = 0.2627 $l5.00.r'l02.9 = 0i 458 Variable $l000!57.l = 0.l75l $l0.00.!l029 = 00972 overhead Total cost $04484 $02968 per piece Saving per piece by use of = $0.4484 550.2968 = 0.l5l 6 brass Because l00.000 parts are made each year, revenues are constant across the alternatives. Rule 2 would select brass. and its use will produce a savings of $l 5t .60 per thousand [a total of $15. I60 for the year]. It is also deny that costs other than the cost of material [such as labor and overhead] were important in the study. Answer vb Choosing the Most Economical Mac hine for Production Sample Problem: Two currently owned machines are being considered for the production of a part. The capital investment associated with the machines is about the some and can be ignored for purposes of this example. The important differences between the ma chines are their production capacities [production rate x available production hours] and their reject rates [percentage of parts produced that cannot be sold]. Consider the following table: Machine A Machine 8 Production rate l00 partsfhour I30 partsfhour Hours available for 7 hoursrday 6 hoursfday production Percent parts rejected 3% l0% The material cost is $6.00 per part, and all defect-free par'ts produced can be sold for $12 each. [Rejected parts have negligible scrap value] For either machine. the operator cost is $15.00 per hour and the variable overhead rate for traceable costs is $5.00 per hour. [a] Assume that the daily demand for this part is large enough that all defect-free parts can be sold. Which machine should be selected? (b) What would the percent of parts rejected have to be for Machine B to be as profitable as Machine A? Solution (a) Rule 1 applies in this situation because total daily revenues ( selling price per part times the number of parts sold per day) and total daily costs will vary dending on the machine chosen. Therefore, we should select the machine that will maximize the profit per day: Profit per day = Revenue per day - Cost per day = (Production rate) (Production hours) ($12/part) x [1 - (%%rejected/100)] - (Production rate) (Production hours) ($6/part) - (Production hours) ($15/hour + $5/hour). Machine A: Profit per day = (100 parts/hour) (7 hours/ day ) ($12/part) (1-10.03) - (100 parts/hour) (7 hours/day) ($6/part) - (7 hours/day) ($15/hour + $5/hour) = $3,808 per day. Machine B: Profit per day = (130 parts/hour) (6 hours/day) ( $12/part) (1-10.10) - (130 parts/hour) (6 hours/day) ($6/part) - (6 hours/day) ($15/hour + $5/hour) = $3,624 per day. Therefore, select Machine A to maximize profit per day. Answer (b) To find the breakeven percent of parts rejected, X, for Machine B, set the profit per day of Machine A equal to the profit per day of Machine B, and solve for X: $3,808/day = (130 parts/hour) (6 hours/day) ($12/part) (1-X) - (130 parts/hour) x (6 hour/day) ($6/part ) - (6 hours/day) ($15/hour + $5/hour) Thus, X = 0.08, so the percent of parts rejected for Machine B can be no higher than 8% for it to be as profitable as Machine A. Answer2. Investing in Electrical Efficiency Two pumps capable of delivering 100 hp to an agricultural application are being evaluated in a present economy study. The selected pump will only be utilized for one year, and it will have no market value at the end of the year. Pertinent data are summarized as follows: Purchase . rice Maintenance cost Efficien If electric power costs $0.10 per kWh and the pump will be operated 4,000 hours per year, which pump should be chosen? Recall that 1 hp = 0.746 kW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts