Question: Solve the following problem in Excel and submit your Excel file on Canvas (10 points) (Only submit your answers in Excel. PDF, Word or other

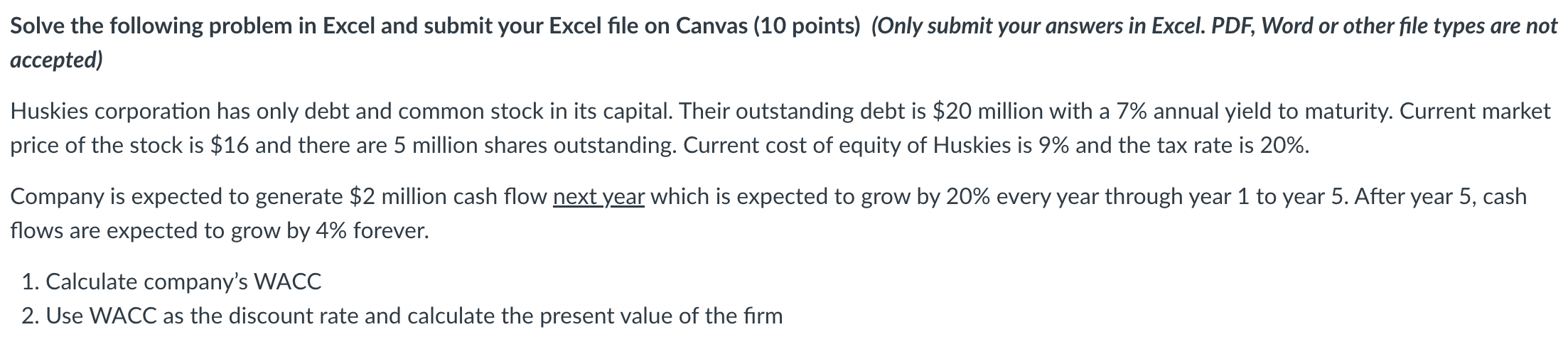

Solve the following problem in Excel and submit your Excel file on Canvas (10 points) (Only submit your answers in Excel. PDF, Word or other file types are not accepted) Huskies corporation has only debt and common stock in its capital. Their outstanding debt is $20 million with a 7% annual yield to maturity. Current market price of the stock is $16 and there are 5 million shares outstanding. Current cost of equity of Huskies is 9% and the tax rate is 20%. Company is expected to generate $2 million cash flow next year which is expected to grow by 20% every year through year 1 to year 5 . After year 5 , cash flows are expected to grow by 4% forever. 1. Calculate company's WACC 2. Use WACC as the discount rate and calculate the present value of the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts