Question: Solve the following problem using Microsoft Excels built in financial functions which are shown in the following photo. The values for alternatives a, alternative b,

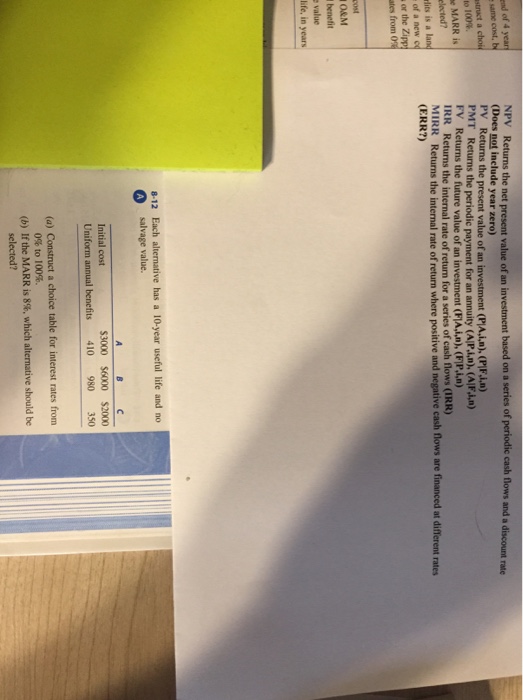

NPV Returns the net present value of an investment based on a series of periodic cash flows and a discount rate (Does not include year zero) PV Returns the present value of an investment PMT Returns the periodic payment for an annuity (A/P.i.n),(AjF.J.n) FV Returns the future value of an investment (FIA,i,n FP,i,n) IRR Returns the internal rate of return for a series of cash flows (IRR) MIRR Returns the internal rate of return where positive and negative cash flows are financed at different rates nt (PlA,i,n), (PIF.in) to 100%. e MARR is lits is a land of a new c or the Zippt ates from ( (ERR?) O&M 8-12 Each alternative has a 10-year useful life and no 0 A salvage value. Initial cost Uniform annual benefits 410 980 350 (a) Construct a choice table for interest rates from 0% to 100%. (b) If the MARR is 8%, which alternative should be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts