Question: Solve the following problems and show the complete solution and explanation. 'CHANGE IN DEPRECIATION METHOD. On January 1, 2021, BTS acquired equipment for P10,000,000. It

Solve the following problems and show the complete solution and explanation.

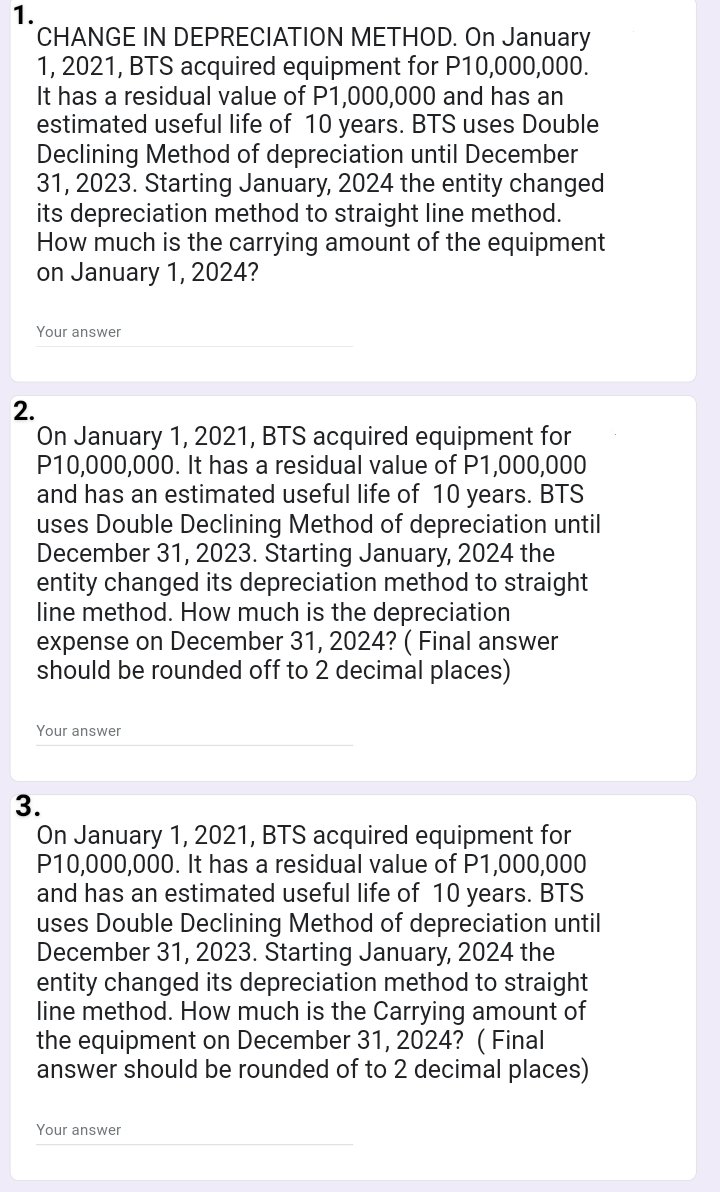

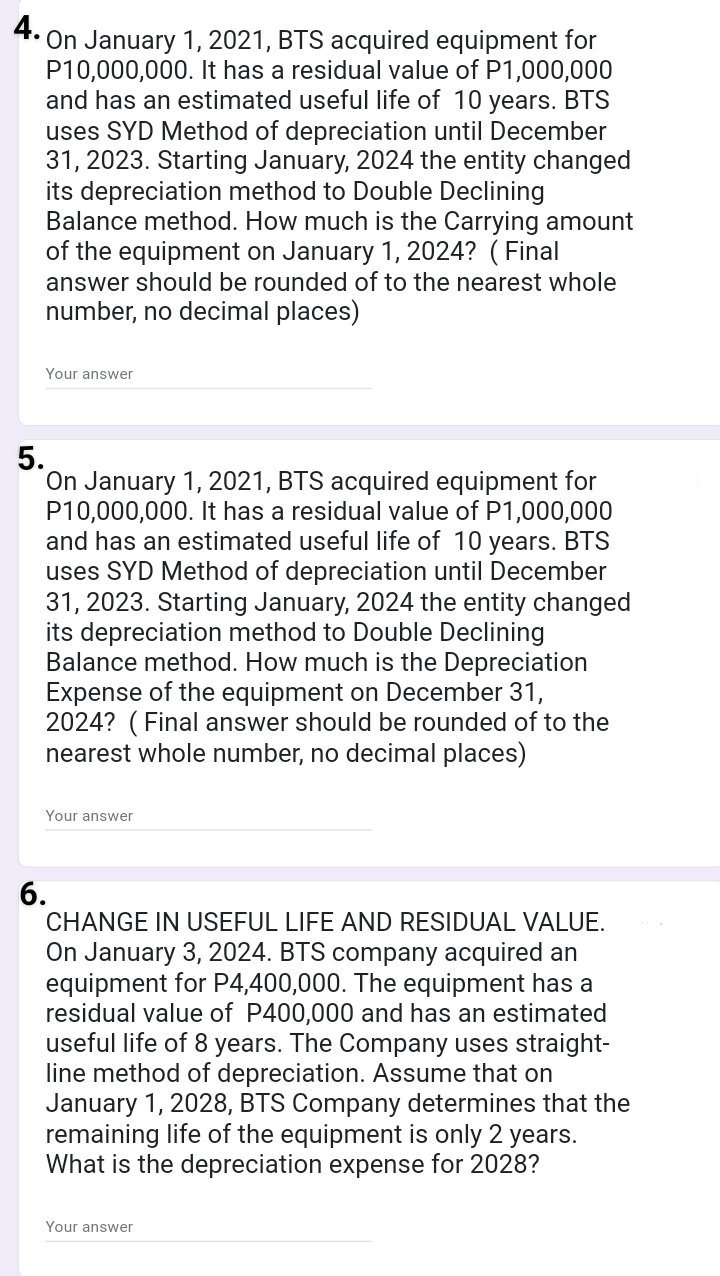

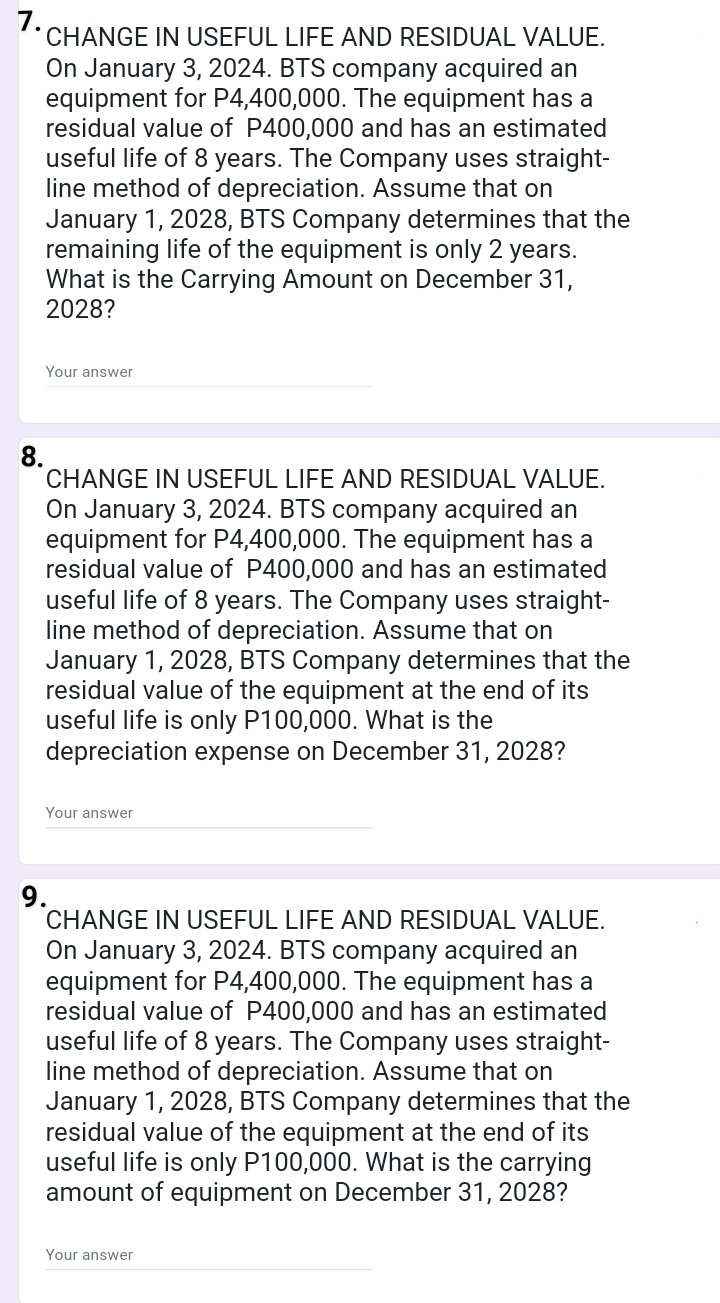

'CHANGE IN DEPRECIATION METHOD. On January 1, 2021, BTS acquired equipment for P10,000,000. It has a residual value of P1,000,000 and has an estimated useful life of 10 years. BTS uses Double Declining Method of depreciation until December 31 , 2023. Starting January, 2024 the entity changed its depreciation method to straight line method. How much is the carrying amount of the equipment on January 1, 2024? Your answer On January 1, 2021, BTS acquired equipment for P10000000. It has a residual value of P1,000,000 and has an estimated useful life of 10 years. BTS uses Double Declining Method of depreciation until December 31, 2023. Starting January, 2024 the entity changed its depreciation method to straight line method. How much is the depreciation expense on December 31, 2024? ( Final answer should be rounded off to 2 decimal places) Your answer 3. On January 1, 2021, BTS acquired equipment for P10000000. It has a residual value of P1,000,000 and has an estimated useful life of 10 years. BTS uses Double Declining Method of depreciation until December 31, 2023. Starting January, 2024 the entity changed its depreciation method to straight line method. How much is the Carrying amount of the equipment on December 31, 2024? (Final answer should be rounded of to 2 decimal places) Your answer 4' On January 1, 2021, BTS acquired equipment for P10,000,000. It has a residual value of P1,000,000 and has an estimated useful life of 10 years. BTS uses SYD Method of depreciation until December 31,2023. Starting January, 2024 the entity changed its depreciation method to Double Declining Balance method. How much is the Carrying amount of the equipment on January 1, 2024? (Final answer should be rounded of to the nearest whole number, no decimal places) Your answer On January 1, 2021, BTS acquired equipment for P10,000,000. It has a residual value of P1,000,000 and has an estimated useful life of 10 years. BTS uses SYD Method of depreciation until December 31, 2023. Starting January, 2024 the entity changed its depreciation method to Double Declining Balance method. How much is the Depreciation Expense of the equipment on December 31, 2024? (Final answer should be rounded of to the nearest whole number, no decimal places) Your answer 6. CHANGE IN USEFUL LIFE AND RESIDUAL VALUE. On January 3, 2024. BTS company acquired an equipment for P4,400,000. The equipment has a residual value of P400,000 and has an estimated useful life of 8 years. The Company uses straight- line method of depreciation. Assume that on January 1, 2028, BTS Company determines that the remaining life of the equipment is only 2 years. What is the depreciation expense for 2028? Your answer 7' CHANGE IN USEFUL LIFE AND RESIDUAL VALUE. On January 3, 2024. BTS company acquired an equipment for P4,400,000. The equipment has a residual value of P400,000 and has an estimated useful life of 8 years. The Company uses straight- line method of depreciation. Assume that on January 1,2028, BTS Company determines that the remaining life of the equipment is only 2 years. What is the Carrying Amount on December 31, 2028? Your answer 8. CHANGE IN USEFUL LIFE AND RESIDUAL VALUE. On January 3, 2024. BTS company acquired an equipment for P4,400,000. The equipment has a residual value of P400,000 and has an estimated useful life of 8 years. The Company uses straight- line method of depreciation. Assume that on January 1,2028, BTS Company determines that the residual value of the equipment at the end of its useful life is only P100000. What is the depreciation expense on December 31,2028? Your answer 9. CHANGE IN USEFUL LIFE AND RESIDUAL VALUE. On January 3, 2024. BTS company acquired an equipment for P4,400,000. The equipment has a residual value of P400,000 and has an estimated useful life of 8 years. The Company uses straight- line method of depreciation. Assume that on January 1, 2028, BTS Company determines that the residual value of the equipment at the end of its useful life is only P100000. What is the carrying amount of equipment on December 31, 2028? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts