Question: Solve the following problems. Show all the steps, please Solve the following problems. Show all the steps. Problem 1. Given the following portfolios and assuming

Solve the following problems. Show all the steps, please

Solve the following problems. Show all the steps, please

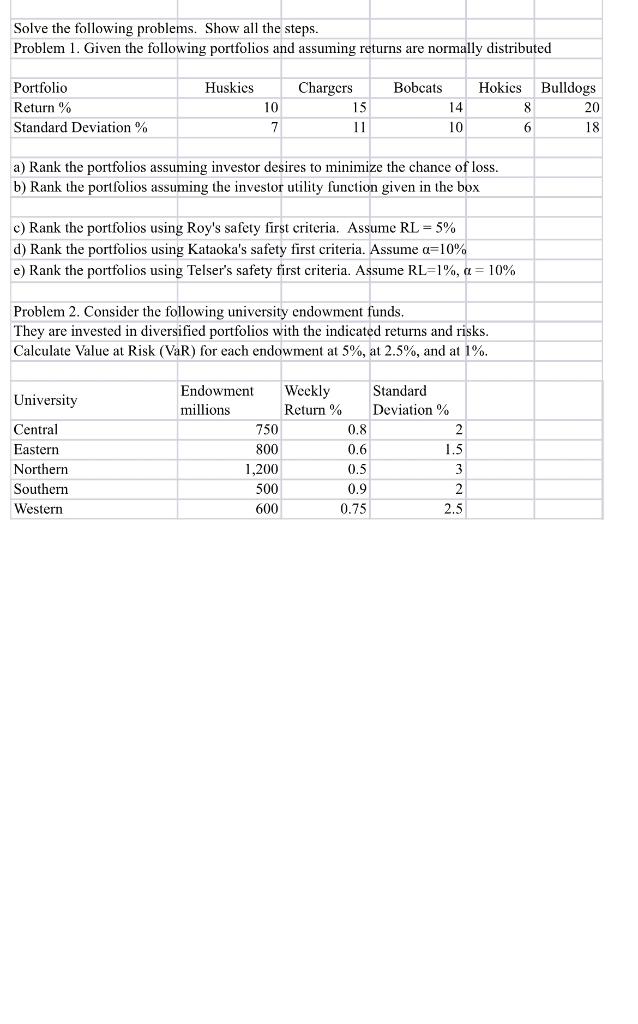

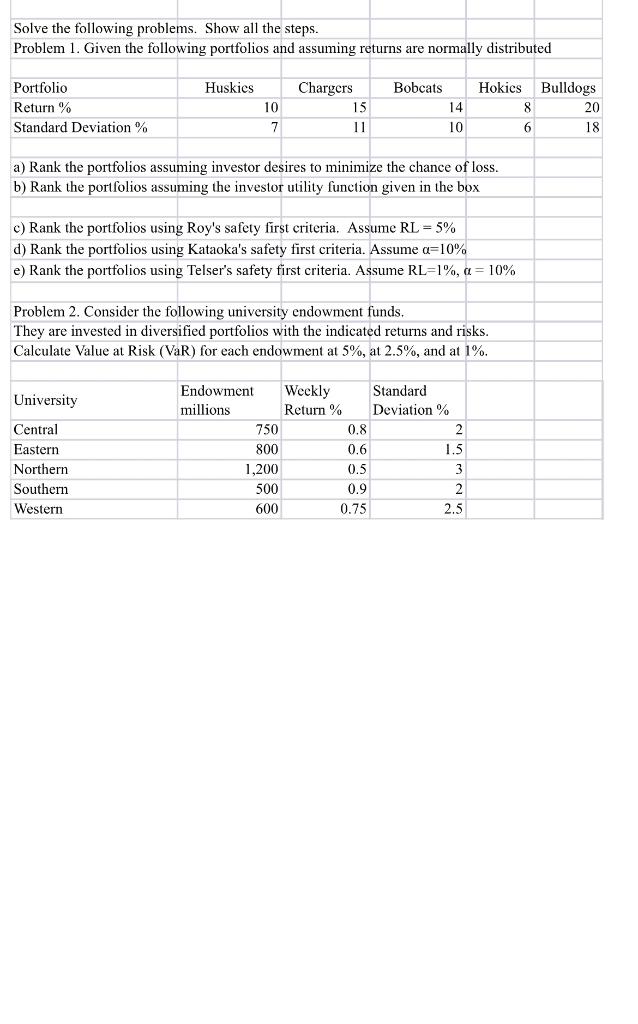

Solve the following problems. Show all the steps. Problem 1. Given the following portfolios and assuming returns are normally distributed \begin{tabular}{|l|r|r|r|r|r|} \hline Portfolio & Huskics & \multicolumn{1}{|c|}{ Chargers } & Bobcats & Hokics & Bulldogs \\ \hline Return \% & 10 & 15 & 14 & 8 & 20 \\ \hline Standard Deviation \% & 7 & 11 & 10 & 6 & 18 \\ \hline \end{tabular} a) Rank the portfolios assuming investor desires to minimize the chance of loss. b) Rank the portfolios assuming the investor utility function given in the box c) Rank the portfolios using Roy's safety first criteria. Assume RL=5% d) Rank the portfolios using Kataoka's safety first criteria. Assume =10% e) Rank the portfolios using Telser's safety first criteria. Assume RL=1%,=10% Problem 2. Consider the following university endowment funds. They are invested in diversified portfolios with the indicated returns and risks. Calculate Value at Risk (VaR) for each endowment at 5%, at 2.5%, and at 1%. Solve the following problems. Show all the steps. Problem 1. Given the following portfolios and assuming returns are normally distributed \begin{tabular}{|l|r|r|r|r|r|} \hline Portfolio & Huskics & \multicolumn{1}{|c|}{ Chargers } & Bobcats & Hokics & Bulldogs \\ \hline Return \% & 10 & 15 & 14 & 8 & 20 \\ \hline Standard Deviation \% & 7 & 11 & 10 & 6 & 18 \\ \hline \end{tabular} a) Rank the portfolios assuming investor desires to minimize the chance of loss. b) Rank the portfolios assuming the investor utility function given in the box c) Rank the portfolios using Roy's safety first criteria. Assume RL=5% d) Rank the portfolios using Kataoka's safety first criteria. Assume =10% e) Rank the portfolios using Telser's safety first criteria. Assume RL=1%,=10% Problem 2. Consider the following university endowment funds. They are invested in diversified portfolios with the indicated returns and risks. Calculate Value at Risk (VaR) for each endowment at 5%, at 2.5%, and at 1%. Solve the following problems. Show all the steps. Problem 1. Given the following portfolios and assuming returns are normally distributed \begin{tabular}{|l|r|r|r|r|r|} \hline Portfolio & Huskics & \multicolumn{1}{|c|}{ Chargers } & Bobcats & Hokics & Bulldogs \\ \hline Return \% & 10 & 15 & 14 & 8 & 20 \\ \hline Standard Deviation \% & 7 & 11 & 10 & 6 & 18 \\ \hline \end{tabular} a) Rank the portfolios assuming investor desires to minimize the chance of loss. b) Rank the portfolios assuming the investor utility function given in the box c) Rank the portfolios using Roy's safety first criteria. Assume RL=5% d) Rank the portfolios using Kataoka's safety first criteria. Assume =10% e) Rank the portfolios using Telser's safety first criteria. Assume RL=1%,=10% Problem 2. Consider the following university endowment funds. They are invested in diversified portfolios with the indicated returns and risks. Calculate Value at Risk (VaR) for each endowment at 5%, at 2.5%, and at 1%. Solve the following problems. Show all the steps. Problem 1. Given the following portfolios and assuming returns are normally distributed \begin{tabular}{|l|r|r|r|r|r|} \hline Portfolio & Huskics & \multicolumn{1}{|c|}{ Chargers } & Bobcats & Hokics & Bulldogs \\ \hline Return \% & 10 & 15 & 14 & 8 & 20 \\ \hline Standard Deviation \% & 7 & 11 & 10 & 6 & 18 \\ \hline \end{tabular} a) Rank the portfolios assuming investor desires to minimize the chance of loss. b) Rank the portfolios assuming the investor utility function given in the box c) Rank the portfolios using Roy's safety first criteria. Assume RL=5% d) Rank the portfolios using Kataoka's safety first criteria. Assume =10% e) Rank the portfolios using Telser's safety first criteria. Assume RL=1%,=10% Problem 2. Consider the following university endowment funds. They are invested in diversified portfolios with the indicated returns and risks. Calculate Value at Risk (VaR) for each endowment at 5%, at 2.5%, and at 1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts