Question: Solve the following question a) Explain DuPont Analysis using five Factor Analysis. b) American Furniture has a return on equity (ROE) of 13 percent and

Solve the following question

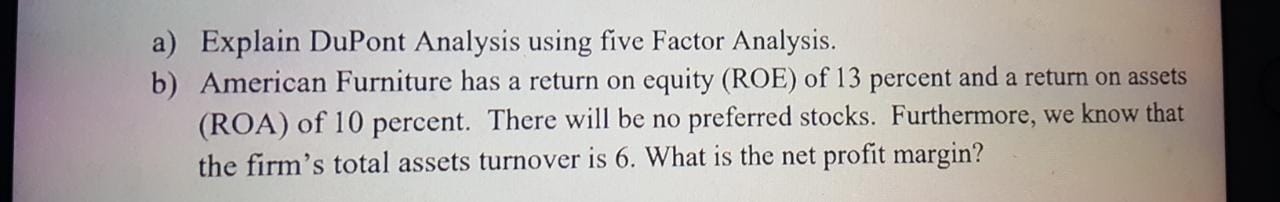

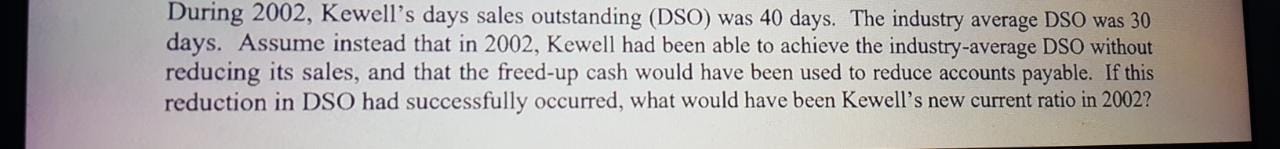

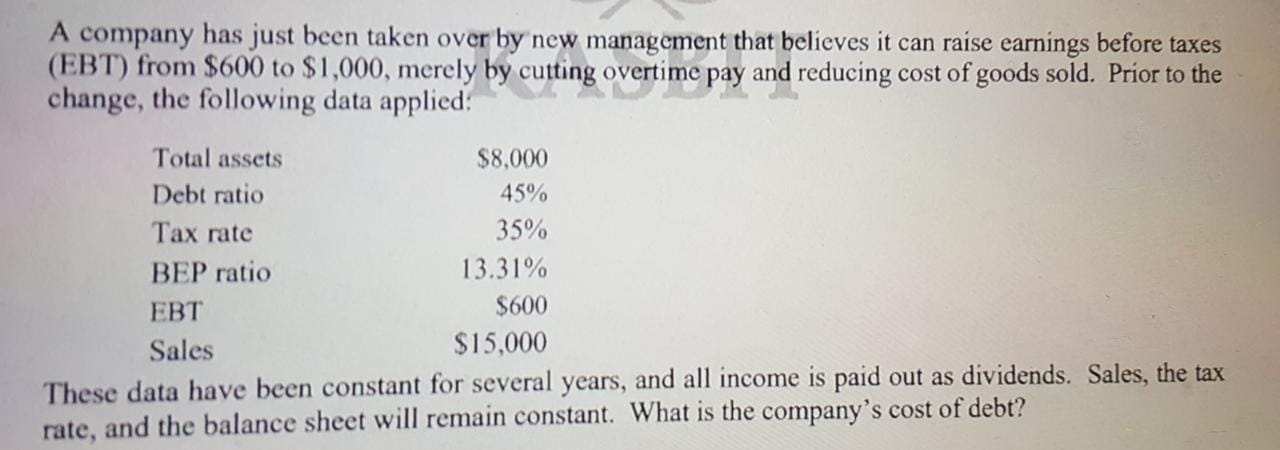

a) Explain DuPont Analysis using five Factor Analysis. b) American Furniture has a return on equity (ROE) of 13 percent and a return on assets (ROA) of 10 percent. There will be no preferred stocks. Furthermore, we know that the firm's total assets turnover is 6. What is the net profit margin?During 2002, Kewell's days sales outstanding (DSO) was 40 days. The industry average DSO was 30 days. Assume instead that in 2002, Kewell had been able to achieve the industry-average DSO without reducing its sales, and that the freed-up cash would have been used to reduce accounts payable. If this reduction in DSO had successfully occurred, what would have been Kewell's new current ratio in 2002?A company has just been taken over by new management that believes it can raise earnings before taxes (EBT) from $600 to $1,000, merely by cutting overtime pay and reducing cost of goods sold. Prior to the change, the following data applied: Total assets $8.000 Debt ratio 45% Tax rate 35% BEP ratio 13.31% EBT $600 Sales $15,000 These data have been constant for several years, and all income is paid out as dividends. Sales, the tax rate, and the balance sheet will remain constant. What is the company's cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts