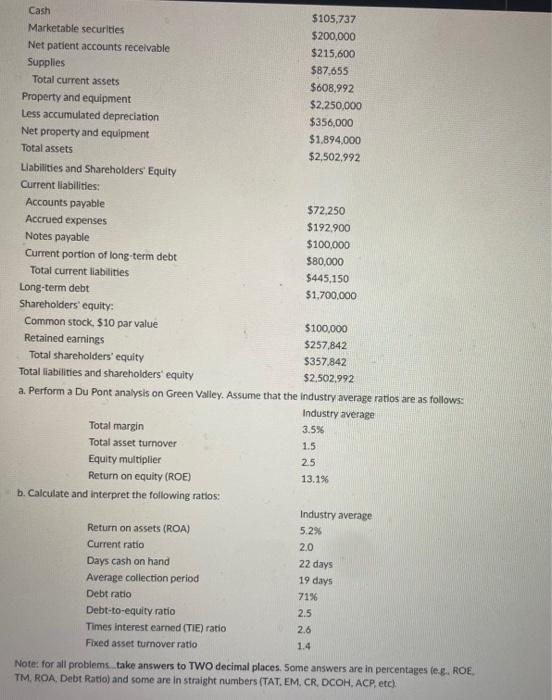

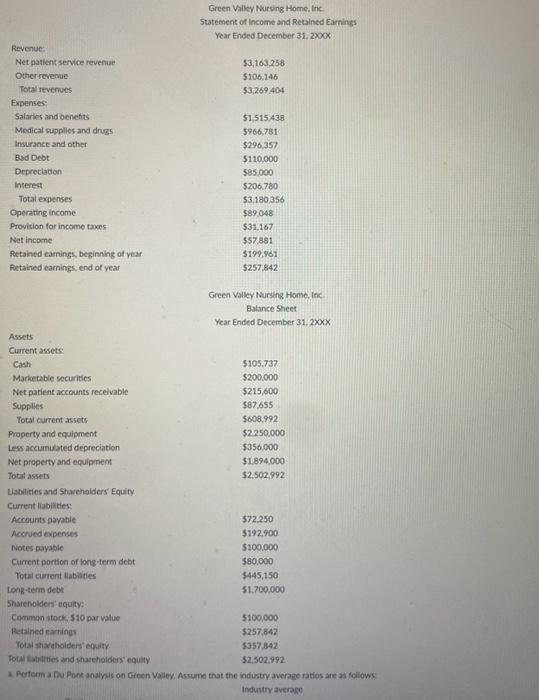

Question: solve the following question from the data given below. Cash Marketable securities Net patient accounts receivable Supplies Total current assets Property and equipment Less accumulated

solve the following question from the data given below.

![Please calculate the following ratios for Green Valley: [ R O E= ] Total Margin = Total Asset Turnover ( = ) Equity Multi](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/05/6463704dee081_1684238412570.jpg)

Cash Marketable securities Net patient accounts receivable Supplies Total current assets Property and equipment Less accumulated depreciation Net property and equipment Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued expenses Notes payable Current portion of long-term debt Total current liabilities Long-term debt Total margin Total asset turnover Equity multiplier Return on equity (ROE) b. Calculate and interpret the following ratios: Return on assets (ROA) Current ratio Shareholders' equity: Common stock, $10 par value Retained earnings Total shareholders' equity Total liabilities and shareholders' equity a. Perform a Du Pont analysis on Green Valley. Assume that the industry average ratios are as follows: Industry average Days cash on hand Average collection period Debt ratio Debt-to-equity ratio $105,737 $200,000 $215,600 $87,655 $608,992 $2,250,000 $356,000 $1,894,000 $2,502,992 Times interest earned (TIE) ratio Fixed asset turnover ratio $72,250 $192,900 $100,000 $80,000 $445,150 $1,700,000 $100,000 $257,842 $357,842 $2,502,992 3.5% 1.5 25 13.1% Industry average 5.2% 2.0 22 days 19 days 71% 2.5 2.6 1.4 Note: for all problems...take answers to TWO decimal places. Some answers are in percentages (e.g. ROE. TM, ROA, Debt Ratio) and some are in straight numbers (TAT, EM, CR, DCOH, ACP, etc).

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

To perform a DuPont analysis we need to calculate the following ratios 1 Return on Equity ROE ROE To... View full answer

Get step-by-step solutions from verified subject matter experts