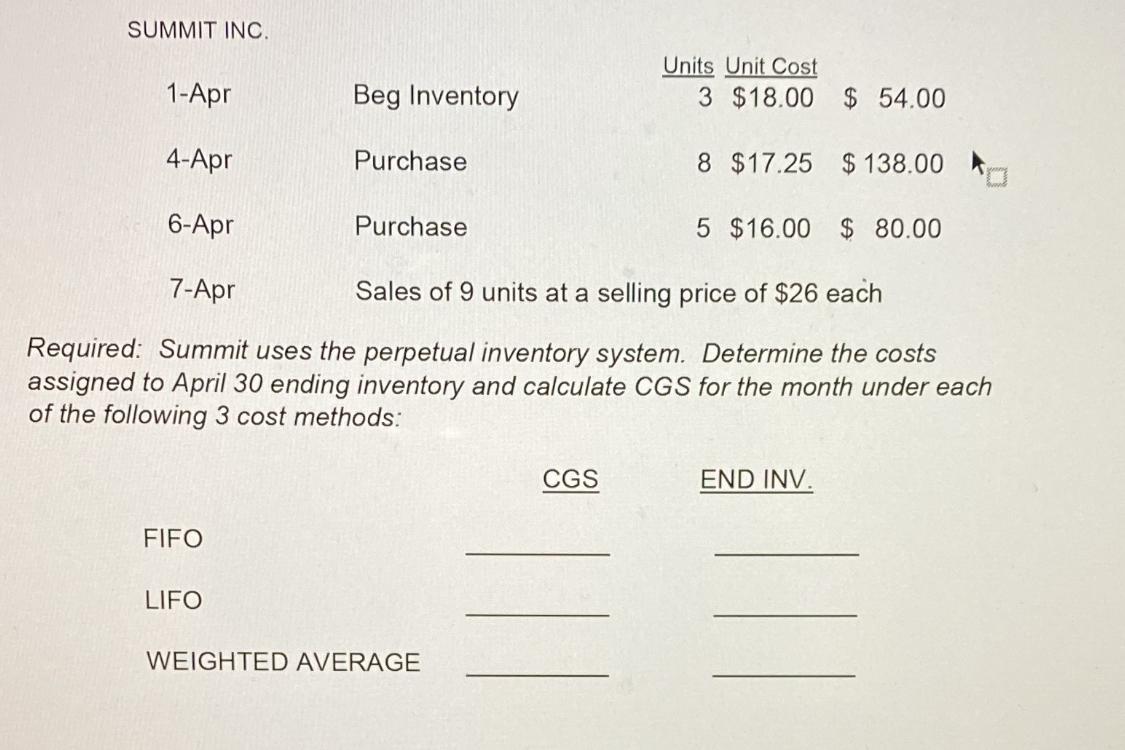

Question: Solve the following questions using the provided information. SUMMIT INC. 1-Apr 4-Apr 6-Apr 7-Apr Sales of 9 units at a selling price of $26 each

Solve the following questions using the provided information.

SUMMIT INC. 1-Apr 4-Apr 6-Apr 7-Apr Sales of 9 units at a selling price of $26 each Required: Summit uses the perpetual inventory system. Determine the costs assigned to April 30 ending inventory and calculate CGS for the month under each of the following 3 cost methods: FIFO LIFO Beg Inventory Purchase Purchase WEIGHTED AVERAGE Units Unit Cost CGS 3 $18.00 $ 54.00 8 $17.25 $138.00 5 $16.00 $ 80.00 END INV.

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

1 FIFO FirstInFirstOut Method Calculation of the cost of goods sold CGS April 1 3 units 18 54 added ... View full answer

Get step-by-step solutions from verified subject matter experts