Question: Solve the following with an Excel Spreadsheet. Problem 1: A leasing company is planning to purchase an asset for $15,000 with a 6-year life and

Solve the following with an Excel Spreadsheet.

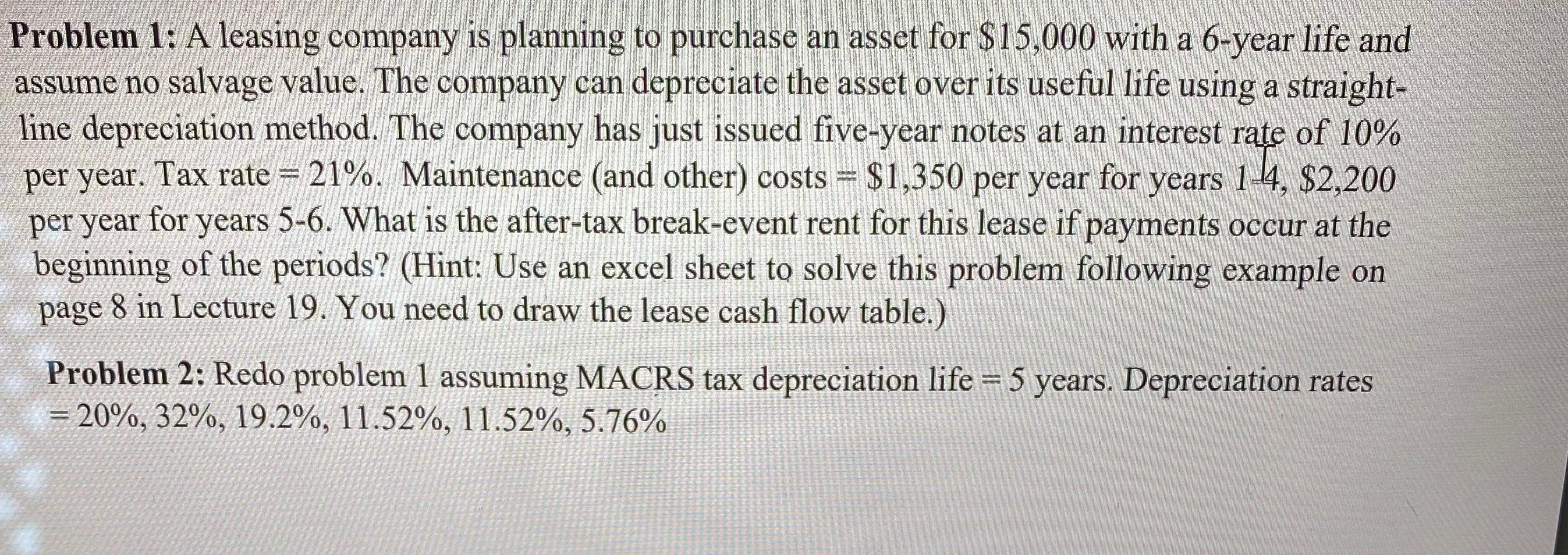

Problem 1: A leasing company is planning to purchase an asset for $15,000 with a 6-year life and assume no salvage value. The company can depreciate the asset over its useful life using a straightline depreciation method. The company has just issued five-year notes at an interest rate of 10% per year. Tax rate =21%. Maintenance (and other) costs =$1,350 per year for years 14,$2,200 per year for years 5-6. What is the after-tax break-event rent for this lease if payments occur at the beginning of the periods? (Hint: Use an excel sheet to solve this problem following example on page 8 in Lecture 19. You need to draw the lease cash flow table.) Problem 2: Redo problem 1 assuming MACRS tax depreciation life =5 years. Depreciation rates =20%,32%,19.2%,11.52%,11.52%,5.76%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts