Question: Solve the given Case Study: 1. Al Hisabil Manufacturers LLC can make either of two investments at the beginning of 2020. The given two proposals

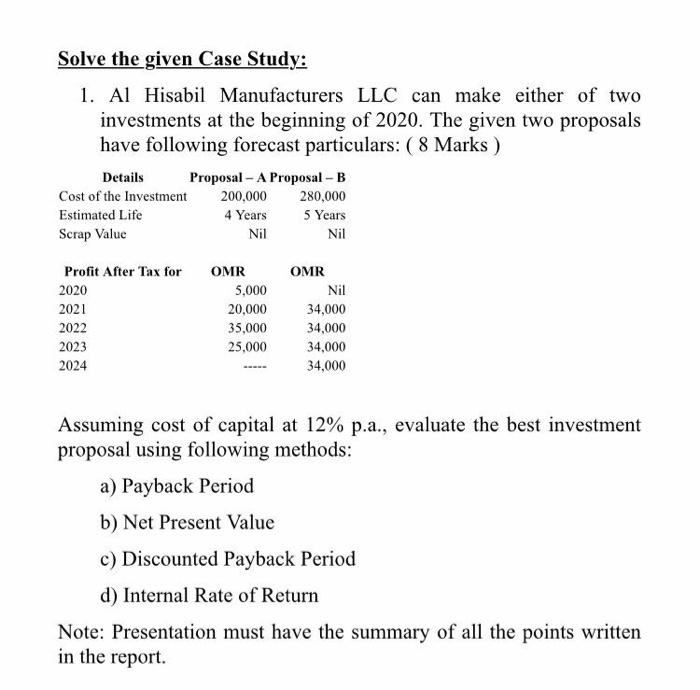

Solve the given Case Study: 1. Al Hisabil Manufacturers LLC can make either of two investments at the beginning of 2020. The given two proposals have following forecast particulars: ( 8 Marks ) Details Proposal - A Proposal - B Cost of the Investment 200.000 280,000 Estimated Life 4 Years 5 Years Scrap Value Nil Nil Profit After Tax for 2020 2021 2022 2023 2024 OMR 5,000 20,000 35,000 25,000 OMR Nil 34,000 34,000 34,000 34,000 Assuming cost of capital at 12% p.a., evaluate the best investment proposal using following methods: a) Payback Period b) Net Present Value c) Discounted Payback Period d) Internal Rate of Return Note: Presentation must have the summary of all the points written in the report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts