Question: Solve the problems below as indicated. Upload the completed assignment to this link. 1. The double-declining balance rate for calculating depreciation expense is determined by

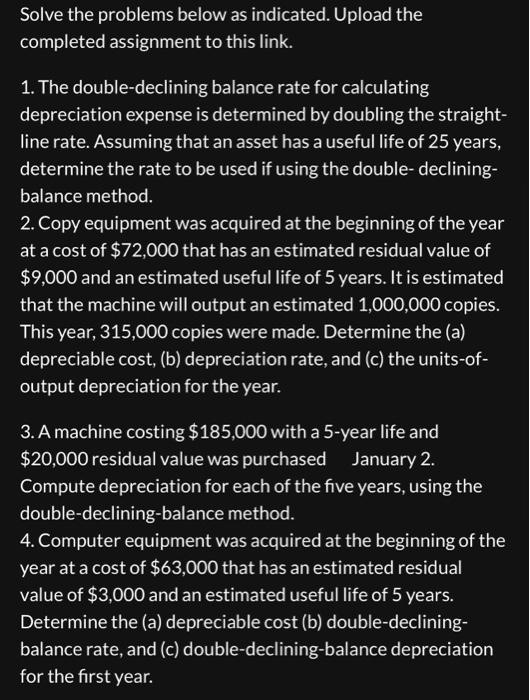

Solve the problems below as indicated. Upload the completed assignment to this link. 1. The double-declining balance rate for calculating depreciation expense is determined by doubling the straightline rate. Assuming that an asset has a useful life of 25 years, determine the rate to be used if using the double- decliningbalance method. 2. Copy equipment was acquired at the beginning of the year at a cost of $72,000 that has an estimated residual value of $9,000 and an estimated useful life of 5 years. It is estimated that the machine will output an estimated 1,000,000 copies. This year, 315,000 copies were made. Determine the (a) depreciable cost, (b) depreciation rate, and (c) the units-ofoutput depreciation for the year. 3. A machine costing $185,000 with a 5 -year life and $20,000 residual value was purchased January 2 . Compute depreciation for each of the five years, using the double-declining-balance method. 4. Computer equipment was acquired at the beginning of the year at a cost of $63,000 that has an estimated residual value of $3,000 and an estimated useful life of 5 years. Determine the (a) depreciable cost (b) double-decliningbalance rate, and (c) double-declining-balance depreciation for the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts