Question: solve the problems following each step using Excel Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows:

solve the problems following each step using Excel

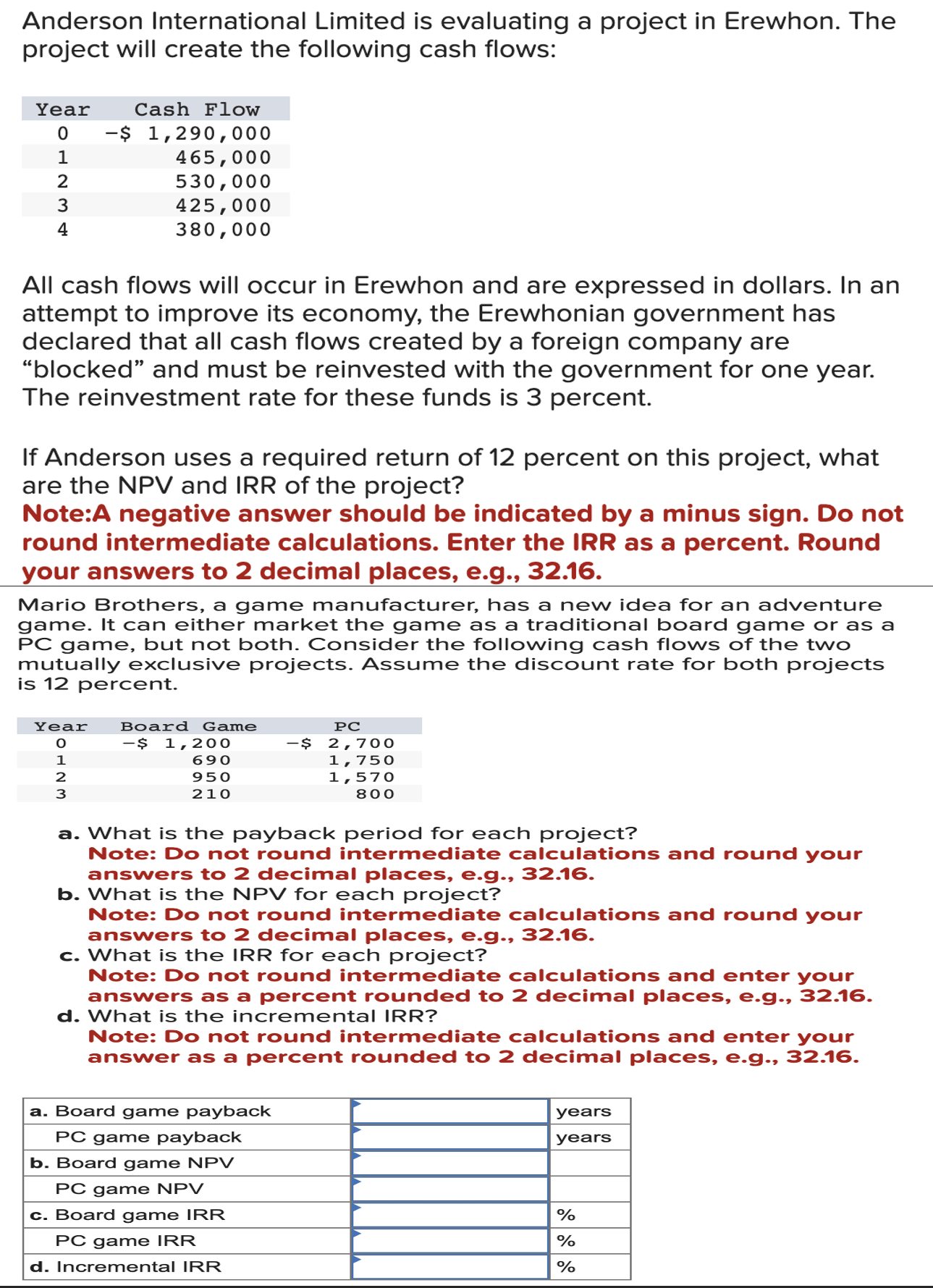

Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. The reinvestment rate for these funds is 3 percent. If Anderson uses a required return of 12 percent on this project, what are the NPV and IRR of the project? Note:A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter the IRR as a percent. Round your answers to 2 decimal places, e.g., 32.16. Mario Brothers, a game manufacturer, has a new idea for an adventure game. It can either market the game as a traditional board game or as a PC game, but not both. Consider the following cash flows of the two mutually exclusive projects. Assume the discount rate for both projects is 12 percent. a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. What is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. c. What is the IRR for each project? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. d. What is the incremental IRR? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts