Question: Solve the Problems in its Entirety Only Question 2 - IPO Underwriter Spreads and Money Left on the Table Below is a table with data

Solve the Problems in its Entirety Only

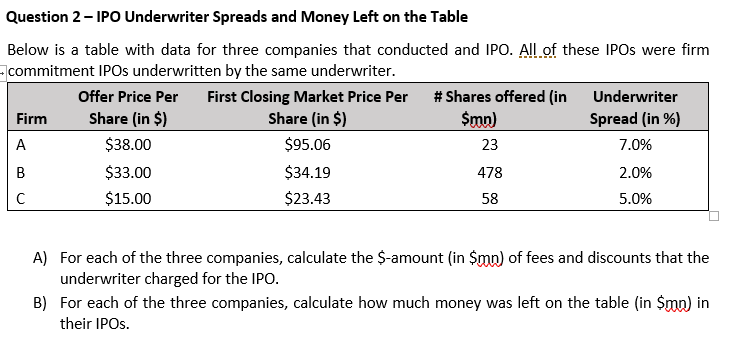

Question 2 - IPO Underwriter Spreads and Money Left on the Table Below is a table with data for three companies that conducted and IPO. All of these IPOs were firm commitment IPOs underwritten by the same underwriter. Offer Price Per First Closing Market Price Per #Shares offered in Underwriter Firm Share (in $) Share (in $) $mo) Spread (in %) $38.00 $95.06 7.0% $33.00 $34.19 478 2.0% $15.00 $23.43 58 5.0% 23 A) For each of the three companies, calculate the $-amount (in $mo) of fees and discounts that the underwriter charged for the IPO. B) For each of the three companies, calculate how much money was left on the table (in $mo) in their IPOs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts