Question: Solve the Problems in its Entirety Only Question 3 - IPO Winner's Curse Suppose DCB Inc. currently has 100mn shares outstanding and is attempting to

Solve the Problems in its Entirety Only

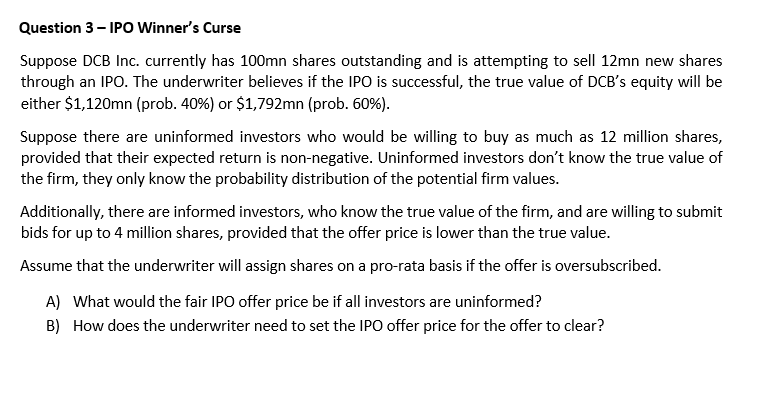

Question 3 - IPO Winner's Curse Suppose DCB Inc. currently has 100mn shares outstanding and is attempting to sell 12mn new shares through an IPO. The underwriter believes if the IPO is successful, the true value of DCB's equity will be either $1,120mn (prob. 40%) or $1,792mn (prob. 60%). Suppose there are uninformed investors who would be willing to buy as much as 12 million shares, provided that their expected return is non-negative. Uninformed investors don't know the true value of the firm, they only know the probability distribution of the potential firm values. Additionally, there are informed investors, who know the true value of the firm, and are willing to submit bids for up to 4 million shares, provided that the offer price is lower than the true value. Assume that the underwriter will assign shares on a pro-rata basis if the offer is oversubscribed. A) What would the fair IPO offer price be if all investors are uninformed? B) How does the underwriter need to set the IPO offer price for the offer to clear? Question 3 - IPO Winner's Curse Suppose DCB Inc. currently has 100mn shares outstanding and is attempting to sell 12mn new shares through an IPO. The underwriter believes if the IPO is successful, the true value of DCB's equity will be either $1,120mn (prob. 40%) or $1,792mn (prob. 60%). Suppose there are uninformed investors who would be willing to buy as much as 12 million shares, provided that their expected return is non-negative. Uninformed investors don't know the true value of the firm, they only know the probability distribution of the potential firm values. Additionally, there are informed investors, who know the true value of the firm, and are willing to submit bids for up to 4 million shares, provided that the offer price is lower than the true value. Assume that the underwriter will assign shares on a pro-rata basis if the offer is oversubscribed. A) What would the fair IPO offer price be if all investors are uninformed? B) How does the underwriter need to set the IPO offer price for the offer to clear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts