Question: Solve the problems on scratch paper, write out your final answers by hand (showing your work), and scan your answers for submission in pdf format

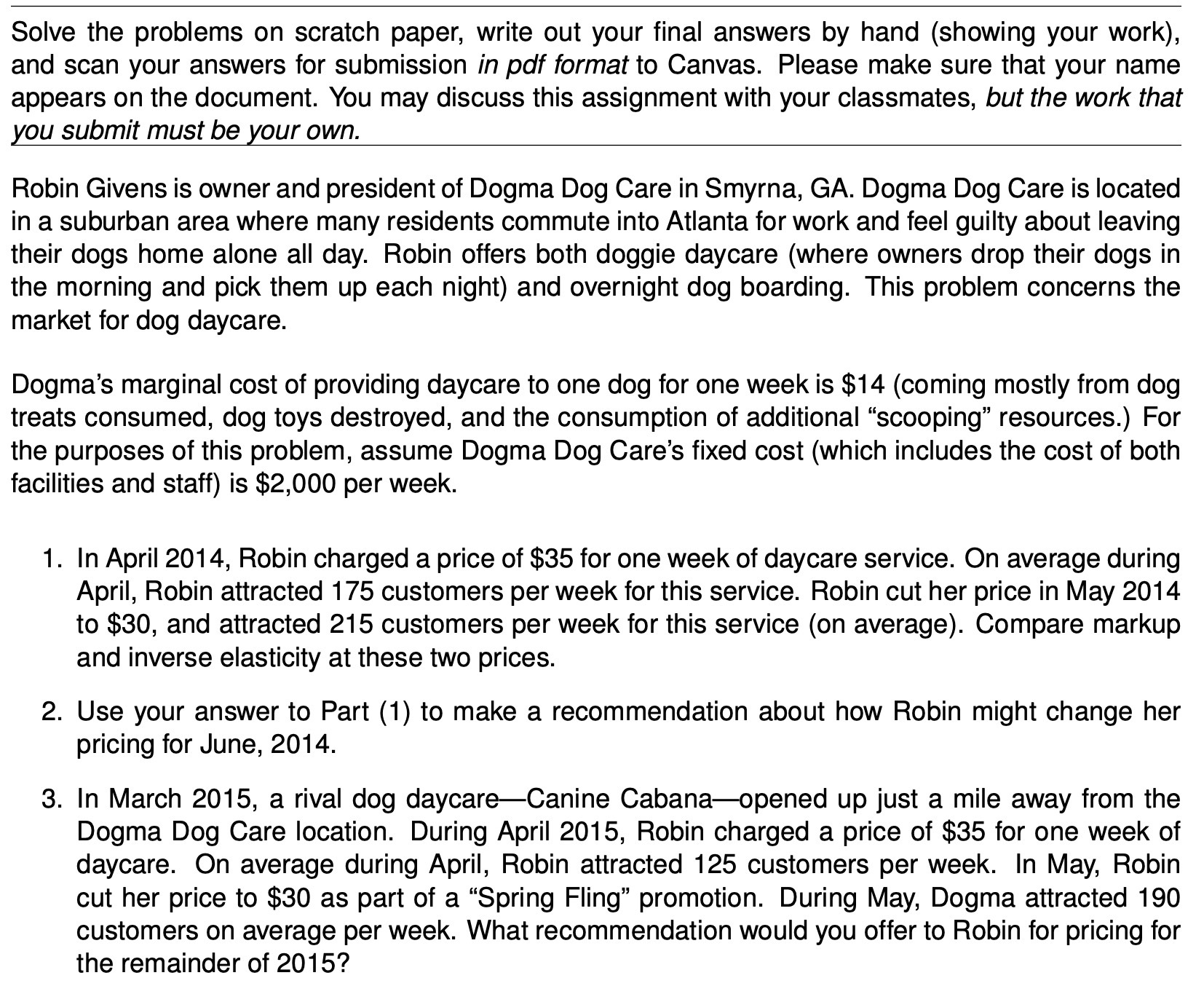

Solve the problems on scratch paper, write out your final answers by hand (showing your work), and scan your answers for submission in pdf format to Canvas. Please make sure that your name appears on the document. You may discuss this assignment with your classmates, but the work that you submit must be your own. Robin Givens is owner and president of Dogma Dog Care in Smyrna, GA. Dogma Dog Care is located in a suburban area where many residents commute into Atlanta for work and feel guilty about leaving their dogs home alone all day. Robin offers both doggie daycare (where owners drop their dogs in the morning and pick them up each night) and overnight dog boarding. This problem concerns the market for dog daycare. Dogma's marginal cost of providing daycare to one dog for one week is $14 (coming mostly from dog treats consumed, dog toys destroyed, and the consumption of additional \"scooping" resources.) For the purposes of this problem, assume Dogma Dog Care's fixed cost (which includes the cost of both facilities and staff) is $2,000 per week. 1. In April 2014, Robin charged a price of $35 for one week of daycare service. On average during April, Robin attracted 175 customers per week for this service. Robin cut her price in May 2014 to $30, and attracted 215 customers per week for this service (on average). Compare markup and inverse elasticity at these two prices. 2. Use your answer to Part (1) to make a recommendation about how Robin might change her pricing for June, 2014. 3. In March 2015, a rival dog daycareCanine Cabanaopened up just a mile away from the Dogma Dog Care location. During April 2015, Robin charged a price of $35 for one week of daycare. On average during April, Robin attracted 125 customers per week. In May, Robin cut her price to $30 as part of a \"Spring Fling\" promotion. During May, Dogma attracted 190 customers on average per week. What recommendation would you offer to Robin for pricing for the remainder of 2015