Question: solve the question If an alternative has a salvage value, how is it han- dled in the calculation of a B/C ratio relative to benefits,

solve the question

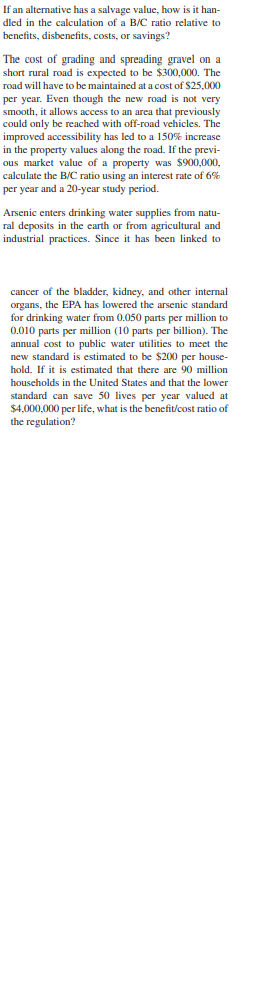

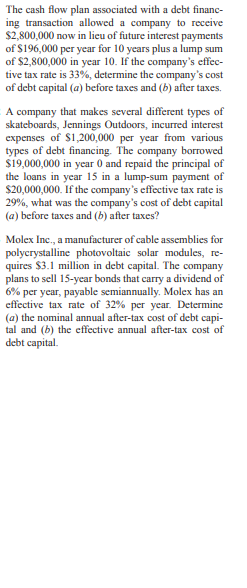

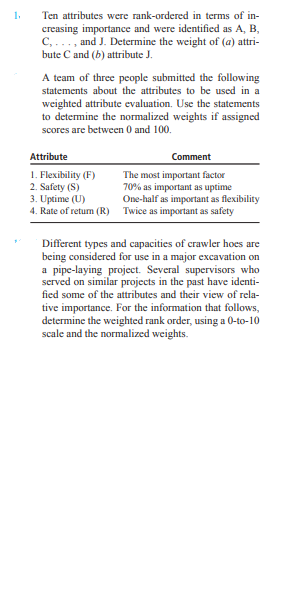

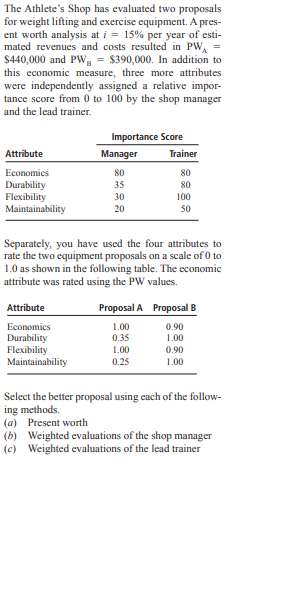

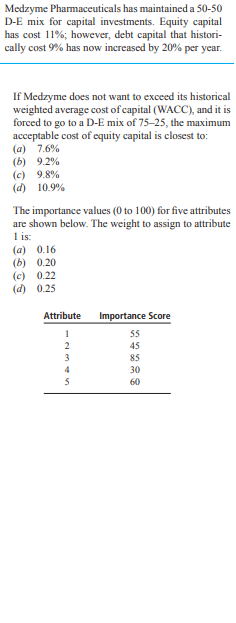

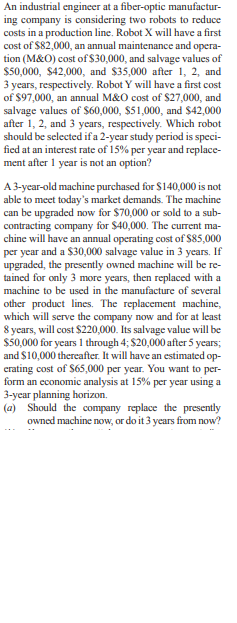

If an alternative has a salvage value, how is it han- dled in the calculation of a B/C ratio relative to benefits, disbenefits, costs, or savings? The cost of grading and spreading gravel on a short rural road is expected to be $300,000. The road will have to be maintained at a cost of $25,000 per year. Even though the new road is not very smooth, it allows access to an area that previously could only be reached with off-road vehicles. The improved accessibility has led to a 150% increase in the property values along the road. If the previ- ous market value of a property was $900,000, calculate the B/C ratio using an interest rate of 6% per year and a 20-year study period. Arsenic enters drinking water supplies from natu- ral deposits in the earth or from agricultural and industrial practices. Since it has been linked to cancer of the bladder, kidney, and other internal organs, the EPA has lowered the arsenic standard for drinking water from 0.050 parts per million to 0.010 parts per million (10 parts per billion). The annual cost to public water utilities to meet the new standard is estimated to be $200 per house- hold. If it is estimated that there are 90 million households in the United States and that the lower standard can save 50 lives per year valued at $4,000,000 per life, what is the benefit/cost ratio of the regulation?The cash flow plan associated with a debt finance ing transaction allowed a company to receive $2,800,000 now in lieu of future interest payments of $196,000 per year for 10 years plus a lump sum of $2,800,000 in year 10. If the company's effect live tax rate is 33%, determine the company's cost of debt capital (a) before taxes and (b) after taxes. A company that makes several different types of skateboards, Jennings Outdoors, incurred interest expenses of $1,200,000 per year from various types of debt financing. The company borrowed $19,000,000 in year 0 and repaid the principal of the loans in year 15 in a lump-sum payment of $20,000,000. If the company's effective tax rate is 29%, what was the company's cost of debt capital (a) before taxes and (b) after taxes? Molex Inc., a manufacturer of cable assemblies for polycrystalline photovoltaic solar modules, re- quires $3.1 million in debt capital. The company plans to sell 15-year bonds that carry a dividend of 6% per year, payable semiannually. Molex has an effective tax rate of 32% per year. Determine (a) the nominal annual after-tax cost of debt capi- tal and (b) the effective annual after-tax cost of debt capital.1. Ten attributes were rank-ordered in terms of in- creasing importance and were identified as A, B, C, . . ., and J. Determine the weight of (a) attri- bute C and (b) attribute J. A team of three people submitted the following statements about the attributes to be used in a weighted attribute evaluation. Use the statements to determine the normalized weights if assigned scores are between 0 and 100. Attribute Comment 1. Flexibility (F) The most important factor 2. Safety (S) 70% as important as uptime 3. Uptime (U) One-half as important as flexibility 4. Rate of retum (R) Twice as important as safety Different types and capacities of crawler hoes are being considered for use in a major excavation on a pipe-laying project. Several supervisors who served on similar projects in the past have identi- fied some of the attributes and their view of rela- tive importance. For the information that follows, determine the weighted rank order, using a 0-to-10 scale and the normalized weights.The Athlete's Shop has evaluated two proposals for weight lifting and exercise equipment. A pres- ent worth analysis at i = 15% per year of esti- mated revenues and costs resulted in PW = $440,000 and PW = $390,000. In addition to this economic measure, three more attributes were independently assigned a relative impor- tance score from 0 to 100 by the shop manager and the lead trainer. Importance Score Attribute Manager Trainer Economics 20 80 Durability 35 80 Flexibility 30 100 Maintainability 20 50 Separately, you have used the four attributes to rate the two equipment proposals on a scale of 0 to 1.0 as shown in the following table. The economic attribute was rated using the PW values. Attribute Proposal A Proposal B Economics 1.00 0.90 Durability 0.35 1.00 Flexibility 1.00 0.90 Maintainability 0.25 1.00 Select the better proposal using each of the follow- ing methods. (a) Present worth (b) Weighted evaluations of the shop manager (c) Weighted evaluations of the lead trainerMedzyme Pharmaceuticals has maintained a 50-50 D-E mix for capital investments. Equity capital has cost 11%; however, debt capital that histori- cally cost 9% has now increased by 20% per year. If Medzyme does not want to exceed its historical weighted average cost of capital (WACC), and it is forced to go to a D-E mix of 75-25, the maximum acceptable cost of equity capital is closest to: (a) 7.6% (6) 9.2% (c) 9.8% (d) 10.9% The importance values (0 to 100) for five attributes are shown below. The weight to assign to attribute 1 is: (a) 0.16 (6) 0.20 (c) 0.22 (d) 0.25 Attribute Importance Score 55 45 85 30 60An industrial engineer at a fiber-optic manufactur ing company is considering two robots to reduce costs in a production line. Robot X will have a first cost of $82,000, an annual maintenance and opera- tion (M&O) cost of $30,000, and salvage values of $50,000, $42,000, and $35,000 after 1, 2, and 3 years, respectively. Robot Y will have a first cost of $97,000, an annual M&O cost of $27,000, and salvage values of $60,000, $51,000, and $42,000 after 1, 2, and 3 years, respectively. Which robot should be selected if a 2-year study period is speci- fied at an interest rate of 15% per year and replace- ment after 1 year is not an option? A 3-year-old machine purchased for $140,000 is not able to meet today's market demands. The machine can be upgraded now for $70,000 or sold to a sub- contracting company for $40,000. The current ma- chine will have an annual operating cost of $85,000 per year and a $30,000 salvage value in 3 years. If upgraded, the presently owned machine will be re- tained for only 3 more years, then replaced with a machine to be used in the manufacture of several other product lines. The replacement machine, which will serve the company now and for at least 8 years, will cost $220,000. Its salvage value will be $50,000 for years I through 4; $20,000 after 5 years; and $10,000 thereafter. It will have an estimated op- crating cost of $65,000 per year. You want to per- form an economic analysis at 15% per year using a 3-year planning horizon. (a) Should the company replace the presently owned machine now, or do it 3 years from now?Construct a graph of the cumulative distribution function of Exercise 3. 15. Reference: Exercise 3. 15: Find the cumulative distribution function of the random variable X representing the number of defectives in Exercise 3.11. Then using F(x), find (a) P(X = 1); (b) P(0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts