Question: solve the two problems please. the questions are at the bottom of each problem. thank you 5. Nabeel owned a special purpose boat for use

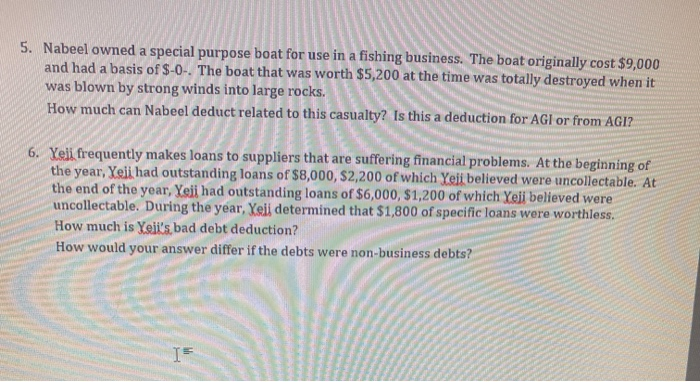

5. Nabeel owned a special purpose boat for use in a fishing business. The boat originally cost $9,000 and had a basis of $-0-. The boat that was worth $5,200 at the time was totally destroyed when it was blown by strong winds into large rocks. How much can Nabeel deduct related to this casualty? Is this a deduction for AGI or from AGI? 6. Yeli frequently makes loans to suppliers that are suffering financial problems. At the beginning of the year, Xeli had outstanding loans of $8,000, $2,200 of which Yeii believed were uncollectable. At the end of the year, Yeii had outstanding loans of $6,000, $1,200 of which Yeli believed were uncollectable. During the year, Xeij determined that $1,800 of specific loans were worthless. How much is Yeii's bad debt deduction? How would your answer differ if the debts were non-business debts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts